- Page 1 and 2:

Royal Ten CateAnnual Report 2009Con

- Page 3 and 4:

COMMERCIAL OVERVIEWas at 1 January

- Page 5 and 6:

Annual Report 2009Royal Ten CatePro

- Page 7:

Financial highlights inmillions of

- Page 10 and 11:

Corporate technology3D weavingThe T

- Page 12 and 13:

Vision, mission, strategy and objec

- Page 14 and 15:

TenCate technology overviewEND-USER

- Page 16 and 17:

The TenCate shareLISTINGThe TenCate

- Page 18 and 19:

ConnectedTenCate is a producer of m

- Page 20 and 21:

Report of the Supervisory BoardANNU

- Page 22 and 23:

REPORT OF THE SUPERVISORY BOARD◾

- Page 24 and 25:

ADVANCED ARMOURIn Europe demand has

- Page 26 and 27:

The Boards (as at 1 January 2010)EX

- Page 28 and 29:

PROTECTIVE FABRICSIn 2009 TenCate P

- Page 30 and 31:

REPORT OF THE EXECUTIVE BOARDAnalys

- Page 32 and 33:

REPORT OF THE EXECUTIVE BOARDOPERAT

- Page 34 and 35:

REPORT OF THE EXECUTIVE BOARDPOST B

- Page 36 and 37:

PROTECTIVE FABRICSProtective clothi

- Page 38 and 39:

REPORT OF THE EXECUTIVE BOARD > Adv

- Page 40 and 41:

REPORT OF THE EXECUTIVE BOARD > Adv

- Page 42 and 43:

AEROSPACE COMPOSITESIn March 2009 A

- Page 44 and 45:

ADVANCED ARMOURPeace operations are

- Page 46 and 47:

GEOSYNTHETICSIn 2009 TenCate Geosyn

- Page 48 and 49:

REPORT OF THE EXECUTIVE BOARD > Geo

- Page 50 and 51:

REPORT OF THE EXECUTIVE BOARD > Geo

- Page 52 and 53:

REPORT OF THE EXECUTIVE BOARD > Geo

- Page 54 and 55:

innovative inkjet solutionsAs globa

- Page 56 and 57:

REPORT OF THE EXECUTIVE BOARD > Oth

- Page 58 and 59:

GEOSYNTHETICSTenCate GeoDetect ® i

- Page 60 and 61:

Corporate informationCORPORATE GOVE

- Page 62 and 63:

CORPORATE INFORMATIONSWOT ANALYSIST

- Page 64 and 65:

GRASSThe 100th Cruyff Court was ope

- Page 66 and 67:

CORPORATE INFORMATIONbodies, in par

- Page 68 and 69:

CORPORATE INFORMATIONWith regard to

- Page 70 and 71:

CORPORATE INFORMATIONCentral manage

- Page 72 and 73:

CORPORATE INFORMATIONthe reduction

- Page 74 and 75:

CORPORATE INFORMATIONSAFETYOur empl

- Page 76 and 77: CORPORATE INFORMATIONResearch and d

- Page 78 and 79: CORPORATE INFORMATIONSUSTAINABILITY

- Page 80 and 81: SPACE COMPOSITESGalileo is the firs

- Page 82 and 83: Corporate communicationIn October 2

- Page 84 and 85: 24 Share capital 10125 Pension liab

- Page 86 and 87: Consolidated statement of comprehen

- Page 88 and 89: Consolidated balance sheetin millio

- Page 90 and 91: Consolidated cash flow statementFor

- Page 92 and 93: Consolidated statement of changes i

- Page 94 and 95: Notes to the consolidated financial

- Page 96 and 97: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 98 and 99: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 100 and 101: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 102 and 103: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 104 and 105: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 106 and 107: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 108 and 109: Notes to the statement of comprehen

- Page 110 and 111: NOTES TO THE STATEMENT OF COMPREHEN

- Page 112 and 113: NOTES TO THE STATEMENT OF COMPREHEN

- Page 114 and 115: NOTES TO THE CONSOLIDATED BALANCE S

- Page 116 and 117: NOTES TO THE CONSOLIDATED BALANCE S

- Page 118 and 119: NOTES TO THE CONSOLIDATED BALANCE S

- Page 120 and 121: NOTES TO THE CONSOLIDATED BALANCE S

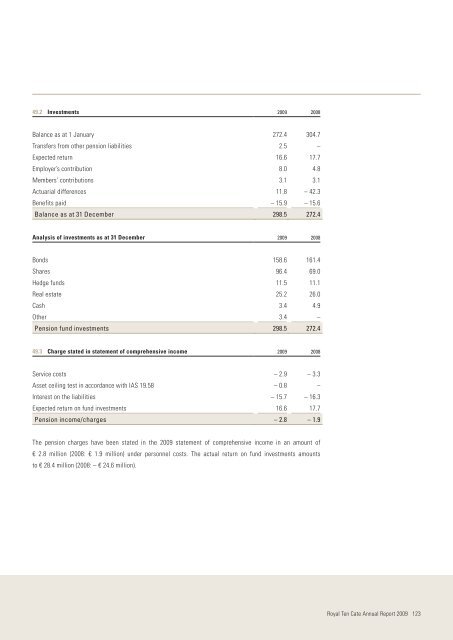

- Page 122 and 123: NOTES TO THE CONSOLIDATED BALANCE S

- Page 124 and 125: NOTES TO THE CONSOLIDATED BALANCE S

- Page 128 and 129: NOTES TO THE CONSOLIDATED BALANCE S

- Page 130 and 131: NOTES TO THE CONSOLIDATED BALANCE S

- Page 132 and 133: OTHER INFORMATIONThe term of the fi

- Page 134 and 135: OTHER INFORMATION51.3 Interest rate

- Page 136 and 137: OTHER INFORMATION51.5 Hedge account

- Page 138 and 139: OTHER INFORMATIONThe effect of a ge

- Page 140 and 141: OTHER INFORMATION56.2 Directors’

- Page 142 and 143: Company financial statements58 COMP

- Page 144 and 145: NOTES TO THE COMPANY FINANCIAL STAT

- Page 146 and 147: NOTES TO THE COMPANY FINANCIAL STAT

- Page 148 and 149: NOTES TO THE COMPANY FINANCIAL STAT

- Page 150 and 151: Other informationTo the General Mee

- Page 152 and 153: OTHER INFORMATIONSUBSEQUENT EVENTSA

- Page 154 and 155: Ten-year summaryIn millions of euro

- Page 156 and 157: 152 Royal Ten Cate Annual Report 20

- Page 158 and 159: OTHER ACTIVITIESNON-CONSOLIDATED CO

- Page 160: Royal Ten Cateinvestor relations &