Untitled - PRIME Gold

Untitled - PRIME Gold

Untitled - PRIME Gold

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

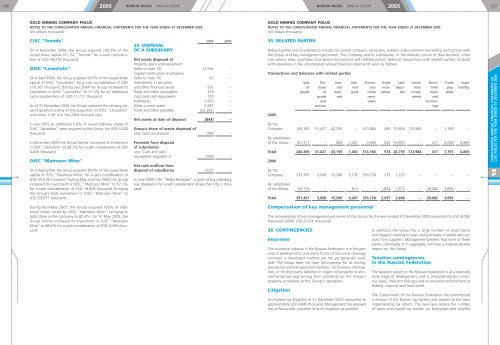

1862005NORILSK NICKEL • ANNUAL REPORT •NORILSK NICKEL • ANNUAL REPORT •2005187GOLD MINING COMPANY POLUSNOTES TO THE CONSOLIDATED ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2005(US dollars thousand)GOLD MINING COMPANY POLUSNOTES TO THE CONSOLIDATED ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2005(US dollars thousand)CJSC "TonÓd‡"On 9 December 2004, the Group acquired 100.0% of theissued share capital of CJSC "Tonoda" for a cash considerationof USD 28,276 thousand.OJSC "Lenzoloto"On 6 April 2004, the Group acquired 50.5% of the issued sharecapital of OJSC "Lenzoloto" for a cash consideration of USD179,307 thousand. During July 2004 the Group increased itsinvestment in OJSC "Lenzoloto" to 57.0% for an additionalcash consideration of USD 11,711 thousand.As of 31 December 2004 the Group reviewed the carrying valueof goodwill arising on the acquisition of OJSC "Lenzoloto"and wrote it off it in the 2004 financial year.In July 2005 an additional 5.6% of issued ordinary shares ofOJSC "Lenzoloto" were acquired by the Group, for USD 3,000thousand.In December 2005 the Group further increased its investmentin OJSC "Lenzoloto" to 68.2% for a cash consideration of USD4,636 thousand.OJSC "Matrosov Mine"On 6 April 2004, the Group acquired 38.0% of the issued sharecapital of OJSC "Matrosov Mine" for a cash consideration ofUSD 35,618 thousand. During May and July 2004 the Groupincreased its investment in OJSC "Matrosov Mine" to 57.1%for a cash consideration of USD 18,059 thousand, bringingthe Group's total investment in OJSC "Matrosov Mine" toUSD 53,677 thousand.34. DISPOSALOF A SUBSIDIARY2005 2004Net assets disposed ofProperty, plant and equipment(refer to note 15) 12,592 –Capital construction-in-progress(refer to note 16) 42 –Investments in securitiesand other financial assets 501 –Trade and other receivables 319 –Cash and cash equivalents 107 –Inventories 1,970 –Other current assets 5,987 –Trade and other payables (22,362) –Net assets at date of disposal (844) –Group's share of assets disposed ofLess: Gain on disposal 844 –Proceeds from disposalof subsidiariesLess: Cash and cashequivalents disposed of (107) –Net cash outflow fromdisposal of subsidiaries (107) –In June 2005 CJSC "Nedra Bodaybo", a gold mining subsidiary,was disposed of for a cash consideration of less than USD 1 thousand.35. RELATED PARTIESRelated parties are considered to include the parent company, associates, entities under common ownership and control withthe Group and key management personnel. The Company and its subsidiaries, in the ordinary course of their business, enterinto various sales, purchases and service transactions with related parties. Material transactions with related parties not dealtwith elsewhere in the consolidated annual financial statements were as follows:Transactions and balances with related parties2005Sale Pur- Inte- Inte- Promis- Trade Cash Short- Short- Trade Leaseof chase rest rest sory recei- depo- term term pay- liabilitygoods of recei- paid notes vables sits invest- loans ablesgoods ved recei- ments andand vable borrowservicesingsBy theCompany 145,185 31,427 42,235 – 310,484 449 15,804 172,984 – 1,769 –By subsidiariesof the Group 101,311 – 924 1,401 3,696 525 10,955 – 417 6,028 6,869Total 246,496 31,427 43,159 1,401 314,180 974 26,759 172,984 417 7,797 6,8692004By theCompany 333,705 3,928 15,290 5,192 393,738 273 1,223 – – – –By subsidiariesof the Group 63,716 – – 815 – 1,824 1,675 – 28,082 3,836 –Total 397,421 3,928 15,290 6,007 393,738 2,097 2,898 – 28,082 3,836 –CONSOLIDATED ANNUAL FINANCIAL STATEMENTS OFCJSC POLUS FOR THE YEAR ENDED 31 DECEMBER 200514During April-May 2005, the Group acquired 100% of additionalshares issued by OJSC "Matrosov Mine", bringing itstotal share in the company to 87.4%. On 31 May 2005, theGroup further increased its investment in OJSC "MatrosovMine" to 88.4% for a cash consideration of USD 4,265 thousand.Compensation of key management personnelThe remuneration of key management personnel of the Group for the year ended 31 December 2005 amounted to USD 8,782thousand (2004: USD 5,914 thousand).36. CONTINGENCIESInsuranceThe insurance industry in the Russian Federation is in the processof development, and many forms of insurance coveragecommon in developed markets are not yet generally available.The Group does not have full coverage for its mining,processing and transportation facilities, for business interruption,or for third party liabilities in respect of property or environmentaldamage arising from accidents on the Group'sproperty or relating to the Group's operations.LitigationUnresolved tax litigation at 31 December 2005 amounted toapproximately USD 4,845 thousand. Management has assessedthe unfavourable outcome of such litigation as possible.In addition, the Group has a large number of small claimsand litigation relating to sales and purchases of goods and servicesfrom suppliers. Management believes that none of theseclaims, individually or in aggregate, will have a material adverseimpact on the Group.Taxation contingenciesin the Russian FederationThe taxation system in the Russian Federation is at a relativelyearly stage of development, and is characterised by numeroustaxes, frequent changes and inconsistent enforcement atfederal, regional and local levels.The Government of the Russian Federation has commenceda revision of the Russian tax system and passed certain lawsimplementing tax reform. The new laws reduce the numberof taxes and overall tax burden on businesses and simplify