Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

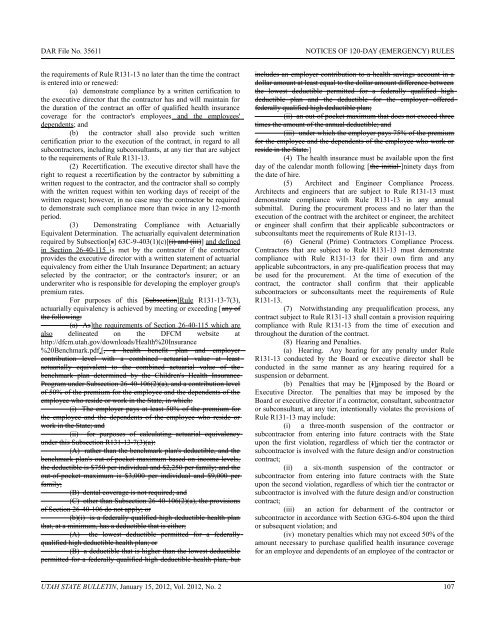

DAR File <strong>No</strong>. 35611NOTICES OF 120-DAY (EMERGENCY) RULESthe requirements of Rule R131-13 no later than the time the contractis entered into or renewed:(a) demonstrate compliance by a written certification tothe executive director that the contractor has and will maintain forthe duration of the contract an offer of qualified health insurancecoverage for the contractor's employees and the employees'dependents; and(b) the contractor shall also provide such writtencertification prior to the execution of the contract, in regard to allsubcontractors, including subconsultants, at any tier that are subjectto the requirements of Rule R131-13.(2) Recertification. The executive director shall have theright to request a recertification by the contractor by submitting awritten request to the contractor, and the contractor shall so complywith the written request within ten working days of receipt of thewritten request; however, in no case may the contractor be requiredto demonstrate such compliance more than twice in any 12-monthperiod.(3) Demonstrating Compliance with ActuariallyEquivalent Determination. The actuarially equivalent determinationrequired by Subsection[s] 63C-9-403(1)(c)[(i) and (iii)] and definedin Section 26-40-1<strong>15</strong> is met by the contractor if the contractorprovides the executive director with a written statement of actuarialequivalency from either the <strong>Utah</strong> Insurance Department; an actuaryselected by the contractor; or the contractor's insurer; or anunderwriter who is responsible for developing the employer group'spremium rates.For purposes of this [Subsection]Rule R131-13-7(3),actuarially equivalency is achieved by meeting or exceeding [any ofthe following:(a) As]the requirements of Section 26-40-1<strong>15</strong> which arealso delineated on the DFCM website athttp://dfcm.utah.gov/downloads/Health%20Insurance%20Benchmark.pdf.[, a health benefit plan and employercontribution level with a combined actuarial value at leastactuarially equivalent to the combined actuarial value of thebenchmark plan determined by the Children's Health InsuranceProgram under Subsection 26-40-106(2)(a), and a contribution levelof 50% of the premium for the employee and the dependents of theemployee who reside or work in the <strong>State</strong>, in which:(i) The employer pays at least 50% of the premium forthe employee and the dependents of the employee who reside orwork in the <strong>State</strong>; and(ii) for purposes of calculating actuarial equivalencyunder this Subsection R131-13-7(3)(a):(A) rather than the benchmark plan's deductible, and thebenchmark plan's out-of-pocket maximum based on income levels,the deductible is $750 per individual and $2,250 per family; and theout-of-pocket maximum is $3,000 per individual and $9,000 perfamily;(B) dental coverage is not required; and(C) other than Subsection 26-40-106(2)(a), the provisionsof Section 26-40-106 do not apply; or(b)(i) is a federally qualified high deductible health planthat, at a minimum, has a deductible that is either;(A) the lowest deductible permitted for a federallyqualified high deductible health plan; or(B) a deductible that is higher than the lowest deductiblepermitted for a federally qualified high deductible health plan, butincludes an employer contribution to a health savings account in adollar amount at least equal to the dollar amount difference betweenthe lowest deductible permitted for a federally qualified highdeductible plan and the deductible for the employer offeredfederally qualified high deductible plan;(ii) an out-of pocket maximum that does not exceed threetimes the amount of the annual deductible; and(iii) under which the employer pays 75% of the premiumfor the employee and the dependents of the employee who work orreside in the <strong>State</strong>.](4) The health insurance must be available upon the firstday of the calendar month following [the initial ]ninety days fromthe date of hire.(5) Architect and Engineer Compliance Process.Architects and engineers that are subject to Rule R131-13 mustdemonstrate compliance with Rule R131-13 in any annualsubmittal. During the procurement process and no later than theexecution of the contract with the architect or engineer, the architector engineer shall confirm that their applicable subcontractors orsubconsultants meet the requirements of Rule R131-13.(6) General (Prime) Contractors Compliance Process.Contractors that are subject to Rule R131-13 must demonstratecompliance with Rule R131-13 for their own firm and anyapplicable subcontractors, in any pre-qualification process that maybe used for the procurement. At the time of execution of thecontract, the contractor shall confirm that their applicablesubcontractors or subconsultants meet the requirements of RuleR131-13.(7) <strong>No</strong>twithstanding any prequalification process, anycontract subject to Rule R131-13 shall contain a provision requiringcompliance with Rule R131-13 from the time of execution andthroughout the duration of the contract.(8) Hearing and Penalties.(a) Hearing. Any hearing for any penalty under RuleR131-13 conducted by the Board or executive director shall beconducted in the same manner as any hearing required for asuspension or debarment.(b) Penalties that may be [I]imposed by the Board orExecutive Director. The penalties that may be imposed by theBoard or executive director if a contractor, consultant, subcontractoror subconsultant, at any tier, intentionally violates the provisions ofRule R131-13 may include:(i) a three-month suspension of the contractor orsubcontractor from entering into future contracts with the <strong>State</strong>upon the first violation, regardless of which tier the contractor orsubcontractor is involved with the future design and/or constructioncontract;(ii) a six-month suspension of the contractor orsubcontractor from entering into future contracts with the <strong>State</strong>upon the second violation, regardless of which tier the contractor orsubcontractor is involved with the future design and/or constructioncontract;(iii) an action for debarment of the contractor orsubcontractor in accordance with Section 63G-6-804 upon the thirdor subsequent violation; and(iv) monetary penalties which may not exceed 50% of theamount necessary to purchase qualified health insurance coveragefor an employee and dependents of an employee of the contractor orUTAH STATE BULLETIN, <strong>January</strong> <strong>15</strong>, <strong>2012</strong>, <strong>Vol</strong>. <strong>2012</strong>, <strong>No</strong>. 2 107

![Lynx avoidance [PDF] - Wisconsin Department of Natural Resources](https://img.yumpu.com/41279089/1/159x260/lynx-avoidance-pdf-wisconsin-department-of-natural-resources.jpg?quality=85)