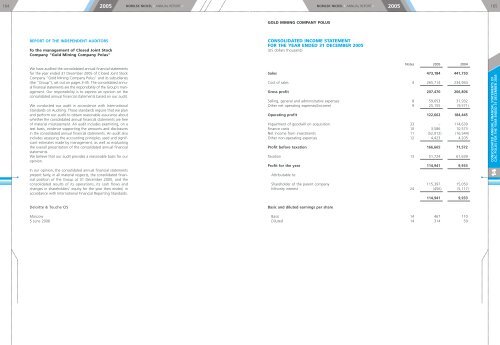

1642005NORILSK NICKEL • ANNUAL REPORT •NORILSK NICKEL • ANNUAL REPORT •2005165GOLD MINING COMPANY POLUSREPORT OF THE INDEPENDENT AUDITORSTo the management of Closed Joint StockCompany "<strong>Gold</strong> Mining Company Polus"CONSOLIDATED INCOME STATEMENTFOR THE YEAR ENDED 31 DECEMBER 2005(US dollars thousand)We have audited the consolidated annual financial statementsfor the year ended 31 December 2005 of Closed Joint StockCompany "<strong>Gold</strong> Mining Company Polus" and its subsidiaries(the "Group"), set out on pages 3-45. The consolidated annualfinancial statements are the responsibility of the Group's management.Our responsibility is to express an opinion on theconsolidated annual financial statements based on our audit.We conducted our audit in accordance with InternationalStandards on Auditing. Those standards require that we planand perform our audit to obtain reasonable assurance aboutwhether the consolidated annual financial statements are freeof material misstatement. An audit includes examining, on atest basis, evidence supporting the amounts and disclosuresin the consolidated annual financial statements. An audit alsoincludes assessing the accounting principles used and significantestimates made by management, as well as evaluatingthe overall presentation of the consolidated annual financialstatements.We believe that our audit provides a reasonable basis for ouropinion.In our opinion, the consolidated annual financial statementspresent fairly, in all material respects, the consolidated financialposition of the Group at 31 December 2005, and theconsolidated results of its operations, its cash flows andchanges in shareholders' equity for the year then ended, inaccordance with International Financial Reporting Standards.Notes 2005 2004Sales 473,184 441,750Cost of sales 4 265,714 234,944Gross profit 207,470 206,806Selling, general and administrative expenses 8 59,653 31,932Other net operating expenses/(income) 9 25,155 (9,571)Operating profit 122,662 184,445Impairment of goodwill on acquisition 33 – 114,639Finance costs 10 3,586 10,573Net income from investments 11 (52,012) (16,544)Other non-operating expenses 12 4,423 4,205Profit before taxation 166,665 71,572Taxation 13 51,724 61,639Profit for the year 114,941 9,933Attributable to:Shareholder of the parent company 115,397 15,050Minority interest 24 (456) (5,117)114,941 9,933CONSOLIDATED ANNUAL FINANCIAL STATEMENTS OFCJSC POLUS FOR THE YEAR ENDED 31 DECEMBER 200514Deloitte & Touche CISMoscow5 June 2006Basic and diluted earnings per shareBasic 14 467 110Diluted 14 314 59

1662005NORILSK NICKEL • ANNUAL REPORT •NORILSK NICKEL • ANNUAL REPORT •2005167GOLD MINING COMPANY POLUSGOLD MINING COMPANY POLUSCONSOLIDATED BALANCE SHEETAT 31 DECEMBER 2005(US dollars thousand)CONSOLIDATED CASH FLOW STATEMENTFOR THE YEAR ENDED 31 DECEMBER 2005(US dollars thousand)ASSETSNotes 2005 2004Operating activitiesNotes 2005 2004Non-current assets 1,085,348 590,848Property, plant and equipment 15 965,413 515,591Capital construction-in-progress 16 106,966 62,425Investments in associates 17 326 9,357Investments in securities and other financial assets 18 3,744 3,475Other non-current assets 21 8,899 –Current assets 2,487,464 547,442Inventories 19 123,616 70,046Advances to suppliers and other receivables 20 25,409 12,315Other current assets 21 79,775 58,224Investments in securities and other financial assets 18 2,230,256 393,842Cash and cash equivalents 22 28,408 13,015Total assets 3,572,812 1,138,290SHAREHOLDER'S EQUITY AND LIABILITIESShare capital and reserves 3,106,042 943,467Share capital 23 5 3Share premium 1,777,027 523,645Investments revaluation reserve 816,709 –Accumulated profits 482,669 375,849Equity attributable to shareholder of the parent company 3,076,410 899,497Minority interest 24 29,632 43,970Cash flows from operations 32 99,587 188,807Interest paid (2,438) (11,839)Taxation paid (45,600) (49,775)Net cash inflow from operating activities 51,549 127,193Investing activitiesAcquisition of subsidiaries, net of cash acquired,and increase of ownershipin subsidiaries 33 (152,929) (270,602)Proceeds from disposal of subsidiaries,net of cash disposed of 34 (107) –Purchase of property, plant and equipment (145,972) (70,493)Proceeds from sale of property, plant and equipment 2,876 328Purchase of shares of <strong>Gold</strong> Fields Ltd. (944,940) –Dividends received 6,062 –Purchase of promissory notes and other financial assets (613,452) (756,115)Proceeds from sale of promissory notes and other financial assets 541,517 503,918Net cash outflow from investing activities (1,306,945) (592,964)Financing activitiesProceeds from short-term loans and borrowings 5,041 171,563Repayments of short-term loans and borrowings (32,401) (196,485)Repayments of long-term loans and borrowings (305) (1,485)Repayments of finance lease obligations (2,234) (1,117)Proceeds from shares issuance 23 1,299,745 498,819CONSOLIDATED ANNUAL FINANCIAL STATEMENTS OFCJSC POLUS FOR THE YEAR ENDED 31 DECEMBER 200514Non-current liabilities 227,867 108,290Deferred tax liabilities‡ 25 161,768 88,754Environmental obligations 26 60,828 10,480Obligations under finance lease 27 4,025 3,783Other long-term liabilities 28 1,246 5,273Current liabilities 238,903 86,533Current portion of obligations under finance lease 27 2,844 1,045Contingent consideration for acquisition of subsidiaries 33 140,000 –Short-term loans and borrowings 29 23,243 35,112Trade and other payables 30 49,643 35,864Taxes payable 31 23,173 14,512Net cash inflow from financing activities 1,269,846 471,295Effect of translation to presentation currency for the year 943 3,865Net increase in cash and cash equivalents 15,393 9,389Cash and cash equivalents at beginning of the year 13,015 3,626Cash and cash equivalents at end of the year 22 28,408 13,015Total shareholder's equity and liabilities 3,572,812 1,138,290