1362005NORILSK NICKEL • ANNUAL REPORT •NORILSK NICKEL • ANNUAL REPORT •2005137MINING AND METALLURGICAL COMPANY NORILSK NICKELNOTES TO THE CONSOLIDATED ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2005MINING AND METALLURGICAL COMPANY NORILSK NICKELNOTES TO THE CONSOLIDATED ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2005(m) Government grantsGovernment grants related to assets are deducted from thecost of these assets in arriving at their carrying value. Suchgrants are effectively recognised as income over the life ofthe depreciated asset through a reduced depreciation charge.(n) Revenue recognitionRevenue consists of the sale of joint product metals, and isrecognised when the risks and rewards of ownership are transferredto the buyer. Metal sales revenue represents the netinvoiced value for all joint product metals supplied to customers,excluding sales and value-added taxes. Revenues fromthe sale of by-products are netted-off against production costs.Revenue from contracts that are entered into and continue tomeet the Group's expected sale requirements designated forthat purpose at their inception, and are expected to be settledby physical delivery, are recognised in the financial statementsas and when they are delivered.(o) Segmental informationThe Group predominantly operates in a single business segment,being mining, refining and marketing of base and preciousmetals. Reportable segments are based on the geographiclocation of the Group's operations, which are theRussian Federation, United States of America and Europe.(p) ProvisionsProvisions are recognised when the Group has legal or constructiveobligations, as a result of a past event for which itis probable that an outflow of economic benefits will berequired to settle the obligations, and the amount of the obligationscan be reliably estimated.(q) Interest on borrowingsInterest on borrowings relating to major qualifying capital projectsunder construction is capitalised during the constructionperiod in which they are incurred. Once a qualifying capitalproject has been fully commissioned, the associated interestis expensed in the income statement as and when incurred.(s) Dividends declaredDividends and related taxation thereon are recognised as a liabilityin the period in which they have been declared andbecome legally payable.Accumulated profits legally distributable are based on theamounts available for distribution in accordance with theapplicable legislation and as reflected in the statutory financialstatements of the individual entities of the Group. Theseamounts may differ significantly from the amounts calculatedon the basis of IFRS.(t) Environmental obligationsEnvironmental obligations include decommissioning and landrestoration costs.Future decommissioning costs, discounted to net present value,are capitalised and corresponding decommissioning obligationsraised as soon as the constructive obligation to incursuch costs arises and the future decommissioning cost canbe reliably estimated. Decommissioning assets are amortisedon a straight-line basis over the life of mine. The unwindingof the decommissioning obligation is included in the incomestatement. Decommissioning obligations are periodicallyreviewed in light of current laws and regulations, and adjustmentsmade as necessary.Provision for land restoration, representing the cost of restoringland damage after the commencement of commercialproduction, is estimated at net present value of the expendituresexpected to settle the obligation. Increases in provisionare charged to the income statement as a cost of production.The unwinding of restoration costs are expensed over thelife of mine.Ongoing rehabilitation costs are expensed when incurred.(u) Discontinued operationsDiscontinued operations are disclosed when a component ofthe Group either has been disposed of during the reportingperiod, or is classified as held for sale or other type of disposalat the balance sheet date. This condition is regarded as metonly when the disposal is highly probable within one yearfrom the date of classification.The Group amends prior period disclosures in the incomestatement related to discontinued operations.Assets and liabilities of a disposal group are presented in thebalance sheet separately from other assets and liabilities. TheGroup does not amend disclosure of amounts presented in thebalance sheets of the prior periods.(v) ReclassificationsCertain comparative information, presented in the consolidatedannual financial statements for the year ended31 December 2004, has been reclassified in order to achievecomparability with the presentation used in the consolidatedannual financial statements for the year ended 31 December2005.3. CRITICAL ACCOUNTING JUDGMENTSAND ESTIMATESPreparation of the financial statements in accordance withIFRS requires the Group's management to make estimatesand assumptions that affect the reported amounts of assetsand liabilities and disclosure of contingent assets and liabilitiesat the date of the financial statements, and the reportedamounts of revenues and expenses during the reporting period.The determination of estimates requires judgments whichare based on historical experience, current and expected economicconditions, and all other available information. Actualresults could differ from those estimates.The most significant areas requiring the use of managementestimates and assumptions relate to useful economic lives ofassets; assets impairment; environmental obligations; employeebenefit obligations and tax matters.Useful economic lives of property,plant and equipmentThe Group's mining assets, classified within property, plantand equipment, are amortised over the respective life of mineusing the straight-line method based on proven and probableore reserves. When determining life of mine, assumptionsthat were valid at the time of estimation, may change whennew information becomes available.The factors that could affect estimation of life of mine includethe following:• changes of proven and probable ore reserves;• the grade of mineral reserves varying significantly from timeto time;• differences between actual commodity prices and commodityprice assumptions used in the estimation of orereserves;• unforeseen operational issues at mine sites; and• changes in capital, operating mining, processing and reclamationcosts, discount rates and foreign exchange ratespossibly adversely affecting the economic viability of orereserves.Any of these changes could affect prospective amortisation ofmining assets and their carrying value.CONSOLIDATED ANNUAL FINANCIAL STATEMENTS OF MMCNORILSK NICKEL FOR THE YEAR ENDED 31 DECEMBER 200513Interest relating to operating activities is expensed in theincome statement as and when incurred.(r) Operating lease paymentsPayments made under operating leases are recognised in theincome statement in the period in which they are due inaccordance with lease terms. Lease of assets under which allthe risks and benefits of ownership are retained by the lessorare classified as operating leases.Non-mining property, plant and equipment are depreciated ona straight line basis over their useful economic lives.Management periodically reviews the appropriateness of assetsuseful economic lives. The review is based on the current conditionof the assets and the estimated period during which theywill continue to bring economic benefit to the Group.

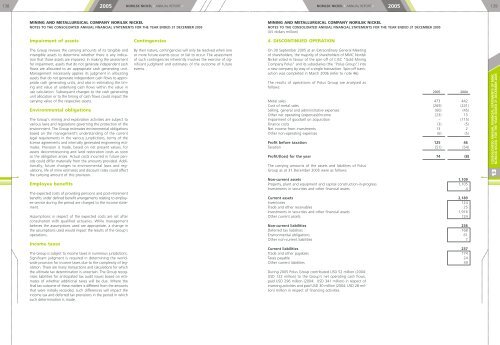

138 2005 NORILSK NICKEL • ANNUAL REPORT •NORILSK NICKEL • ANNUAL REPORT •2005139MINING AND METALLURGICAL COMPANY NORILSK NICKELNOTES TO THE CONSOLIDATED ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2005MINING AND METALLURGICAL COMPANY NORILSK NICKELNOTES TO THE CONSOLIDATED ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2005(US dollars million)Impairment of assetsContingencies4. DISCONTINUED OPERATIONThe Group reviews the carrying amounts of its tangible andintangible assets to determine whether there is any indicationthat those assets are impaired. In making the assessmentfor impairment, assets that do not generate independent cashflows are allocated to an appropriate cash generating unit.Management necessarily applies its judgment in allocatingassets that do not generate independent cash flows to appropriatecash generating units, and also in estimating the timingand value of underlying cash flows within the value inuse calculation. Subsequent changes to the cash generatingunit allocation or to the timing of cash flows could impact thecarrying value of the respective assets.Environmental obligationsThe Group's mining and exploration activities are subject tovarious laws and regulations governing the protection of theenvironment. The Group estimates environmental obligationsbased on the management's understanding of the currentlegal requirements in the various jurisdictions, terms of thelicense agreements and internally generated engineering estimates.Provision is made, based on net present values, forassets decommissioning and land restoration costs as soonas the obligation arises. Actual costs incurred in future periodscould differ materially from the amounts provided. Additionally,future changes to environmental laws and regulations,life of mine estimates and discount rates could affectthe carrying amount of this provision.Employee benefitsThe expected costs of providing pensions and post-retirementbenefits under defined benefit arrangements relating to employeeservice during the period are charged to the income statement.Assumptions in respect of the expected costs are set afterconsultation with qualified actuaries. While managementbelieves the assumptions used are appropriate, a change inthe assumptions used would impact the results of the Group'soperations.Income taxesThe Group is subject to income taxes in numerous jurisdictions.Significant judgment is required in determining the worldwideprovision for income taxes due to the complexity of legislation.There are many transactions and calculations for whichthe ultimate tax determination is uncertain. The Group recognisesliabilities for anticipated tax audit issues based on estimatesof whether additional taxes will be due. Where thefinal tax outcome of these matters is different from the amountsthat were initially recorded, such differences will impact theincome tax and deferred tax provisions in the period in whichsuch determination is made.By their nature, contingencies will only be resolved when oneor more future events occur or fail to occur. The assessmentof such contingencies inherently involves the exercise of significantjudgment and estimates of the outcome of futureevents.On 30 September 2005 at an Extraordinary General Meetingof shareholders, the majority of shareholders of MMC NorilskNickel voted in favour of the spin-off of CJSC "<strong>Gold</strong> MiningCompany Polus" and its subsidiaries (the "Polus Group") intoa new company by way of a single transaction. Spin-off transactionwas completed in March 2006 (refer to note 46).The results of operations of Polus Group are analysed asfollows:2005 2004Metal sales 473 442Cost of metal sales (269) (241)Selling, general and administrative expenses (60) (45)Other net operating (expenses)/income (23) 13Impairment of goodwill on acquisition – (115)Finance costs (3) (5)Net income from investments 13 2Other non-operating expenses (6) (5)Profit before taxation 125 46Taxation (51) (54)Profit/(loss) for the year 74 (8)The carrying amounts of the assets and liabilities of PolusGroup as at 31 December 2005 were as follows:Non-current assets 1,109Property, plant and equipment and capital construction-in-progress 1,105Investments in securities and other financial assets 4Current assets 2,189Inventories 124Trade and other receivables 25Investments in securities and other financial assets 1,916Other current assets 124Non-current liabilities 236Deferred tax liabilities 168Environmental obligations 61Other non-current liabilities 7Current liabilities 237Trade and other payables 174Taxes payable 24Other current liabilities 39During 2005 Polus Group contributed USD 52 million (2004:USD 122 million) to the Group's net operating cash flows,paid USD 296 million (2004: USD 341 million) in respect ofinvesting activities and paid USD 30 million (2004: USD 28 million)million in respect of financing activities.CONSOLIDATED ANNUAL FINANCIAL STATEMENTS OF MMCNORILSK NICKEL FOR THE YEAR ENDED 31 DECEMBER 200513