Untitled - PRIME Gold

Untitled - PRIME Gold

Untitled - PRIME Gold

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

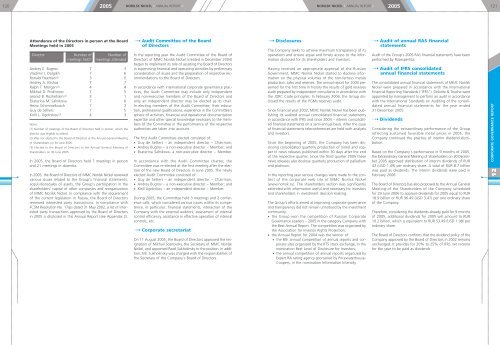

120 2005 NORILSK NICKEL • ANNUAL REPORT •NORILSK NICKEL • ANNUAL REPORT •2005121Attendance of the Directors in person at the BoardMeetings held in 2005Director Number of Number ofmeetings held 1) meetings attendedAndrey E. Bugrov 7 3Vladimir I. Dolgikh 7 6Ronald Freeman (2) 3 0Andrey A. Klishas 7 7Ralph T. Morgan (3) 4 4Mikhail D. Prokhorov 7 5Leonid B. Rozhetskin (2) 3 1Ekaterina M. Salnikova 7 6Heinz Schimmelbusch 7 3Guy de Selliers 7 5Kirill L. Ugolnikov (3) 4 3Notes:(1) Number of meetings of the Board of Directors held in person, which thedirector was eligible to attend.(2) Was not elected to the Board of Directors at the Annual General Meetingof Shareholders on 30 June 2005.(3) Elected to the Board of Directors at the Annual General Meeting ofShareholders on 30 June 2005.In 2005, the Board of Directors held 7 meetings in personand 21 meetings in absentia.In 2005, the Board of Directors of MMC Norilsk Nickel reviewedvarious issues related to the Group's financial statements,acquisitions/sales of assets, the Group's participation in theshareholders' capital of other companies and reorganizationof MMC Norilsk Nickel. In compliance with the requirementof the current legislation in Russia, the Board of Directorsreviewed interested party transactions. In compliance withFCSM Resolution No. 17/ps dated 31 May 2002, a list of interestedparty transactions approved by the Board of Directorsin 2005 is disclosed in this Annual Report (see Appendix 2).••• Audit Committee of the Boardof DirectorsIn the reporting year the Audit Committee of the Board ofDirectors of MMC Norilsk Nickel (created in December 2004)began to implement its role of assisting the Board of Directorsin supervising financial and operating activities by preliminaryconsideration of issues and the preparation of respective recommendationsto the Board of Directors.In accordance with international corporate governance practices,the Audit Committee may include only independentand non-executive members of the Board of Directors andonly an independent director may be elected as its chair.In electing members of the Audit Committee, their education,professional qualifications, experience in the Committee'ssphere of activities, financial and operational documentationexpertise and other special knowledge necessary to the membersof the Committee in the performance of the respectiveauthorities are taken into account.The first Audit Committee elected consisted of:• Guy de Selliers – an independent director – Chairman;• Andrey Bugrov – a non-executive director – Member; and• Ekaterina Salnikova- a non-executive director – Member.In accordance with the Audit Committee charter, theCommittee was re-elected at the first meeting after the electionof the new Board of Directors in June 2005. The newlyelected Audit Committee consisted of:• Guy de Selliers – an independent director – Chairman;• Andrey Bugrov – a non-executive director – Member; and• Kirill Ugolnikov – an independent director – Member.During 2005, the Committee held 3 meetings and 2 conferencecalls, which considered various issues within its competence,in particular: financial statements, interaction of theCompany with the external auditors, assessment of internalcontrol efficiency, assistance in effective operation of internalcontrols, etc.••• Corporate secretariatOn 11 August 2005, the Board of Directors approved the resignationof Mikhail Sosnovsky, the Secretary of MMC NorilskNickel, and appointed Pavel Sukholinsky to the position. In addition,Mr. Sukholinsky was charged with the responsibilities ofthe Secretary of the Company's Board of Directors.••• DisclosuresThe Company seeks to achieve maximum transparency of itsoperations and ensure equal and timely access to the informationdisclosed for its shareholders and investors.Having received an appropriate approval of the RussianGovernment, MMC Norilsk Nickel started to disclose informationon the physical volumes of the non-ferrous metalsproduction, sales and reserves. The annual report for 2004 presentedfor the first time in history the results of gold reservesaudit prepared by independent consultants in accordance withthe JORC Code principles. In February 2006, the Group disclosedthe results of the PGMs reserves audit.Since financial year 2002, MMC Norilsk Nickel has been publishingits audited annual consolidated financial statementsin accordance with IFRS and since 2004 – interim consolidatedfinancial statements on a semi-annual basis. After the issueof financial statements teleconferences are held with analystsand investors.Since the beginning of 2005, the Company has been disclosingconsolidated quarterly production of nickel and copperin news releases published within 30 days after the endof the respective quarter. Since the third quarter 2005 thesenews releases also disclose quarterly production of palladiumand platinum.In the reporting year serious changes were made to the contentof the corporate web site of MMC Norilsk Nickel(www.nornik.ru). The shareholders section was significantlyextended with information useful and necessary for investorsand shareholders in investment decision making.The Group's efforts aimed at improving corporate governanceand transparency did not remain unnoticed by the investmentcommunity:• the Group won the competition of Russian CorporateGovernance Leaders – 2005 in the category Company withthe Best Annual Report. The competition was organized bythe Association for Investor Rights Protection;• the Annual Report for 2004 was the winner of:• the 8th annual competition of annual reports and corporatesites organized by the RTS stock exchange, in thenomination Best Level of Disclosure for Investors;• the annual competition of annual reports organized byExpert RA rating agency sponsored by Pricewaterhouse-Coopers, in the nomination Information Intensity.••• Audit of annual RAS financialstatementsAudit of the Group's 2005 RAS financial statements have beenperformed by Rosexpertiza.••• Audit of IFRS consolidatedannual financial statementsThe consolidated annual financial statements of MMC NorilskNickel were prepared in accordance with the InternationalFinancial Reporting Standards ("IFRS"). Deloitte & Touche wereappointed by management to perform an audit in accordancewith the International Standards on Auditing of the consolidatedannual financial statements for the year ended31 December 2005.••• DividendsConsidering the extraordinary performance of the Groupreflecting sustained favorable metal prices in 2005, theCompany continued the practice of interim dividend distribution.Based on the Company's performance in 9 months of 2005,the Extraordinary General Meeting of Shareholders on 30 December2005 approved distribution of interim dividends of RUR43 (USD 1.49) per ordinary share. A total of RUR 8.7 billionwas paid as dividends. The interim dividends were paid inFebruary 2006.The Board of Directors has also proposed to the Annual GeneralMeeting of the Shareholders of the Company scheduledfor 29 June 2006 to approve dividends for 2005 equal to RUR18.9 billion or RUR 96.49 (USD 3.47) per one ordinary shareof the Company.Therefore, considering the dividends already paid for 9 monthsof 2005, additional dividends for 2005 will amount to RUR10.2 billion, which is equivalent to RUR 53.49 (USD 1.98) perordinary share.The Board of Directors confirms that the dividend policy of theCompany approved by the Board of Directors in 2002 remainsunchanged. It provides for 20% to 25% of IFRS net incomefor the year to be paid as dividends.CORPORATE GOVERNANCE REPORT12