2009 - Jaarverslag

2009 - Jaarverslag

2009 - Jaarverslag

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

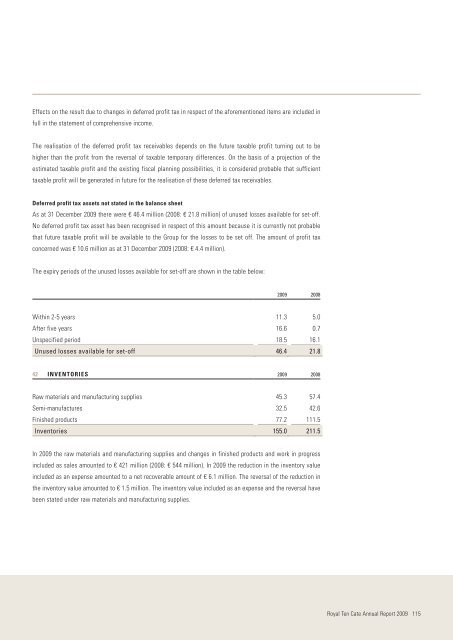

Effects on the result due to changes in deferred profit tax in respect of the aforementioned items are included infull in the statement of comprehensive income.The realisation of the deferred profit tax receivables depends on the future taxable profit turning out to behigher than the profit from the reversal of taxable temporary differences. On the basis of a projection of theestimated taxable profit and the existing fiscal planning possibilities, it is considered probable that sufficienttaxable profit will be generated in future for the realisation of these deferred tax receivables.Deferred profit tax assets not stated in the balance sheetAs at 31 December <strong>2009</strong> there were € 46.4 million (2008: € 21.8 million) of unused losses available for set-off.No deferred profit tax asset has been recognised in respect of this amount because it is currently not probablethat future taxable profit will be available to the Group for the losses to be set off. The amount of profit taxconcerned was € 10.6 million as at 31 December <strong>2009</strong> (2008: € 4.4 million).The expiry periods of the unused losses available for set-off are shown in the table below:<strong>2009</strong> 2008Within 2-5 years 11.3 5.0After five years 16.6 0.7Unspecified period 18.5 16.1Unused losses available for set-off 46.4 21.842 INVENTORIES <strong>2009</strong> 2008Raw materials and manufacturing supplies 45.3 57.4Semi-manufactures 32.5 42.6Finished products 77.2 111.5Inventories 155.0 211.5In <strong>2009</strong> the raw materials and manufacturing supplies and changes in finished products and work in progressincluded as sales amounted to € 421 million (2008: € 544 million). In <strong>2009</strong> the reduction in the inventory valueincluded as an expense amounted to a net recoverable amount of € 6.1 million. The reversal of the reduction inthe inventory value amounted to € 1.5 million. The inventory value included as an expense and the reversal havebeen stated under raw materials and manufacturing supplies.Royal Ten Cate Annual Report <strong>2009</strong> 115