36NORILSK NICKEL • ANNUAL REPORT •200537••• Management structure reform8.3Before the start of the reforms the Group operated as a unifiedmulti-industry organization with diverse assets and divisions.The diversity of operations and assets predeterminedthe complexity of the management system. The managementsystem used before 2005 fully achieved its tasks, havingensured stability and profitability of operations and preservationof the personnel, management, resource and productionpotential.Embarking on the reform, the Group's management pursuedthe following objectives:• increase the effectiveness of the Group, and as a result, achieveshareholder value growth and improve the Group's image inthe international markets;• establish the Group's management structure appropriate forthe multi-industry geographically distributed organization;• optimize the management structures on the basis of industry-basedsegregation of the areas of responsibility, achieve thetransparency and economic reasonableness of the managementstructures;• delegate responsibility to the regions, assign respective authoritiesto the managers of industry streams and division managersin the regions;• reduce management staff and non-productive costs.The reform is expected to be performed in three stages. Thefirst stage was completed in 2005 which resulted in structuralre-grouping of the Group's entities. Industry streams andprofessional service functions have been formed operatingwithin a single legal entity. The new industry structure includes:• mining and metallurgical stream, bringing together the coreproduction assets. Includes entities and divisions involved inmining and enrichment, as well as metallurgical plants;• transport and logistics stream, bringing together entitiesand divisions involved in freight and passenger transportation.Includes river and seaports, river and sea transport, airand road transport companies, cargo terminals;• energy stream, bringing together two production areas –power and heat generation, transmission and distribution;and natural gas production, treatment and transportation;• geology stream, comprising assets and divisions involved inprospecting and exploration for new deposits and additionalexploration of deposits already being mined;• sales stream, involved in attracting and serving customers;• procurement stream – purchasing, transportation, storageand distribution of inventories, equipment, spare parts, toolingand instrumentation used in the operations of otherindustry streams;• support stream – a group of support and non-core enterprises.Includes design, telecommunications, medical andother assets;• maintenance stream – divisions and entities ensuring trouble-freeoperation of process equipment and engineeringinfrastructure;• construction stream – divisions and entities involved in capitalconstruction, including special construction (mines) andcivil engineering;• security stream – divisions ensuring security of the Group'sfacilities.MMC NORILSK NICKEL NOT INCLUDINGGOLD MINING ASSETS (POLUS)8

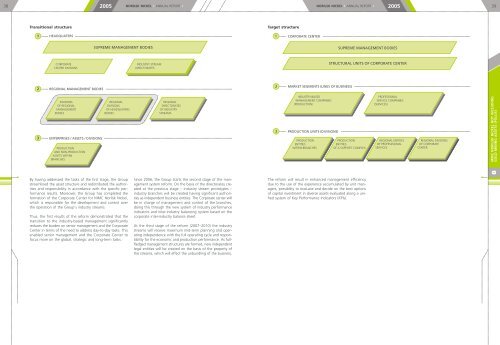

38 2005 NORILSK NICKEL • ANNUAL REPORT •NORILSK NICKEL • ANNUAL REPORT •200539Transitional structureTarget structure8MMC NORILSK NICKEL NOT INCLUDINGGOLD MINING ASSETS (POLUS)By having addressed the tasks of the first stage, the Groupstreamlined the asset structure and redistributed the authoritiesand responsibility in accordance with the specific performanceresults. Moreover, the Group has completed theformation of the Corporate Center for MMC Norilsk Nickel,which is responsible for the development and control overthe operation of the Group's industry streams.Thus, the first results of the reform demonstrated that thetransition to the industry-based management significantlyreduces the burden on senior management and the CorporateCenter in terms of the need to address day-to-day tasks. Thisenabled senior management and the Corporate Center tofocus more on the global, strategic and long-term tasks.Since 2006, the Group starts the second stage of the managementsystem reform. On the basis of the directorates createdat the previous stage – industry stream prototypes –industry branches will be created having significant authoritiesas independent business entities. The Corporate center willbe in charge of management and control of the branches,doing this through the new system of industry performanceindicators and inter-industry balancing system based on thecorporate inter-industry balance sheet.At the third stage of the reform (2007–2010) the industrystreams will receive maximum mid-term planning and operatingindependence with the full operating cycle and responsibilityfor the economic and production performance. As fullfledgedmanagement structures are formed, new independentlegal entities will be created on the basis of the property ofthe streams, which will effect the unbundling of the business.The reform will result in enhanced management efficiencydue to the use of the experience accumulated by unit managers,possibility to evaluate and decide on the best optionsof capital investment in diverse assets evaluated along a unifiedsystem of Key Performance Indicators (KPIs).