1802005NORILSK NICKEL • ANNUAL REPORT •NORILSK NICKEL • ANNUAL REPORT •2005181GOLD MINING COMPANY POLUSNOTES TO THE CONSOLIDATED ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2005(US dollars thousand)GOLD MINING COMPANY POLUSNOTES TO THE CONSOLIDATED ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2005(US dollars thousand)2005 2004Summarised financial information in respect of the Group'sassociates is set out below:Total assets 944 51,592Total liabilities 112 15,320Revenue – 8Loss for the year (156) (208)18. INVESTMENTS IN SECURITIES ANDOTHER FINANCIAL ASSETSNon-currentEquity investments available-for-sale 3,339 1,462Loans advanced 347 360Other 58 1,653Total non-current 3,744 3,475CurrentInvestment in <strong>Gold</strong> Fields Ltd. 1,735,987 –Promissory notes receivable 314,189 393,738Investment deposit in Rosbank 172,984 –Deposits 6,997 –Other 99 104Total current 2,230,256 393,842Investment in <strong>Gold</strong> Fields Ltd. (South Africa) was acquiredfrom MMC Norilsk Nickel, parent company, in May 2005 forUSD 944,940 thousand. In March 2006 it was sold to thirdparties (refer to note 40).Short-term promissory notes are purchased from the shareholderand bear interest of 10.4% per annum (refer to note 35).The investment deposit in Rosbank, a party related, by meansof common ownership and control, represents the amountmanaged by the bank on behalf of the Group and primarilyconsists of promissory notes. The principal amount of thisdeposit of USD 168,331 thousand is guaranteed by the bank.Income on this deposit is accrued as interest and is not guaranteedby the bank. Accrued income is capitalized into theprincipal amount of deposit.19. INVENTORIES2005 2004Refined gold at net production cost 1,306 2,445Work-in-process at production cost 30,470 11,070Total metal inventories 31,776 13,515Stores and materials at cost 92,472 57,104Less: Provision for obsolescence (632) (573)Total 123,616 70,04620. ADVANCES TO SUPPLIERSAND OTHER RECEIVABLESAdvances to suppliers 17,077 7,514Other receivables fromnon-mining activities 16,047 12,25233,124 19,766Less: Provision for impairmentof advances to suppliersand other receivables (7,715) (7,451)Total 25,409 12,31521. OTHER ASSETSNon-currentValue added tax recoverable 10,239 –Less: Provision for impairmentof value added tax recoverable (1,340) –Total non-current assets 8,899 –CurrentValue added tax recoverable 64,392 40,476Deferred expenditures 11,683 14,507Income tax prepaid 1,434 1,183Other taxes prepaid 2,266 2,058Total current assets 79,775 58,224Deferred expenditures mostly comprise excavation costs, generalproduction costs and mine specific administration costs associatedwith preparation for the seasons in which the alluvial operationsundertake mining activities.22. CASH ANDCASH EQUIVALENTS2005 2004Current bank accounts– RUR 18,376 8,905– foreign currency 3,849 38Bank deposit 5,681 –Cash in hand 296 117Letters of credit 174 3,308Other cash and cash equivalents 32 647Total 28,408 13,01523. SHARE CAPITALAuthorised1,123 ordinary sharesat par value of RUR 400 each 16 16120 preference sharesat par value of RUR 100 each – –Total 16 16Issued and fully paid31 December 2005: 299 ordinary sharesat par value of RUR 400 each 5 –31 December 2004: 173 ordinary sharesat par value of RUR 400 each – 3120 preference sharesat par value of RUR 100 each – –Total 5 3During 2004 the Company issued 50 additional ordinary sharesfor total proceeds of RUR 14,530,498 thousand (USD 498,819thousand). In 2005 the Company issued 126 additional ordinaryshares for total proceeds of RUR 36,616,855 thousand(USD 1,299,745 thousand).Preference shares are freely convertible into ordinary shares.24. MINORITY INTEREST2005 2004Balance at beginning of the year 43,970 –Minority interest in subsidiariesacquired (refer to note 33) (5,390) 48,416Minority interest in net lossof subsidiaries for the year (456) (5,117)Net decrease in minority interestdue to increase of Group's sharein subsidiaries(refer to comments below) (7,389) –Effect of translation topresentation currency for the year (1,103) 671Balance at end of the year 29,632 43,970In March 2005 six subsidiaries of OJSC "Lenzoloto", a 57.0%subsidiary of the Group, were sold to LLC "LenskayaZolotorudnaya Company", a 100.0% subsidiary of the Group.This transaction resulted in a decrease in minority interest andan increase in equity attributable to shareholder of theCompany of USD 11,136 thousand.In April 2005 26.0% share of OJSC "Lenzoloto" in OJSC"Pervenets" was sold to LLC "Lenskaya ZolotorudnayaCompany". This transaction resulted in a decrease in minorityinterest and increase in equity attributable to shareholderof the Company in the amount of USD 3,938 thousand.During April-May 2005 OJSC "Matrosov Mine", a subsidiaryof the Group, issued additional ordinary shares that wereacquired by the Group. Prior to this transaction all losses ofthe company applicable to minority interest were allocatedagainst the interest of the shareholder of the Company. As aresult of the transaction minority interest in the increased netassets of OJSC "Matrosov Mine" of USD 7,685 thousand wasrecognised.CONSOLIDATED ANNUAL FINANCIAL STATEMENTS OFCJSC POLUS FOR THE YEAR ENDED 31 DECEMBER 200514

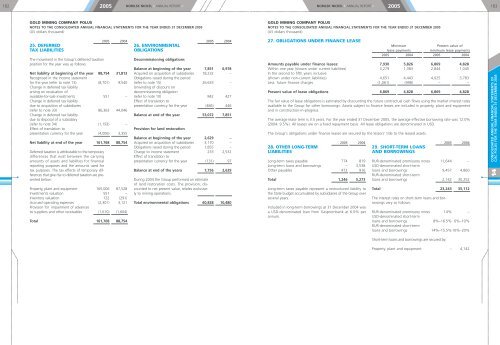

1822005NORILSK NICKEL • ANNUAL REPORT •NORILSK NICKEL • ANNUAL REPORT •2005183GOLD MINING COMPANY POLUSNOTES TO THE CONSOLIDATED ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2005(US dollars thousand)GOLD MINING COMPANY POLUSNOTES TO THE CONSOLIDATED ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2005(US dollars thousand)25. DEFERREDTAX LIABILITIESThe movement in the Group's deferred taxationposition for the year was as follows:2005 2004Net liability at beginning of the year 88,754 31,813Recognised in the income statementfor the year (refer to note 13) (8,701) 9,540Change in deferred tax liabilityarising on revaluation ofavailable-for-sale investments 551 –Change in deferred tax liabilitydue to acquisition of subsidiaries(refer to note 33) 86,363 44,046Change in deferred tax liabilitydue to disposal of a subsidiary(refer to note 34) (1,193) –Effect of translation topresentation currency for the year (4,006) 3,355Net liability at end of the year 161,768 88,754Deferred taxation is attributable to the temporarydifferences that exist between the carryingamounts of assets and liabilities for financialreporting purposes and the amounts used fortax purposes. The tax effects of temporary differencesthat give rise to deferred taxation are presentedbelow:Property, plant and equipment 165,006 87,528Investments valuation 551 –Inventory valuation 122 (291)Accrued operating expenses (2,301) 3,121Provision for impairment of advancesto suppliers and other receivables (1,610) (1,604)Total 161,768 88,75426. ENVIRONMENTALOBLIGATIONSDecommissioning obligations2005 2004Balance at beginning of the year 7,851 6,978Acquired on acquisition of subsidiaries 18,232 –Obligations raised during the period(refer to note 15) 26,633 –Unwinding of discount ondecommissioning obligation(refer to note 10) 842 427Effect of translation topresentation currency for the year (486) 446Balance at end of the year 53,072 7,851Provision for land restorationBalance at beginning of the year 2,629 –Acquired on acquisition of subsidiaries 3,170 –Obligations raised during the period 1,855 –Charge to income statement 233 2,532Effect of translation topresentation currency for the year (131) 97Balance at end of the year‡ 7,756 2,629During 2004 the Group performed an estimateof land restoration costs. The provision, discountedto net present value, relates exclusivelyto mining operations.Total environmental obligations 60,828 10,48027. OBLIGATIONS UNDER FINANCE LEASEMinimumPresent value oflease paymentsminimum lease payments2005 2004 2005 2004Amounts payable under finance leases: 7,930 5,826 6,869 4,828Within one year (shown under current liabilities) 3,279 1,383 2,844 1,045In the second to fifth years inclusive(shown under non-current liabilities) 4,651 4,443 4,025 3,783Less: future finance charges (1,061) (998) – –Present value of lease obligations 6,869 4,828 6,869 4,828The fair value of lease obligations is estimated by discounting the future contractual cash flows using the market interest ratesavailable to the Group for other borrowings. Assets subject to finance leases are included in property, plant and equipmentand in construction-in-progress.The average lease term is 3.5 years. For the year ended 31 December 2005, the average effective borrowing rate was 12.0%(2004: 9.5%). All leases are on a fixed repayment basis. All lease obligations are denominated in USD.The Group's obligations under finance leases are secured by the lessors' title to the leased assets.28. OTHER LONG-TERMLIABILITIES2005 2004Long-term taxes payable 774 819Long-term loans and borrowings – 3,538Other payables 472 916Total 1,246 5,273Long-term taxes payable represent a restructured liability tothe State budget accumulated by subsidiaries of the Group overseveral years.Included in long-term borrowings at 31 December 2004 wasa USD-denominated loan from Gasprombank at 6.0% perannum.29. SHORT-TERM LOANSAND BORROWINGS2005 2004RUR-denominated promissory notes 11,644 –USD-denominated short-termloans and borrowings 9,457 4,860RUR-denominated short-termloans and borrowings 2,142 30,252Total 23,243 35,112The interest rates on short-term loans and borrowingsvary as follows:RUR-denominated promissory notes 14% –USD-denominated short-termloans and borrowings 8%–16.5% 6%–10%RUR-denominated short-termloans and borrowings 14%–15.5%10%–20%CONSOLIDATED ANNUAL FINANCIAL STATEMENTS OFCJSC POLUS FOR THE YEAR ENDED 31 DECEMBER 200514Short-term loans and borrowings are secured by:Property, plant and equipment – 4,142