omc: no mention; hence safe - BMA Capital Management

omc: no mention; hence safe - BMA Capital Management

omc: no mention; hence safe - BMA Capital Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

27<br />

Outlook FY11E<br />

June 7, 2010<br />

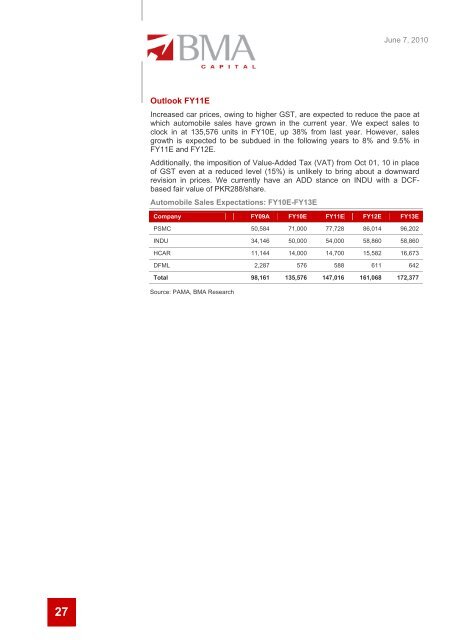

Increased car prices, owing to higher GST, are expected to reduce the pace at<br />

which automobile sales have grown in the current year. We expect sales to<br />

clock in at 135,576 units in FY10E, up 38% from last year. However, sales<br />

growth is expected to be subdued in the following years to 8% and 9.5% in<br />

FY11E and FY12E.<br />

Additionally, the imposition of Value-Added Tax (VAT) from Oct 01, 10 in place<br />

of GST even at a reduced level (15%) is unlikely to bring about a downward<br />

revision in prices. We currently have an ADD stance on INDU with a DCFbased<br />

fair value of PKR288/share.<br />

Automobile Sales Expectations: FY10E-FY13E<br />

Company FY09A FY10E FY11E FY12E FY13E<br />

PSMC 50,584 71,000 77,728 86,014 96,202<br />

INDU 34,146 50,000 54,000 58,860 58,860<br />

HCAR 11,144 14,000 14,700 15,582 16,673<br />

DFML 2,287 576 588 611 642<br />

Total 98,161 135,576 147,016 161,068 172,377<br />

Source: PAMA, <strong>BMA</strong> Research