Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

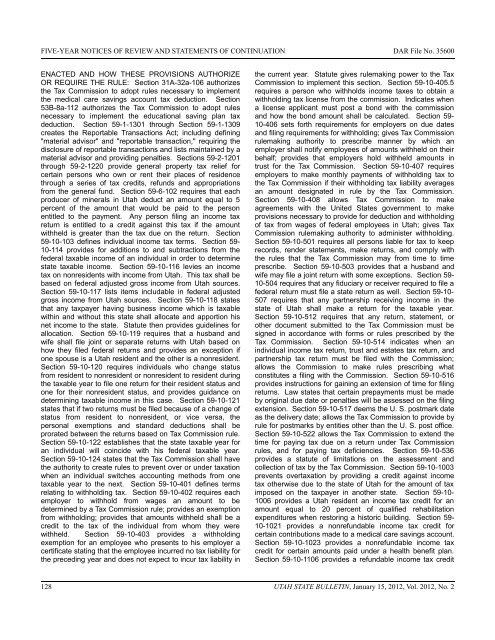

FIVE-YEAR NOTICES OF REVIEW AND STATEMENTS OF CONTINUATION DAR File <strong>No</strong>. 35600ENACTED AND HOW THESE PROVISIONS AUTHORIZEOR REQUIRE THE RULE: Section 31A-32a-106 authorizesthe Tax Commission to adopt rules necessary to implementthe medical care savings account tax deduction. Section53B-8a-112 authorizes the Tax Commission to adopt rulesnecessary to implement the educational saving plan taxdeduction. Section 59-1-1301 through Section 59-1-1309creates the Reportable Transactions Act; including defining"material advisor" and "reportable transaction," requiring thedisclosure of reportable transactions and lists maintained by amaterial advisor and providing penalties. Sections 59-2-1201through 59-2-1220 provide general property tax relief forcertain persons who own or rent their places of residencethrough a series of tax credits, refunds and appropriationsfrom the general fund. Section 59-6-102 requires that eachproducer of minerals in <strong>Utah</strong> deduct an amount equal to 5percent of the amount that would be paid to the personentitled to the payment. Any person filing an income taxreturn is entitled to a credit against this tax if the amountwithheld is greater than the tax due on the return. Section59-10-103 defines individual income tax terms. Section 59-10-114 provides for additions to and subtractions from thefederal taxable income of an individual in order to determinestate taxable income. Section 59-10-116 levies an incometax on nonresidents with income from <strong>Utah</strong>. This tax shall bebased on federal adjusted gross income from <strong>Utah</strong> sources.Section 59-10-117 lists items includable in federal adjustedgross income from <strong>Utah</strong> sources. Section 59-10-118 statesthat any taxpayer having business income which is taxablewithin and without this state shall allocate and apportion hisnet income to the state. Statute then provides guidelines forallocation. Section 59-10-119 requires that a husband andwife shall file joint or separate returns with <strong>Utah</strong> based onhow they filed federal returns and provides an exception ifone spouse is a <strong>Utah</strong> resident and the other is a nonresident.Section 59-10-120 requires individuals who change statusfrom resident to nonresident or nonresident to resident duringthe taxable year to file one return for their resident status andone for their nonresident status, and provides guidance ondetermining taxable income in this case. Section 59-10-121states that if two returns must be filed because of a change ofstatus from resident to nonresident, or vice versa, thepersonal exemptions and standard deductions shall beprorated between the returns based on Tax Commission rule.Section 59-10-122 establishes that the state taxable year foran individual will coincide with his federal taxable year.Section 59-10-124 states that the Tax Commission shall havethe authority to create rules to prevent over or under taxationwhen an individual switches accounting methods from onetaxable year to the next. Section 59-10-401 defines termsrelating to withholding tax. Section 59-10-402 requires eachemployer to withhold from wages an amount to bedetermined by a Tax Commission rule; provides an exemptionfrom withholding; provides that amounts withheld shall be acredit to the tax of the individual from whom they werewithheld. Section 59-10-403 provides a withholdingexemption for an employee who presents to his employer acertificate stating that the employee incurred no tax liability forthe preceding year and does not expect to incur tax liability inthe current year. Statute gives rulemaking power to the TaxCommission to implement this section. Section 59-10-405.5requires a person who withholds income taxes to obtain awithholding tax license from the commission. Indicates whena license applicant must post a bond with the commissionand how the bond amount shall be calculated. Section 59-10-406 sets forth requirements for employers on due datesand filing requirements for withholding; gives Tax Commissionrulemaking authority to prescribe manner by which anemployer shall notify employees of amounts withheld on theirbehalf; provides that employers hold withheld amounts intrust for the Tax Commission. Section 59-10-407 requiresemployers to make monthly payments of withholding tax tothe Tax Commission if their withholding tax liability averagesan amount designated in rule by the Tax Commission.Section 59-10-408 allows Tax Commission to makeagreements with the United <strong>State</strong>s government to makeprovisions necessary to provide for deduction and withholdingof tax from wages of federal employees in <strong>Utah</strong>; gives TaxCommission rulemaking authority to administer withholding.Section 59-10-501 requires all persons liable for tax to keeprecords, render statements, make returns, and comply withthe rules that the Tax Commission may from time to timeprescribe. Section 59-10-503 provides that a husband andwife may file a joint return with some exceptions. Section 59-10-504 requires that any fiduciary or receiver required to file afederal return must file a state return as well. Section 59-10-507 requires that any partnership receiving income in thestate of <strong>Utah</strong> shall make a return for the taxable year.Section 59-10-512 requires that any return, statement, orother document submitted to the Tax Commission must besigned in accordance with forms or rules prescribed by theTax Commission. Section 59-10-514 indicates when anindividual income tax return, trust and estates tax return, andpartnership tax return must be filed with the Commission;allows the Commission to make rules prescribing whatconstitutes a filing with the Commission. Section 59-10-516provides instructions for gaining an extension of time for filingreturns. Law states that certain prepayments must be madeby original due date or penalties will be assessed on the filingextension. Section 59-10-517 deems the U. S. postmark dateas the delivery date; allows the Tax Commission to provide byrule for postmarks by entities other than the U. S. post office.Section 59-10-522 allows the Tax Commission to extend thetime for paying tax due on a return under Tax Commissionrules, and for paying tax deficiencies. Section 59-10-536provides a statute of limitations on the assessment andcollection of tax by the Tax Commission. Section 59-10-1003prevents overtaxation by providing a credit against incometax otherwise due to the state of <strong>Utah</strong> for the amount of taximposed on the taxpayer in another state. Section 59-10-1006 provides a <strong>Utah</strong> resident an income tax credit for anamount equal to 20 percent of qualified rehabilitationexpenditures when restoring a historic building. Section 59-10-1021 provides a nonrefundable income tax credit forcertain contributions made to a medical care savings account.Section 59-10-1023 provides a nonrefundable income taxcredit for certain amounts paid under a health benefit plan.Section 59-10-1106 provides a refundable income tax credit128 UTAH STATE BULLETIN, <strong>January</strong> <strong>15</strong>, <strong>2012</strong>, <strong>Vol</strong>. <strong>2012</strong>, <strong>No</strong>. 2

![Lynx avoidance [PDF] - Wisconsin Department of Natural Resources](https://img.yumpu.com/41279089/1/159x260/lynx-avoidance-pdf-wisconsin-department-of-natural-resources.jpg?quality=85)