Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

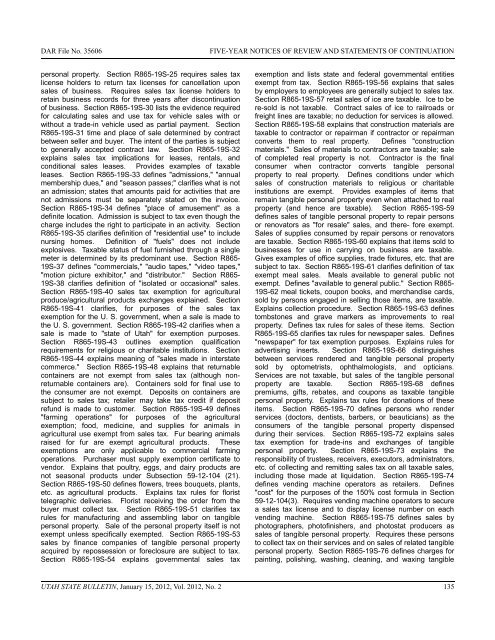

DAR File <strong>No</strong>. 35606FIVE-YEAR NOTICES OF REVIEW AND STATEMENTS OF CONTINUATIONpersonal property. Section R865-19S-25 requires sales taxlicense holders to return tax licenses for cancellation uponsales of business. Requires sales tax license holders toretain business records for three years after discontinuationof business. Section R865-19S-30 lists the evidence requiredfor calculating sales and use tax for vehicle sales with orwithout a trade-in vehicle used as partial payment. SectionR865-19S-31 time and place of sale determined by contractbetween seller and buyer. The intent of the parties is subjectto generally accepted contract law. Section R865-19S-32explains sales tax implications for leases, rentals, andconditional sales leases. Provides examples of taxableleases. Section R865-19S-33 defines "admissions," "annualmembership dues," and "season passes;" clarifies what is notan admission; states that amounts paid for activities that arenot admissions must be separately stated on the invoice.Section R865-19S-34 defines "place of amusement" as adefinite location. Admission is subject to tax even though thecharge includes the right to participate in an activity. SectionR865-19S-35 clarifies definition of "residential use" to includenursing homes. Definition of "fuels" does not includeexplosives. Taxable status of fuel furnished through a singlemeter is determined by its predominant use. Section R865-19S-37 defines "commercials," "audio tapes," "video tapes,""motion picture exhibitor," and "distributor." Section R865-19S-38 clarifies definition of "isolated or occasional" sales.Section R865-19S-40 sales tax exemption for agriculturalproduce/agricultural products exchanges explained. SectionR865-19S-41 clarifies, for purposes of the sales taxexemption for the U. S. government, when a sale is made tothe U. S. government. Section R865-19S-42 clarifies when asale is made to "state of <strong>Utah</strong>" for exemption purposes.Section R865-19S-43 outlines exemption qualificationrequirements for religious or charitable institutions. SectionR865-19S-44 explains meaning of "sales made in interstatecommerce." Section R865-19S-48 explains that returnablecontainers are not exempt from sales tax (although nonreturnablecontainers are). Containers sold for final use tothe consumer are not exempt. Deposits on containers aresubject to sales tax; retailer may take tax credit if depositrefund is made to customer. Section R865-19S-49 defines"farming operations" for purposes of the agriculturalexemption; food, medicine, and supplies for animals inagricultural use exempt from sales tax. Fur bearing animalsraised for fur are exempt agricultural products. Theseexemptions are only applicable to commercial farmingoperations. Purchaser must supply exemption certificate tovendor. Explains that poultry, eggs, and dairy products arenot seasonal products under Subsection 59-12-104 (21).Section R865-19S-50 defines flowers, trees bouquets, plants,etc. as agricultural products. Explains tax rules for floristtelegraphic deliveries. Florist receiving the order from thebuyer must collect tax. Section R865-19S-51 clarifies taxrules for manufacturing and assembling labor on tangiblepersonal property. Sale of the personal property itself is notexempt unless specifically exempted. Section R865-19S-53sales by finance companies of tangible personal propertyacquired by repossession or foreclosure are subject to tax.Section R865-19S-54 explains governmental sales taxexemption and lists state and federal governmental entitiesexempt from tax. Section R865-19S-56 explains that salesby employers to employees are generally subject to sales tax.Section R865-19S-57 retail sales of ice are taxable. Ice to bere-sold is not taxable. Contract sales of ice to railroads orfreight lines are taxable; no deduction for services is allowed.Section R865-19S-58 explains that construction materials aretaxable to contractor or repairman if contractor or repairmanconverts them to real property. Defines "constructionmaterials." Sales of materials to contractors are taxable; saleof completed real property is not. Contractor is the finalconsumer when contractor converts tangible personalproperty to real property. Defines conditions under whichsales of construction materials to religious or charitableinstitutions are exempt. Provides examples of items thatremain tangible personal property even when attached to realproperty (and hence are taxable). Section R865-19S-59defines sales of tangible personal property to repair personsor renovators as "for resale" sales, and there- fore exempt.Sales of supplies consumed by repair persons or renovatorsare taxable. Section R865-19S-60 explains that items sold tobusinesses for use in carrying on business are taxable.Gives examples of office supplies, trade fixtures, etc. that aresubject to tax. Section R865-19S-61 clarifies definition of taxexempt meal sales. Meals available to general public notexempt. Defines "available to general public." Section R865-19S-62 meal tickets, coupon books, and merchandise cards,sold by persons engaged in selling those items, are taxable.Explains collection procedure. Section R865-19S-63 definestombstones and grave markers as improvements to realproperty. Defines tax rules for sales of these items. SectionR865-19S-65 clarifies tax rules for newspaper sales. Defines"newspaper" for tax exemption purposes. Explains rules foradvertising inserts. Section R865-19S-66 distinguishesbetween services rendered and tangible personal propertysold by optometrists, ophthalmologists, and opticians.Services are not taxable, but sales of the tangible personalproperty are taxable. Section R865-19S-68 definespremiums, gifts, rebates, and coupons as taxable tangiblepersonal property. Explains tax rules for donations of theseitems. Section R865-19S-70 defines persons who renderservices (doctors, dentists, barbers, or beauticians) as theconsumers of the tangible personal property dispensedduring their services. Section R865-19S-72 explains salestax exemption for trade-ins and exchanges of tangiblepersonal property. Section R865-19S-73 explains theresponsibility of trustees, receivers, executors, administrators,etc. of collecting and remitting sales tax on all taxable sales,including those made at liquidation. Section R865-19S-74defines vending machine operators as retailers. Defines"cost" for the purposes of the <strong>15</strong>0% cost formula in Section59-12-104(3). Requires vending machine operators to securea sales tax license and to display license number on eachvending machine. Section R865-19S-75 defines sales byphotographers, photofinishers, and photostat producers assales of tangible personal property. Requires these personsto collect tax on their services and on sales of related tangiblepersonal property. Section R865-19S-76 defines charges forpainting, polishing, washing, cleaning, and waxing tangibleUTAH STATE BULLETIN, <strong>January</strong> <strong>15</strong>, <strong>2012</strong>, <strong>Vol</strong>. <strong>2012</strong>, <strong>No</strong>. 2 135

![Lynx avoidance [PDF] - Wisconsin Department of Natural Resources](https://img.yumpu.com/41279089/1/159x260/lynx-avoidance-pdf-wisconsin-department-of-natural-resources.jpg?quality=85)