Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

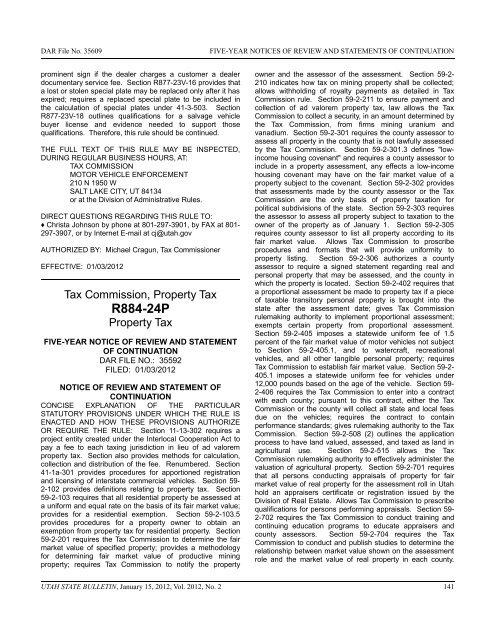

DAR File <strong>No</strong>. 35609FIVE-YEAR NOTICES OF REVIEW AND STATEMENTS OF CONTINUATIONprominent sign if the dealer charges a customer a dealerdocumentary service fee. Section R877-23V-16 provides thata lost or stolen special plate may be replaced only after it hasexpired; requires a replaced special plate to be included inthe calculation of special plates under 41-3-503. SectionR877-23V-18 outlines qualifications for a salvage vehiclebuyer license and evidence needed to support thosequalifications. Therefore, this rule should be continued.THE FULL TEXT OF THIS RULE MAY BE INSPECTED,DURING REGULAR BUSINESS HOURS, AT:TAX COMMISSIONMOTOR VEHICLE ENFORCEMENT210 N 1950 WSALT LAKE CITY, UT 84134or at the Division of Administrative Rules.DIRECT QUESTIONS REGARDING THIS RULE TO:♦ Christa Johnson by phone at 801-297-3901, by FAX at 801-297-3907, or by Internet E-mail at cj@utah.govAUTHORIZED BY: Michael Cragun, Tax CommissionerEFFECTIVE: 01/03/<strong>2012</strong>Tax Commission, Property TaxR884-24PProperty TaxFIVE-YEAR NOTICE OF REVIEW AND STATEMENTOF CONTINUATIONDAR FILE NO.: 35592FILED: 01/03/<strong>2012</strong>NOTICE OF REVIEW AND STATEMENT OFCONTINUATIONCONCISE EXPLANATION OF THE PARTICULARSTATUTORY PROVISIONS UNDER WHICH THE RULE ISENACTED AND HOW THESE PROVISIONS AUTHORIZEOR REQUIRE THE RULE: Section 11-13-302 requires aproject entity created under the Interlocal Cooperation Act topay a fee to each taxing jurisdiction in lieu of ad valoremproperty tax. Section also provides methods for calculation,collection and distribution of the fee. Renumbered. Section41-1a-301 provides procedures for apportioned registrationand licensing of interstate commercial vehicles. Section 59-2-102 provides definitions relating to property tax. Section59-2-103 requires that all residential property be assessed ata uniform and equal rate on the basis of its fair market value;provides for a residential exemption. Section 59-2-103.5provides procedures for a property owner to obtain anexemption from property tax for residential property. Section59-2-201 requires the Tax Commission to determine the fairmarket value of specified property; provides a methodologyfor determining fair market value of productive miningproperty; requires Tax Commission to notify the propertyowner and the assessor of the assessment. Section 59-2-210 indicates how tax on mining property shall be collected;allows withholding of royalty payments as detailed in TaxCommission rule. Section 59-2-211 to ensure payment andcollection of ad valorem property tax, law allows the TaxCommission to collect a security, in an amount determined bythe Tax Commission, from firms mining uranium andvanadium. Section 59-2-301 requires the county assessor toassess all property in the county that is not lawfully assessedby the Tax Commission. Section 59-2-301.3 defines "lowincomehousing covenant" and requires a county assessor toinclude in a property assessment, any effects a low-incomehousing covenant may have on the fair market value of aproperty subject to the covenant. Section 59-2-302 providesthat assessments made by the county assessor or the TaxCommission are the only basis of property taxation forpolitical subdivisions of the state. Section 59-2-303 requiresthe assessor to assess all property subject to taxation to theowner of the property as of <strong>January</strong> 1. Section 59-2-305requires county assessor to list all property according to itsfair market value. Allows Tax Commission to proscribeprocedures and formats that will provide uniformity toproperty listing. Section 59-2-306 authorizes a countyassessor to require a signed statement regarding real andpersonal property that may be assessed, and the county inwhich the property is located. Section 59-2-402 requires thata proportional assessment be made to property tax if a pieceof taxable transitory personal property is brought into thestate after the assessment date; gives Tax Commissionrulemaking authority to implement proportional assessment;exempts certain property from proportional assessment.Section 59-2-405 imposes a statewide uniform fee of 1.5percent of the fair market value of motor vehicles not subjectto Section 59-2-405.1, and to watercraft, recreationalvehicles, and all other tangible personal property; requiresTax Commission to establish fair market value. Section 59-2-405.1 imposes a statewide uniform fee for vehicles under12,000 pounds based on the age of the vehicle. Section 59-2-406 requires the Tax Commission to enter into a contractwith each county; pursuant to this contract, either the TaxCommission or the county will collect all state and local feesdue on the vehicles; requires the contract to containperformance standards; gives rulemaking authority to the TaxCommission. Section 59-2-508 (2) outlines the applicationprocess to have land valued, assessed, and taxed as land inagricultural use. Section 59-2-5<strong>15</strong> allows the TaxCommission rulemaking authority to effectively administer thevaluation of agricultural property. Section 59-2-701 requiresthat all persons conducting appraisals of property for fairmarket value of real property for the assessment roll in <strong>Utah</strong>hold an appraisers certificate or registration issued by theDivision of Real Estate. Allows Tax Commission to prescribequalifications for persons performing appraisals. Section 59-2-702 requires the Tax Commission to conduct training andcontinuing education programs to educate appraisers andcounty assessors. Section 59-2-704 requires the TaxCommission to conduct and publish studies to determine therelationship between market value shown on the assessmentrole and the market value of real property in each county.UTAH STATE BULLETIN, <strong>January</strong> <strong>15</strong>, <strong>2012</strong>, <strong>Vol</strong>. <strong>2012</strong>, <strong>No</strong>. 2 141

![Lynx avoidance [PDF] - Wisconsin Department of Natural Resources](https://img.yumpu.com/41279089/1/159x260/lynx-avoidance-pdf-wisconsin-department-of-natural-resources.jpg?quality=85)