Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

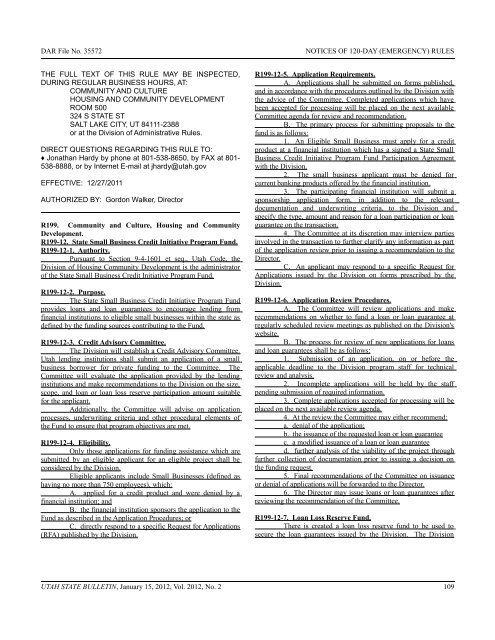

DAR File <strong>No</strong>. 35572NOTICES OF 120-DAY (EMERGENCY) RULESTHE FULL TEXT OF THIS RULE MAY BE INSPECTED,DURING REGULAR BUSINESS HOURS, AT:COMMUNITY AND CULTUREHOUSING AND COMMUNITY DEVELOPMENTROOM 500324 S STATE STSALT LAKE CITY, UT 84111-2388or at the Division of Administrative Rules.DIRECT QUESTIONS REGARDING THIS RULE TO:♦ Jonathan Hardy by phone at 801-538-8650, by FAX at 801-538-8888, or by Internet E-mail at jhardy@utah.govEFFECTIVE: 12/27/2011AUTHORIZED BY: Gordon Walker, DirectorR199. Community and Culture, Housing and CommunityDevelopment.R199-12. <strong>State</strong> Small Business Credit Initiative Program Fund.R199-12-1. Authority.Pursuant to Section 9-4-1601 et seq., <strong>Utah</strong> Code, theDivision of Housing Community Development is the administratorof the <strong>State</strong> Small Business Credit Initiative Program Fund.R199-12-2. Purpose.The <strong>State</strong> Small Business Credit Initiative Program Fundprovides loans and loan guarantees to encourage lending fromfinancial institutions to eligible small businesses within the state asdefined by the funding sources contributing to the Fund.R199-12-3. Credit Advisory Committee.The Division will establish a Credit Advisory Committee.<strong>Utah</strong> lending institutions shall submit an application of a smallbusiness borrower for private funding to the Committee. TheCommittee will evaluate the application provided by the lendinginstitutions and make recommendations to the Division on the size,scope, and loan or loan loss reserve participation amount suitablefor the applicant.Additionally, the Committee will advise on applicationprocesses, underwriting criteria and other procedural elements ofthe Fund to ensure that program objectives are met.R199-12-4. Eligibility.Only those applications for funding assistance which aresubmitted by an eligible applicant for an eligible project shall beconsidered by the Division.Eligible applicants include Small Businesses (defined ashaving no more than 750 employees), which:A. applied for a credit product and were denied by afinancial institution; andB. the financial institution sponsors the application to theFund as described in the Application Procedures; orC. directly respond to a specific Request for Applications(RFA) published by the Division.R199-12-5. Application Requirements.A. Applications shall be submitted on forms published,and in accordance with the procedures outlined by the Division withthe advice of the Committee. Completed applications which havebeen accepted for processing will be placed on the next availableCommittee agenda for review and recommendation.B. The primary process for submitting proposals to thefund is as follows:1. An Eligible Small Business must apply for a creditproduct at a financial institution which has a signed a <strong>State</strong> SmallBusiness Credit Initiative Program Fund Participation Agreementwith the Division.2. The small business applicant must be denied forcurrent banking products offered by the financial institution.3. The participating financial institution will submit asponsorship application form, in addition to the relevantdocumentation and underwriting criteria, to the Division andspecify the type, amount and reason for a loan participation or loanguarantee on the transaction.4. The Committee at its discretion may interview partiesinvolved in the transaction to further clarify any information as partof the application review prior to issuing a recommendation to theDirector.C. An applicant may respond to a specific Request forApplications issued by the Division on forms prescribed by theDivision.R199-12-6. Application Review Procedures.A. The Committee will review applications and makerecommendations on whether to fund a loan or loan guarantee atregularly scheduled review meetings as published on the Division'swebsite.B. The process for review of new applications for loansand loan guarantees shall be as follows:1. Submission of an application, on or before theapplicable deadline to the Division program staff for technicalreview and analysis.2. Incomplete applications will be held by the staffpending submission of required information.3. Complete applications accepted for processing will beplaced on the next available review agenda.4. At the review the Committee may either recommend:a. denial of the application;b. the issuance of the requested loan or loan guaranteec. a modified issuance of a loan or loan guaranteed. further analysis of the viability of the project throughfurther collection of documentation prior to issuing a decision onthe funding request.5. Final recommendations of the Committee on issuanceor denial of applications will be forwarded to the Director.6. The Director may issue loans or loan guarantees afterreviewing the recommendation of the Committee.R199-12-7. Loan Loss Reserve Fund.There is created a loan loss reserve fund to be used tosecure the loan guarantees issued by the Division. The DivisionUTAH STATE BULLETIN, <strong>January</strong> <strong>15</strong>, <strong>2012</strong>, <strong>Vol</strong>. <strong>2012</strong>, <strong>No</strong>. 2 109

![Lynx avoidance [PDF] - Wisconsin Department of Natural Resources](https://img.yumpu.com/41279089/1/159x260/lynx-avoidance-pdf-wisconsin-department-of-natural-resources.jpg?quality=85)