omc: no mention; hence safe - BMA Capital Management

omc: no mention; hence safe - BMA Capital Management

omc: no mention; hence safe - BMA Capital Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BANKS<br />

MARKETWEIGHT<br />

Budget Impact<br />

Positive<br />

Abdul Shakur<br />

Banking Analyst<br />

16<br />

BANKS: KEY BENEFICIARY!<br />

June 7, 2010<br />

A number of favorable decisions were an<strong>no</strong>unced for the banking sector in<br />

Budget FY11 which are expected to have a positive impact on the sector. The<br />

following are the key elements of the Budget FY11:<br />

� In order to address the admissibility of provisions charged by banks as tax<br />

deductible expenses, provisions against advances for consumer and SME<br />

have been allowed up to 5% of total advances while for other loans it has<br />

been maintained at 1% of total advances. In addition, provision under<br />

doubtful and loss categories charged up to 2008 -which were <strong>no</strong>t claimed<br />

as tax admissible – shall be allowed for the period in which advances were<br />

written off. However, in this case admissibility in case of consumer loans<br />

shall be restricted to 3% of the annual income. Considering the current<br />

practice of the banks to create deferred assets in this regard, this<br />

admissibility of provisions will <strong>no</strong>t impact the bottom-line of the banks.<br />

However, it would help reduce the deferred tax issues and improve cash<br />

flows.<br />

� 10% withholding tax deductible on government securities (including T-Bills<br />

and PIBs) is proposed to be treated as final discharge of tax liability, for<br />

corporations other than commercial banks. This measure would help GoP<br />

raise investments through the corporate sector and thus reducing the<br />

crowding-out effect for the sector. Nevertheless, we believe bank lending is<br />

to remain muted in CY10 amid credit risk and liquidity constraints<br />

� The ambit of advance tax collection over cash withdrawal – subject to tax<br />

@0.3% - has been enhanced to include various transactions including TDR,<br />

CDR, TT, online transfer, pay order and demand draft. However, the impact<br />

of the said development is neutral for banks as the same is passed on to<br />

the customers<br />

Outlook CY10: Positive<br />

Taking into account the above <strong>mention</strong>ed amendments in the Finance Bill, the<br />

banking sector is expected to remain the major beneficiary considering<br />

improving private credit which yields higher than govt. securities. On the other<br />

hand, <strong>no</strong>n materialization of the anticipated change regarding higher corporate<br />

tax rate for banks having 5% or higher spreads is also expected to tune-in<br />

further positive sentiments.<br />

Upward revision for NSS targets by 14% to PKR213bn would however exert<br />

further pressure over banking deposit rates. This factor would further intensify<br />

the impact due the prevailing liquidity issues, therefore we expect banking<br />

spreads to adjust downward. Our liking remains limited to banks having<br />

relatively better spreads and lower liquidity risk with our top pick being MCB.<br />

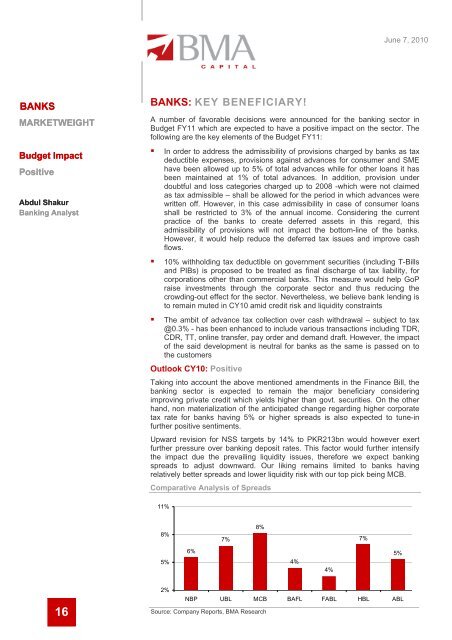

Comparative Analysis of Spreads<br />

11%<br />

8%<br />

5%<br />

2%<br />

6%<br />

7%<br />

8%<br />

4%<br />

NBP UBL MCB BAFL FABL HBL ABL<br />

Source: Company Reports, <strong>BMA</strong> Research<br />

4%<br />

7%<br />

5%