2009 - Jaarverslag

2009 - Jaarverslag

2009 - Jaarverslag

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

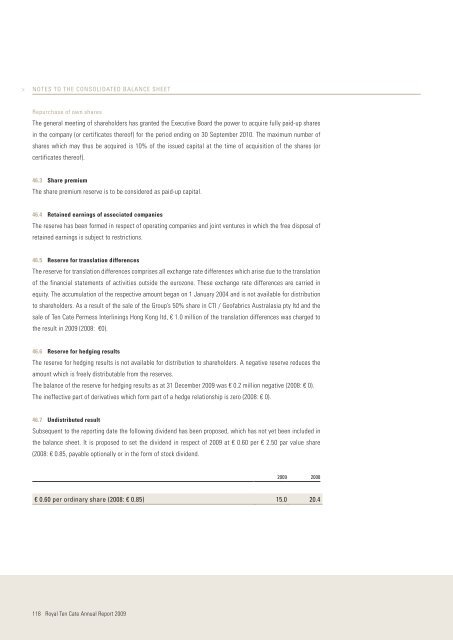

NOTES TO THE CONSOLIDATED BALANCE SHEETRepurchase of own sharesThe general meeting of shareholders has granted the Executive Board the power to acquire fully paid-up sharesin the company (or certificates thereof) for the period ending on 30 September 2010. The maximum number ofshares which may thus be acquired is 10% of the issued capital at the time of acquisition of the shares (orcertificates thereof).46.3 Share premiumThe share premium reserve is to be considered as paid-up capital.46.4 Retained earnings of associated companiesThe reserve has been formed in respect of operating companies and joint ventures in which the free disposal ofretained earnings is subject to restrictions.46.5 Reserve for translation differencesThe reserve for translation differences comprises all exchange rate differences which arise due to the translationof the financial statements of activities outside the eurozone. These exchange rate differences are carried inequity. The accumulation of the respective amount began on 1 January 2004 and is not available for distributionto shareholders. As a result of the sale of the Group’s 50% share in CTI / Geofabrics Australasia pty ltd and thesale of Ten Cate Permess Interlinings Hong Kong ltd, € 1.0 million of the translation differences was charged tothe result in <strong>2009</strong> (2008: €0).46.6 Reserve for hedging resultsThe reserve for hedging results is not available for distribution to shareholders. A negative reserve reduces theamount which is freely distributable from the reserves.The balance of the reserve for hedging results as at 31 December <strong>2009</strong> was € 0.2 million negative (2008: € 0).The ineffective part of derivatives which form part of a hedge relationship is zero (2008: € 0).46.7 Undistributed resultSubsequent to the reporting date the following dividend has been proposed, which has not yet been included inthe balance sheet. It is proposed to set the dividend in respect of <strong>2009</strong> at € 0.60 per € 2.50 par value share(2008: € 0.85, payable optionally or in the form of stock dividend.<strong>2009</strong> 2008€ 0.60 per ordinary share (2008: € 0.85) 15.0 20.4118Royal Ten Cate Annual Report <strong>2009</strong>