Untitled - PRIME Gold

Untitled - PRIME Gold

Untitled - PRIME Gold

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

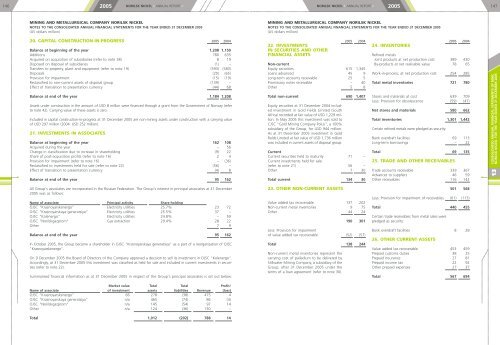

1462005NORILSK NICKEL • ANNUAL REPORT •NORILSK NICKEL • ANNUAL REPORT •2005147MINING AND METALLURGICAL COMPANY NORILSK NICKELNOTES TO THE CONSOLIDATED ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2005(US dollars million)MINING AND METALLURGICAL COMPANY NORILSK NICKELNOTES TO THE CONSOLIDATED ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2005(US dollars million)20. CAPITAL CONSTRUCTION-IN-PROGRESS 2005 2004Balance at beginning of the year 1,208 1,150Additions 780 635Acquired on acquisition of subsidiaries (refer to note 38) 8 19Disposed on disposal of subsidiaries (1) –Transfers to property, plant and equipment (refer to note 19) (593) (580)Disposals (20) (65)Provision for impairment (15) (19)Reclassified to non-current assets of disposal group (139) –Effect of translation to presentation currency (44) 68Balance at end of the year 1,184 1,208Assets under construction in the amount of USD 8 million were financed through a grant from the Government of Norway (referto note 42). Carrying value of these assets is zero.Included in capital construction-in-progress at 31 December 2005 are non-mining assets under construction with a carrying valueof USD 297 million (2004: USD 252 million).21. INVESTMENTS IN ASSOCIATESBalance at beginning of the year 162 108Acquired during the year – 56Change in classification due to increase in shareholding (9) 22Share of post-acquisition profits (refer to note 16) 2 4Provision for impairment (refer to note 16) – (36)Reclassified to investments held for sale (refer to note 22) (56) –Effect of translation to presentation currency (4) 8Balance at end of the year 95 16222. INVESTMENTSIN SECURITIES AND OTHERFINANCIAL ASSETS2005 2004Non-currentEquity securities 615 1,345Loans advanced 45 9Long-term accounts receivable 25 5Promissory notes receivable – 40Other 5 8Total non-current 690 1,407Equity securities at 31 December 2004 includedinvestment in <strong>Gold</strong> Fields Limited (SouthAfrica) recorded at fair value of USD 1,229 million.In May 2005 this investment was sold toCJSC "<strong>Gold</strong> Mining Company Polus", a 100%subsidiary of the Group, for USD 944 million.As at 31 December 2005 investment in <strong>Gold</strong>Fields Limited at fair value of USD 1,736 millionwas included in current assets of disposal group.CurrentCurrent securities held to maturity 71 –Current investments held for sale(refer to note 21) 56 –Other 7 30Total current 134 3024. INVENTORIES2005 2004Refined metalsJoint products at net production cost 389 430By-products at net realisable value 78 65Work-in-process, at net production cost 254 285Total metal inventories 721 780Stores and materials at cost 639 709Less: Provision for obsolescence (59) (47)Net stores and materials 580 662Total inventories 1,301 1,442Certain refined metals were pledged as security:Bank overdraft facilities 69 113Long-term borrowings – 22Total 69 13525. TRADE AND OTHER RECEIVABLESTrade accounts receivable 339 367Advances to suppliers 46 59Other receivables 116 142CONSOLIDATED ANNUAL FINANCIAL STATEMENTS OF MMCNORILSK NICKEL FOR THE YEAR ENDED 31 DECEMBER 200513All Group's associates are incorporated in the Russian Federation. The Group's interest in principal associates at 31 December2005 was as follows:Name of associate Principal activity Share-holdingOJSC "Krasnoyarskenergo" Electricity utilities 25.7% 23 72OJSC "Krasnoyarskaya generatsiya" Electricity utilities 25.5% 37 –OJSC "Kolenergo" Electricity utilities 24.8% – 59OJSC "Norilskgazprom" Gas extraction 29.4% 28 22Other 7 9Balance at end of the year 95 162In October 2005, the Group become a shareholder in OJSC "Krasnoyarskaya generatsiya" as a part of a reorganisation of OJSC"Krasnoyarskenergo".On 9 December 2005 the Board of Directors of the Company approved a decision to sell its investment in OJSC "Kolenergo".Accordingly, at 31 December 2005 this investment was classified as held for sale and included in current investments in securities(refer to note 22).Summarised financial information as at 31 December 2005 in respect of the Group's principal associates is set out below:23. OTHER NON-CURRENT ASSETSValue added tax recoverable 137 202Non-current metal inventories 9 75Other 44 24190 301Less: Provision for impairmentof value added tax recoverable (52) (57)Total 138 244Non-current metal inventories represent thecarrying cost of palladium to be delivered byStillwater Mining Company, a subsidiary of theGroup, after 31 December 2005 under theterms of a loan agreement (refer to note 30).501 568Less: Provision for impairment of receivables (61) (113)Total 440 455Certain trade receivables from metal sales werepledged as security:Bank overdraft facilities 8 2826. OTHER CURRENT ASSETSValue added tax recoverable 453 459Prepaid customs duties 38 25Prepaid insurance 27 81Prepaid income tax 22 92Other prepaid expenses 27 37Total 567 694Market value Total Total Profit/Name of associate of investment assets liabilities Revenue (loss)OJSC "Krasnoyarskenergo" 66 278 (38) 475 4OJSC "Krasnoyarskaya generatsiya" n/a 465 (74) 86 (4)OJSC "Norilskgazprom" n/a 145 (54) 97 14Other n/a 124 (36) 130 –Total 1,012 (202) 788 14