2009 - Jaarverslag

2009 - Jaarverslag

2009 - Jaarverslag

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

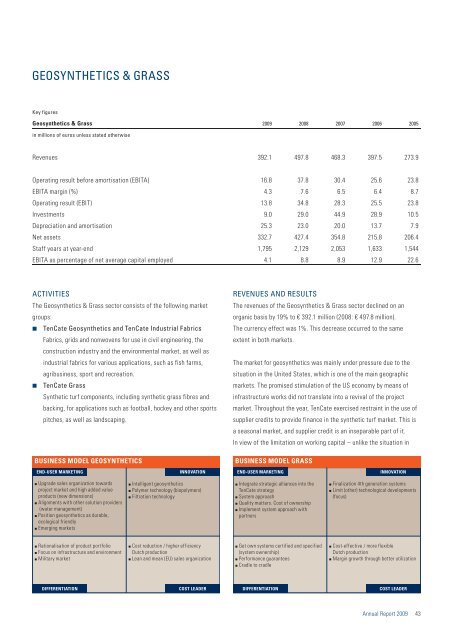

GEOSYNTHETICS & GRASSKey figuresGeosynthetics & Grass <strong>2009</strong> 2008 2007 2006 2005in millions of euros unless stated otherwiseRevenues 392.1 497.8 468.3 397.5 273.9Operating result before amortisation (EBITA) 16.8 37.8 30.4 25.6 23.8EBITA margin (%) 4.3 7.6 6.5 6.4 8.7Operating result (EBIT) 13.8 34.8 28.3 25.5 23.8Investments 9.0 29.0 44.9 28.9 10.5Depreciation and amortisation 25.3 23.0 20.0 13.7 7.9Net assets 332.7 427.4 354.8 215.8 206.4Staff years at year-end 1,795 2,129 2,053 1,633 1,544EBITA as percentage of net average capital employed 4.1 8.8 8.9 12.9 22.6ACTIVITIESThe Geosynthetics & Grass sector consists of the following marketgroups:◾ TenCate Geosynthetics and TenCate Industrial FabricsFabrics, grids and nonwovens for use in civil engineering, theconstruction industry and the environmental market, as well asindustrial fabrics for various applications, such as fish farms,agribusiness, sport and recreation.◾ TenCate GrassSynthetic turf components, including synthetic grass fibres andbacking, for applications such as football, hockey and other sportspitches, as well as landscaping.REVENUES AND RESULTSThe revenues of the Geosynthetics & Grass sector declined on anorganic basis by 19% to € 392.1 million (2008: € 497.8 million).The currency effect was 1%. This decrease occurred to the sameextent in both markets.The market for geosynthetics was mainly under pressure due to thesituation in the United States, which is one of the main geographicmarkets. The promised stimulation of the US economy by means ofinfrastructure works did not translate into a revival of the projectmarket. Throughout the year, TenCate exercised restraint in the use ofsupplier credits to provide finance in the synthetic turf market. This isa seasonal market, and supplier credit is an inseparable part of it.In view of the limitation on working capital – unlike the situation inBUSINESS MODEL GEOSYNTHETICSBUSINESS MODEL GRASSEND-USER MARKETINGINNOVATIONEND-USER MARKETINGINNOVATION▪ Upgrade sales organization towardsproject market and high added valueproducts (new dimensions)▪ Alignments with other solution providers(water management)▪ Position geosynthetics as durable,ecological friendly▪ Emerging markets▪ I n t e l l i g e n t g e o s y n t h e t i c s▪ Polymer technology (biopolymers)▪ Filtration technology▪ Integrate strategic alliances into theTenCate strategy▪ System approach▪ Quality matters. Cost of ownership▪ Implement system approach withpartners▪ Finalization 4th generation systems▪ Limit (other) technological developments(focus)▪ Rationalisation of product portfolio▪ Focus on infrastructure and environment▪ Military market▪ Cost reduction / higher efficiencyDutch production▪ Lean and mean (EU) sales organization▪ Get own systems certified and specified(system ownership)▪ Performance guarantees▪ Cradle to cradle▪ Cost-effective / more flexibleDutch production▪ Margin growth through better utilizationDIFFERENTIATIONCOST LEADERDIFFERENTIATIONCOST LEADERAnnual Report <strong>2009</strong> 43