2009 - Jaarverslag

2009 - Jaarverslag

2009 - Jaarverslag

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

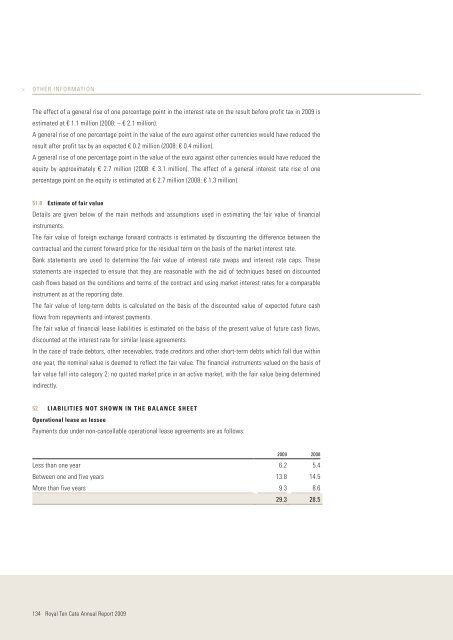

OTHER INFORMATIONThe effect of a general rise of one percentage point in the interest rate on the result before profit tax in <strong>2009</strong> isestimated at € 1.1 million (2008: – € 2.1 million).A general rise of one percentage point in the value of the euro against other currencies would have reduced theresult after profit tax by an expected € 0.2 million (2008: € 0.4 million).A general rise of one percentage point in the value of the euro against other currencies would have reduced theequity by approximately € 2.7 million (2008: € 3.1 million). The effect of a general interest rate rise of onepercentage point on the equity is estimated at € 2.7 million (2008: € 1.3 million).51.8 Estimate of fair valueDetails are given below of the main methods and assumptions used in estimating the fair value of financialinstruments.The fair value of foreign exchange forward contracts is estimated by discounting the difference between thecontractual and the current forward price for the residual term on the basis of the market interest rate.Bank statements are used to determine the fair value of interest rate swaps and interest rate caps. Thesestatements are inspected to ensure that they are reasonable with the aid of techniques based on discountedcash flows based on the conditions and terms of the contract and using market interest rates for a comparableinstrument as at the reporting date.The fair value of long-term debts is calculated on the basis of the discounted value of expected future cashflows from repayments and interest payments.The fair value of financial lease liabilities is estimated on the basis of the present value of future cash flows,discounted at the interest rate for similar lease agreements.In the case of trade debtors, other receivables, trade creditors and other short-term debts which fall due withinone year, the nominal value is deemed to reflect the fair value. The financial instruments valued on the basis offair value fall into category 2: no quoted market price in an active market, with the fair value being determinedindirectly.52 LIABILITIES NOT SHOWN IN THE BALANCE SHEETOperational lease as lesseePayments due under non-cancellable operational lease agreements are as follows:<strong>2009</strong> 2008Less than one year 6.2 5.4Between one and five years 13.8 14.5More than five years 9.3 8.629.3 28.5134Royal Ten Cate Annual Report <strong>2009</strong>