omc: no mention; hence safe - BMA Capital Management

omc: no mention; hence safe - BMA Capital Management

omc: no mention; hence safe - BMA Capital Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

POWER<br />

OVERWEIGHT<br />

Budget Impact<br />

Neutral<br />

Nurali Barkatali<br />

Power Analyst<br />

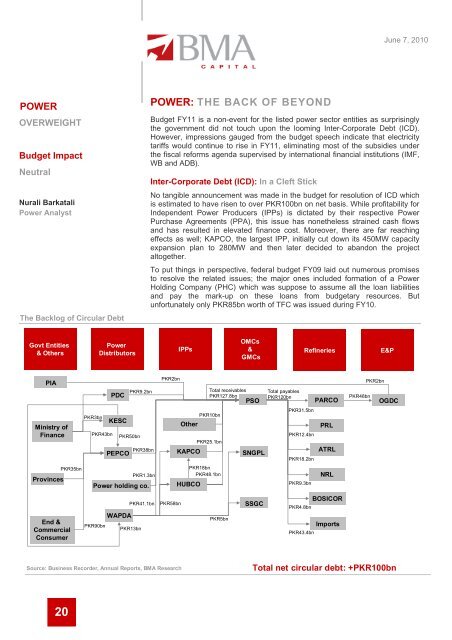

The Backlog of Circular Debt<br />

Govt Entities<br />

& Others<br />

PIA<br />

Ministry of<br />

Finance<br />

Provinces<br />

PKR35bn<br />

End &<br />

Commercial<br />

Consumer<br />

20<br />

PKR3bn<br />

KESC<br />

PEPCO<br />

Power holding co.<br />

PKR90bn<br />

Power<br />

Distributors<br />

PKR43bn<br />

PDC<br />

PKR50bn<br />

WAPDA<br />

PKR9.2bn<br />

PKR13bn<br />

PKR38bn<br />

PKR1.3bn<br />

POWER: THE BACK OF BEYOND<br />

June 7, 2010<br />

Budget FY11 is a <strong>no</strong>n-event for the listed power sector entities as surprisingly<br />

the government did <strong>no</strong>t touch upon the looming Inter-Corporate Debt (ICD).<br />

However, impressions gauged from the budget speech indicate that electricity<br />

tariffs would continue to rise in FY11, eliminating most of the subsidies under<br />

the fiscal reforms agenda supervised by international financial institutions (IMF,<br />

WB and ADB).<br />

Inter-Corporate Debt (ICD): In a Cleft Stick<br />

No tangible an<strong>no</strong>uncement was made in the budget for resolution of ICD which<br />

is estimated to have risen to over PKR100bn on net basis. While profitability for<br />

Independent Power Producers (IPPs) is dictated by their respective Power<br />

Purchase Agreements (PPA), this issue has <strong>no</strong>netheless strained cash flows<br />

and has resulted in elevated finance cost. Moreover, there are far reaching<br />

effects as well; KAPCO, the largest IPP, initially cut down its 450MW capacity<br />

expansion plan to 280MW and then later decided to abandon the project<br />

altogether.<br />

To put things in perspective, federal budget FY09 laid out numerous promises<br />

to resolve the related issues; the major ones included formation of a Power<br />

Holding Company (PHC) which was suppose to assume all the loan liabilities<br />

and pay the mark-up on these loans from budgetary resources. But<br />

unfortunately only PKR85bn worth of TFC was issued during FY10.<br />

PKR2bn<br />

PKR41.1bn PKR58bn<br />

IPPs<br />

Other<br />

KAPCO<br />

HUBCO<br />

Total receivables<br />

PKR127.8bn<br />

PKR10bn<br />

PKR25.1bn<br />

PKR18bn<br />

PKR48.1bn<br />

PKR5bn<br />

OMCs<br />

&<br />

GMCs<br />

PSO<br />

SNGPL<br />

SSGC<br />

Total payables<br />

PKR120bn<br />

PKR31.5bn<br />

PKR12.4bn<br />

PKR18.2bn<br />

PKR9.3bn<br />

PKR4.8bn<br />

PKR43.4bn<br />

Refineries E&P<br />

PARCO<br />

PRL<br />

ATRL<br />

NRL<br />

BOSICOR<br />

Imports<br />

PKR48bn<br />

Source: Business Recorder, Annual Reports, <strong>BMA</strong> Research Total net circular debt: +PKR100bn<br />

PKR2bn<br />

OGDC