omc: no mention; hence safe - BMA Capital Management

omc: no mention; hence safe - BMA Capital Management

omc: no mention; hence safe - BMA Capital Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8%<br />

7%<br />

6%<br />

5%<br />

4%<br />

3%<br />

2%<br />

1%<br />

0%<br />

12<br />

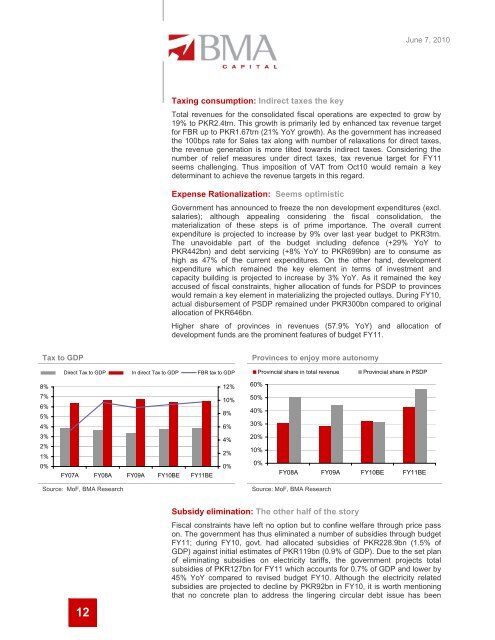

Taxing consumption: Indirect taxes the key<br />

June 7, 2010<br />

Total revenues for the consolidated fiscal operations are expected to grow by<br />

19% to PKR2.4trn. This growth is primarily led by enhanced tax revenue target<br />

for FBR up to PKR1.67trn (21% YoY growth). As the government has increased<br />

the 100bps rate for Sales tax along with number of relaxations for direct taxes,<br />

the revenue generation is more tilted towards indirect taxes. Considering the<br />

number of relief measures under direct taxes, tax revenue target for FY11<br />

seems challenging. Thus imposition of VAT from Oct10 would remain a key<br />

determinant to achieve the revenue targets in this regard.<br />

Expense Rationalization: Seems optimistic<br />

Government has an<strong>no</strong>unced to freeze the <strong>no</strong>n development expenditures (excl.<br />

salaries); although appealing considering the fiscal consolidation, the<br />

materialization of these steps is of prime importance. The overall current<br />

expenditure is projected to increase by 9% over last year budget to PKR3trn.<br />

The unavoidable part of the budget including defence (+29% YoY to<br />

PKR442bn) and debt servicing (+8% YoY to PKR699bn) are to consume as<br />

high as 47% of the current expenditures. On the other hand, development<br />

expenditure which remained the key element in terms of investment and<br />

capacity building is projected to increase by 3% YoY. As it remained the key<br />

accused of fiscal constraints, higher allocation of funds for PSDP to provinces<br />

would remain a key element in materializing the projected outlays. During FY10,<br />

actual disbursement of PSDP remained under PKR300bn compared to original<br />

allocation of PKR646bn.<br />

Higher share of provinces in revenues (57.9% YoY) and allocation of<br />

development funds are the prominent features of budget FY11.<br />

Tax to GDP Provinces to enjoy more auto<strong>no</strong>my<br />

Direct Tax to GDP In direct Tax to GDP FBR tax to GDP<br />

FY07A FY08A FY09A FY10BE FY11BE<br />

Source: MoF, <strong>BMA</strong> Research Source: MoF, <strong>BMA</strong> Research<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

Provincial share in total revenue Provincial share in PSDP<br />

0%<br />

FY08A FY09A FY10BE FY11BE<br />

Subsidy elimination: The other half of the story<br />

Fiscal constraints have left <strong>no</strong> option but to confine welfare through price pass<br />

on. The government has thus eliminated a number of subsidies through budget<br />

FY11; during FY10, govt. had allocated subsidies of PKR228.9bn (1.5% of<br />

GDP) against initial estimates of PKR119bn (0.9% of GDP). Due to the set plan<br />

of eliminating subsidies on electricity tariffs, the government projects total<br />

subsidies of PKR127bn for FY11 which accounts for 0.7% of GDP and lower by<br />

45% YoY compared to revised budget FY10. Although the electricity related<br />

subsidies are projected to decline by PKR92bn in FY10, it is worth <strong>mention</strong>ing<br />

that <strong>no</strong> concrete plan to address the lingering circular debt issue has been