2009 - Jaarverslag

2009 - Jaarverslag

2009 - Jaarverslag

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

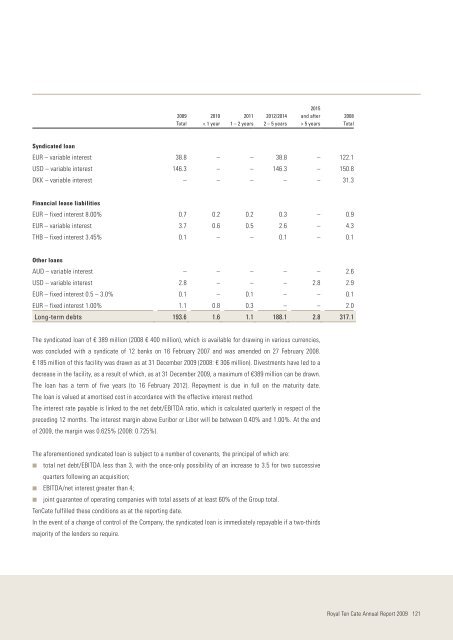

<strong>2009</strong>Total2010< 1 year20111 – 2 years2012/20142 – 5 years2015and after> 5 years2008TotalSyndicated loanEUR – variable interest 38.8 – – 38.8 – 122.1USD – variable interest 146.3 – – 146.3 – 150.8DKK – variable interest – – – – – 31.3Financial lease liabilitiesEUR – fixed interest 8.00% 0.7 0.2 0.2 0.3 – 0.9EUR – variable interest 3.7 0.6 0.5 2.6 – 4.3THB – fixed interest 3.45% 0.1 – – 0.1 – 0.1Other loansAUD – variable interest – – – – – 2.6USD – variable interest 2.8 – – – 2.8 2.9EUR – fixed interest 0.5 – 3.0% 0.1 – 0.1 – – 0.1EUR – fixed interest 1.00% 1.1 0.8 0.3 – – 2.0Long-term debts 193.6 1.6 1.1 188.1 2.8 317.1The syndicated loan of € 389 million (2008 € 400 million), which is available for drawing in various currencies,was concluded with a syndicate of 12 banks on 16 February 2007 and was amended on 27 February 2008.€ 185 million of this facility was drawn as at 31 December <strong>2009</strong> (2008: € 306 million). Divestments have led to adecrease in the facility, as a result of which, as at 31 December <strong>2009</strong>, a maximum of €389 million can be drawn.The loan has a term of five years (to 16 February 2012). Repayment is due in full on the maturity date.The loan is valued at amortised cost in accordance with the effective interest method.The interest rate payable is linked to the net debt/EBITDA ratio, which is calculated quarterly in respect of thepreceding 12 months. The interest margin above Euribor or Libor will be between 0.40% and 1.00%. At the endof <strong>2009</strong>, the margin was 0.625% (2008: 0.725%).The aforementioned syndicated loan is subject to a number of covenants, the principal of which are:◾ total net debt/EBITDA less than 3, with the once-only possibility of an increase to 3.5 for two successivequarters following an acquisition;◾ EBITDA/net interest greater than 4;◾ joint guarantee of operating companies with total assets of at least 60% of the Group total.TenCate fulfilled these conditions as at the reporting date.In the event of a change of control of the Company, the syndicated loan is immediately repayable if a two-thirdsmajority of the lenders so require.Royal Ten Cate Annual Report <strong>2009</strong> 121