Untitled - PRIME Gold

Untitled - PRIME Gold

Untitled - PRIME Gold

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

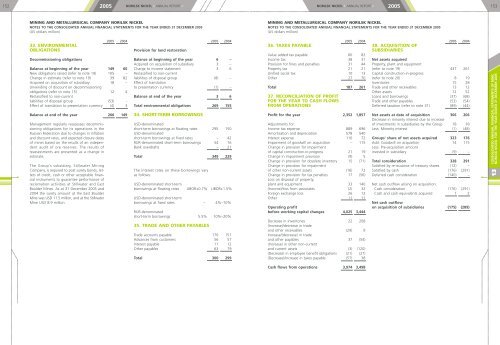

1522005NORILSK NICKEL • ANNUAL REPORT •NORILSK NICKEL • ANNUAL REPORT •2005153MINING AND METALLURGICAL COMPANY NORILSK NICKELNOTES TO THE CONSOLIDATED ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2005(US dollars million)MINING AND METALLURGICAL COMPANY NORILSK NICKELNOTES TO THE CONSOLIDATED ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2005(US dollars million)33. ENVIRONMENTALOBLIGATIONSDecommissioning obligations2005 2004Balance at beginning of the year 149 60New obligations raised (refer to note 19) 105 –Change in estimate (refer to note 19) 39 82Acquired on acquisition of subsidiary 18 –Unwinding of discount on decommissioningobligations (refer to note 15) 12 4Reclassified to non-currentliabilities of disposal group (53) -Effect of translation to presentation currency (4) 3Balance at end of the year 266 149Management regularly reassesses decommissioningobligations for its operations in theRussian Federation due to changes in inflationand discount rates, and expected closure datesof mines based on the results of an independentaudit of ore reserves. The results ofreassessments are presented as a change inestimate.The Group's subsidiary, Stillwater MiningCompany, is required to post surety bonds, lettersof credit, cash or other acceptable financialinstruments to guarantee performance ofreclamation activities at Stillwater and EastBoulder Mines. As at 31 December 2005 and2004 the surety amount at the East BoulderMine was USD 11.5 million, and at the StillwaterMine USD 8.9 million.Provision for land restoration2005 2004Balance at beginning of the year 6 –Acquired on acquisition of subsidiary 3 –Charge to income statement 3 6Reclassified to non-currentliabilities of disposal group (8) –Effect of translationto presentation currency (1) –Balance at end of the year 3 6Total environmental obligations 269 15534. SHORT-TERM BORROWINGSUSD-denominatedshort-term borrowings at floating rates 295 150USD-denominatedshort-term borrowings at fixed rates – 42RUR-denominated short-term borrowings 54 16Bank overdrafts – 21Total 349 229The interest rates on these borrowings varyas follows:USD-denominated short-termborrowings at floating ratesLIBOR+0.7% LIBOR+1.5%USD-denominated short-termborrowings at fixed rates – 4%–10%RUR-denominatedshort-term borrowings 5.5% 10%–20%35. TRADE AND OTHER PAYABLESTrade accounts payable 170 151Advances from customers 56 57Interest payable 11 12Other payables 63 79Total 300 29936. TAXES PAYABLE2005 2004Value added tax payable 60 82Income tax 38 31Provision for fines and penalties 31 44Property tax 21 21Unified social tax 10 13Other 27 70Total 187 26137. RECONCILIATION OF PROFITFOR THE YEAR TO CASH FLOWSFROM OPERATIONSProfit for the year 2,352 1,857Adjustments for:Income tax expense 889 696Amortisation and depreciation 578 540Interest expense 110 72Impairment of goodwill on acquisition – 115Change in provision for impairmentof capital construction-in-progress 21 19Change in impairment provision (9) 5Change in provision for obsolete inventory 15 (71)Change in provision for impairmentof other non-current assets (16) 72Change in provision for tax penalties 17 (56)Loss on disposal of property,plant and equipment 33 140(Income)/loss from associates (2) 32Foreign exchange loss 26 12Other 11 11Operating profitbefore working capital changes 4,025 3,444Decrease in inventories 22 208(Increase)/decrease in tradeand other receivables (29) 9Increase/(decrease) in tradeand other payables 37 (54)(Increase) in other non-currentand current assets (3) (120)(Decrease) in employee benefit obligations (21) (27)(Decrease)/increase in taxes payable (57) 3838. ACQUISITION OFSUBSIDIARIES2005 2004Net assets acquiredProperty, plant and equipment(refer to note 19) 437 261Capital construction-in-progress(refer to note 20) 8 19Inventories 15 28Trade and other receivables 13 12Other assets 12 52Loans and borrowings (37) (68)Trade and other payables (53) (54)Deferred taxation (refer to note 31) (89) (44)Net assets at date of acquisition 306 206Decrease in minority interest due to increaseof investments in subsidiaries by the Group 18 18Less: Minority interest (1) (48)Groups' share of net assets acquired 323 176Add: Goodwill on acquisition 14 115Less: Pre-acquisition amountinvested in subsidiary (9) –Total consideration 328 291Satisfied by re-issuance of treasury shares (12) –Satisfied by cash (176) (291)Deferred cash consideration (140) –Net cash outflow arising on acquisition:Cash consideration (176) (291)Cash and cash equivalents acquired 1 2Net cash outflowon acquisition of subsidiaries (175) (289)CONSOLIDATED ANNUAL FINANCIAL STATEMENTS OF MMCNORILSK NICKEL FOR THE YEAR ENDED 31 DECEMBER 200513Cash flows from operations 3,974 3,498