Banks and Consumers

The Comprehensive Consumer Policy Scheme of the German Private Commercial Banks

The Comprehensive Consumer Policy Scheme of the German Private Commercial Banks

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BANKENVERBAND<br />

ATMs outside Germany.<br />

associations issue the recommendation<br />

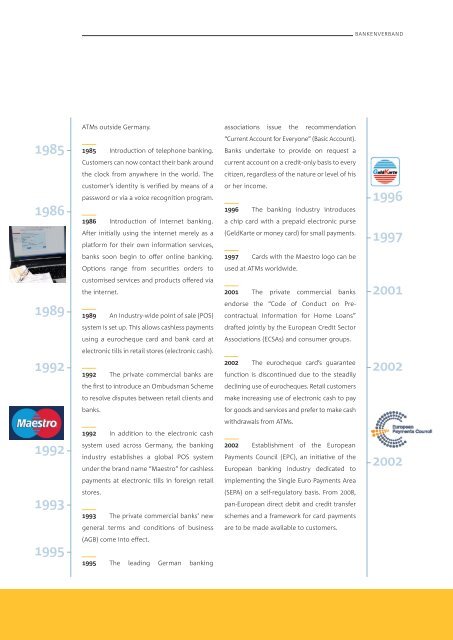

1 9 8 5<br />

1985 Introduction of telephone banking.<br />

Customers can now contact their bank around<br />

“Current Account for Everyone” (Basic Account).<br />

<strong>Banks</strong> undertake to provide on request a<br />

current account on a credit-only basis to every<br />

the clock from anywhere in the world. The<br />

citizen, regardless of the nature or level of his<br />

1 9 8 6<br />

customer’s identity is verified by means of a<br />

password or via a voice recognition program.<br />

1986 Introduction of internet banking.<br />

After initially using the internet merely as a<br />

platform for their own information services,<br />

or her income.<br />

1996 The banking industry introduces<br />

a chip card with a prepaid electronic purse<br />

(GeldKarte or money card) for small payments.<br />

1996<br />

1997<br />

banks soon begin to offer online banking.<br />

1997 Cards with the Maestro logo can be<br />

Options range from securities orders to<br />

used at ATMs worldwide.<br />

1 9 8 9<br />

customised services <strong>and</strong> products offered via<br />

the internet.<br />

1989 An industry-wide point of sale (POS)<br />

2001 The private commercial banks<br />

endorse the “Code of Conduct on Precontractual<br />

Information for Home Loans”<br />

2001<br />

system is set up. This allows cashless payments<br />

drafted jointly by the European Credit Sector<br />

using a eurocheque card <strong>and</strong> bank card at<br />

Associations (ECSAs) <strong>and</strong> consumer groups.<br />

1 9 9 2<br />

electronic tills in retail stores (electronic cash).<br />

1992 The private commercial banks are<br />

2002 The eurocheque card’s guarantee<br />

function is discontinued due to the steadily<br />

2002<br />

the first to introduce an Ombudsman Scheme<br />

declining use of eurocheques. Retail customers<br />

to resolve disputes between retail clients <strong>and</strong><br />

make increasing use of electronic cash to pay<br />

banks.<br />

for goods <strong>and</strong> services <strong>and</strong> prefer to make cash<br />

withdrawals from ATMs.<br />

1992<br />

1992 In addition to the electronic cash<br />

system used across Germany, the banking<br />

industry establishes a global POS system<br />

under the br<strong>and</strong> name “Maestro” for cashless<br />

2002 Establishment of the European<br />

Payments Council (EPC), an initiative of the<br />

European banking industry dedicated to<br />

2 0 0 2<br />

payments at electronic tills in foreign retail<br />

implementing the Single Euro Payments Area<br />

1 9 9 3<br />

stores.<br />

1993 The private commercial banks’ new<br />

(SEPA) on a self-regulatory basis. From 2008,<br />

pan-European direct debit <strong>and</strong> credit transfer<br />

schemes <strong>and</strong> a framework for card payments<br />

general terms <strong>and</strong> conditions of business<br />

are to be made available to customers.<br />

1995<br />

(AGB) come into effect.<br />

1995 The leading German banking<br />

33