omc: no mention; hence safe - BMA Capital Management

omc: no mention; hence safe - BMA Capital Management

omc: no mention; hence safe - BMA Capital Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

14<br />

Fiscal consolidation; Promote savings<br />

June 7, 2010<br />

Considering lower savings and investment ratios for an emerging country like<br />

Pakistan, it is of prime importance that savings are promoted – Pakistan’s<br />

savings currently stand at 13.8% of GDP. In order to attain sustainable growth,<br />

increasing domestic savings is the right step to conserve resources for<br />

investments. As per budget FY11, government targets PKR213bn and<br />

PKR61bn through saving instruments and investment bonds. Alongside the<br />

higher targets, declaration of WHT as final tax on profit on Govt. securities i.e.<br />

PIBs and T-bills seems the right step in this direction. However, the same also<br />

indicates restricted downward adjustment for interest rates.<br />

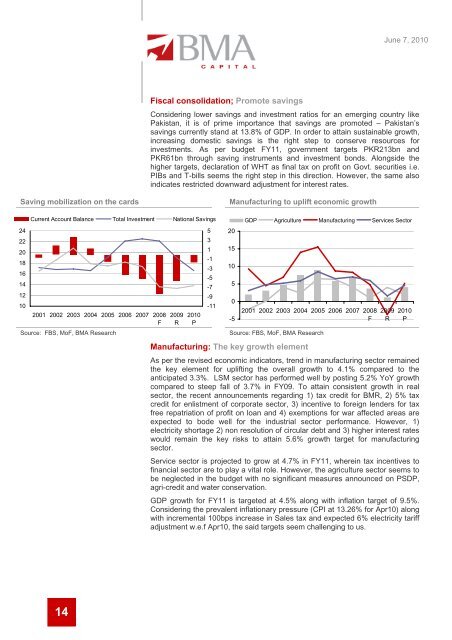

Saving mobilization on the cards Manufacturing to uplift eco<strong>no</strong>mic growth<br />

24<br />

22<br />

20<br />

18<br />

16<br />

14<br />

12<br />

10<br />

Current Account Balance Total Investment National Savings<br />

2001 2002 2003 2004 2005 2006 2007 2008<br />

F<br />

2009<br />

R<br />

Source: FBS, MoF, <strong>BMA</strong> Research Source: FBS, MoF, <strong>BMA</strong> Research<br />

2010<br />

P<br />

5<br />

3<br />

1<br />

-1<br />

-3<br />

-5<br />

-7<br />

-9<br />

-11<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

GDP Agriculture Manufacturing Services Sector<br />

2001 2002 2003 2004 2005 2006 2007 2008<br />

F<br />

2009<br />

R<br />

2010<br />

P<br />

Manufacturing: The key growth element<br />

As per the revised eco<strong>no</strong>mic indicators, trend in manufacturing sector remained<br />

the key element for uplifting the overall growth to 4.1% compared to the<br />

anticipated 3.3%. LSM sector has performed well by posting 5.2% YoY growth<br />

compared to steep fall of 3.7% in FY09. To attain consistent growth in real<br />

sector, the recent an<strong>no</strong>uncements regarding 1) tax credit for BMR, 2) 5% tax<br />

credit for enlistment of corporate sector, 3) incentive to foreign lenders for tax<br />

free repatriation of profit on loan and 4) exemptions for war affected areas are<br />

expected to bode well for the industrial sector performance. However, 1)<br />

electricity shortage 2) <strong>no</strong>n resolution of circular debt and 3) higher interest rates<br />

would remain the key risks to attain 5.6% growth target for manufacturing<br />

sector.<br />

Service sector is projected to grow at 4.7% in FY11, wherein tax incentives to<br />

financial sector are to play a vital role. However, the agriculture sector seems to<br />

be neglected in the budget with <strong>no</strong> significant measures an<strong>no</strong>unced on PSDP,<br />

agri-credit and water conservation.<br />

GDP growth for FY11 is targeted at 4.5% along with inflation target of 9.5%.<br />

Considering the prevalent inflationary pressure (CPI at 13.26% for Apr10) along<br />

with incremental 100bps increase in Sales tax and expected 6% electricity tariff<br />

adjustment w.e.f Apr10, the said targets seem challenging to us.