Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

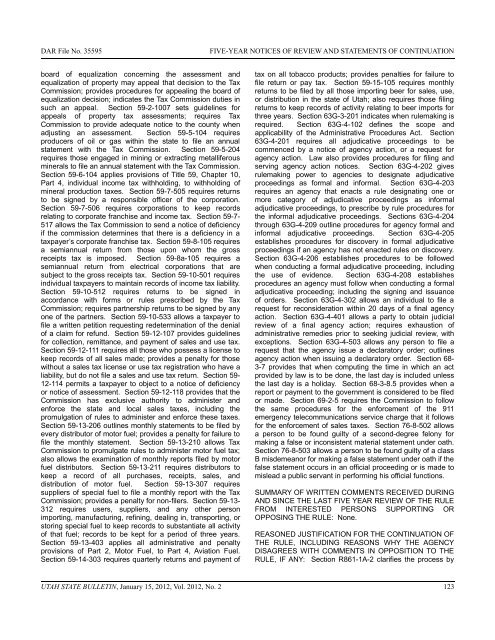

DAR File <strong>No</strong>. 35595FIVE-YEAR NOTICES OF REVIEW AND STATEMENTS OF CONTINUATIONboard of equalization concerning the assessment andequalization of property may appeal that decision to the TaxCommission; provides procedures for appealing the board ofequalization decision; indicates the Tax Commission duties insuch an appeal. Section 59-2-1007 sets guidelines forappeals of property tax assessments; requires TaxCommission to provide adequate notice to the county whenadjusting an assessment. Section 59-5-104 requiresproducers of oil or gas within the state to file an annualstatement with the Tax Commission. Section 59-5-204requires those engaged in mining or extracting metalliferousminerals to file an annual statement with the Tax Commission.Section 59-6-104 applies provisions of Title 59, Chapter 10,Part 4, individual income tax withholding, to withholding ofmineral production taxes. Section 59-7-505 requires returnsto be signed by a responsible officer of the corporation.Section 59-7-506 requires corporations to keep recordsrelating to corporate franchise and income tax. Section 59-7-517 allows the Tax Commission to send a notice of deficiencyif the commission determines that there is a deficiency in ataxpayer’s corporate franchise tax. Section 59-8-105 requiresa semiannual return from those upon whom the grossreceipts tax is imposed. Section 59-8a-105 requires asemiannual return from electrical corporations that aresubject to the gross receipts tax. Section 59-10-501 requiresindividual taxpayers to maintain records of income tax liability.Section 59-10-512 requires returns to be signed inaccordance with forms or rules prescribed by the TaxCommission; requires partnership returns to be signed by anyone of the partners. Section 59-10-533 allows a taxpayer tofile a written petition requesting redetermination of the denialof a claim for refund. Section 59-12-107 provides guidelinesfor collection, remittance, and payment of sales and use tax.Section 59-12-111 requires all those who possess a license tokeep records of all sales made; provides a penalty for thosewithout a sales tax license or use tax registration who have aliability, but do not file a sales and use tax return. Section 59-12-114 permits a taxpayer to object to a notice of deficiencyor notice of assessment. Section 59-12-118 provides that theCommission has exclusive authority to administer andenforce the state and local sales taxes, including thepromulgation of rules to administer and enforce these taxes.Section 59-13-206 outlines monthly statements to be filed byevery distributor of motor fuel; provides a penalty for failure tofile the monthly statement. Section 59-13-210 allows TaxCommission to promulgate rules to administer motor fuel tax;also allows the examination of monthly reports filed by motorfuel distributors. Section 59-13-211 requires distributors tokeep a record of all purchases, receipts, sales, anddistribution of motor fuel. Section 59-13-307 requiressuppliers of special fuel to file a monthly report with the TaxCommission; provides a penalty for non-filers. Section 59-13-312 requires users, suppliers, and any other personimporting, manufacturing, refining, dealing in, transporting, orstoring special fuel to keep records to substantiate all activityof that fuel; records to be kept for a period of three years.Section 59-13-403 applies all administrative and penaltyprovisions of Part 2, Motor Fuel, to Part 4, Aviation Fuel.Section 59-14-303 requires quarterly returns and payment oftax on all tobacco products; provides penalties for failure tofile return or pay tax. Section 59-<strong>15</strong>-105 requires monthlyreturns to be filed by all those importing beer for sales, use,or distribution in the state of <strong>Utah</strong>; also requires those filingreturns to keep records of activity relating to beer imports forthree years. Section 63G-3-201 indicates when rulemaking isrequired. Section 63G-4-102 defines the scope andapplicability of the Administrative Procedures Act. Section63G-4-201 requires all adjudicative proceedings to becommenced by a notice of agency action, or a request foragency action. Law also provides procedures for filing andserving agency action notices. Section 63G-4-202 givesrulemaking power to agencies to designate adjudicativeproceedings as formal and informal. Section 63G-4-203requires an agency that enacts a rule designating one ormore category of adjudicative proceedings as informaladjudicative proceedings, to prescribe by rule procedures forthe informal adjudicative proceedings. Sections 63G-4-204through 63G-4-209 outline procedures for agency formal andinformal adjudicative proceedings. Section 63G-4-205establishes procedures for discovery in formal adjudicativeproceedings if an agency has not enacted rules on discovery.Section 63G-4-206 establishes procedures to be followedwhen conducting a formal adjudicative proceeding, includingthe use of evidence. Section 63G-4-208 establishesprocedures an agency must follow when conducting a formaladjudicative proceeding; including the signing and issuanceof orders. Section 63G-4-302 allows an individual to file arequest for reconsideration within 20 days of a final agencyaction. Section 63G-4-401 allows a party to obtain judicialreview of a final agency action; requires exhaustion ofadministrative remedies prior to seeking judicial review, withexceptions. Section 63G-4-503 allows any person to file arequest that the agency issue a declaratory order; outlinesagency action when issuing a declaratory order. Section 68-3-7 provides that when computing the time in which an actprovided by law is to be done, the last day is included unlessthe last day is a holiday. Section 68-3-8.5 provides when areport or payment to the government is considered to be filedor made. Section 69-2-5 requires the Commission to followthe same procedures for the enforcement of the 911emergency telecommunications service charge that it followsfor the enforcement of sales taxes. Section 76-8-502 allowsa person to be found guilty of a second-degree felony formaking a false or inconsistent material statement under oath.Section 76-8-503 allows a person to be found guilty of a classB misdemeanor for making a false statement under oath if thefalse statement occurs in an official proceeding or is made tomislead a public servant in performing his official functions.SUMMARY OF WRITTEN COMMENTS RECEIVED DURINGAND SINCE THE LAST FIVE YEAR REVIEW OF THE RULEFROM INTERESTED PERSONS SUPPORTING OROPPOSING THE RULE: <strong>No</strong>ne.REASONED JUSTIFICATION FOR THE CONTINUATION OFTHE RULE, INCLUDING REASONS WHY THE AGENCYDISAGREES WITH COMMENTS IN OPPOSITION TO THERULE, IF ANY: Section R861-1A-2 clarifies the process byUTAH STATE BULLETIN, <strong>January</strong> <strong>15</strong>, <strong>2012</strong>, <strong>Vol</strong>. <strong>2012</strong>, <strong>No</strong>. 2 123

![Lynx avoidance [PDF] - Wisconsin Department of Natural Resources](https://img.yumpu.com/41279089/1/159x260/lynx-avoidance-pdf-wisconsin-department-of-natural-resources.jpg?quality=85)