Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

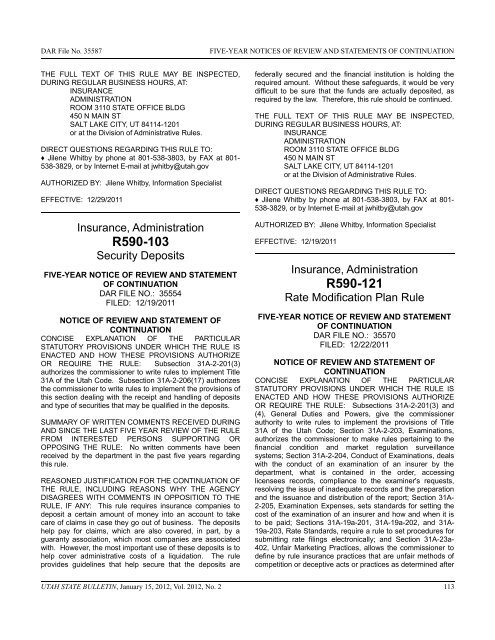

DAR File <strong>No</strong>. 35587FIVE-YEAR NOTICES OF REVIEW AND STATEMENTS OF CONTINUATIONTHE FULL TEXT OF THIS RULE MAY BE INSPECTED,DURING REGULAR BUSINESS HOURS, AT:INSURANCEADMINISTRATIONROOM 3110 STATE OFFICE BLDG450 N MAIN STSALT LAKE CITY, UT 84114-1201or at the Division of Administrative Rules.DIRECT QUESTIONS REGARDING THIS RULE TO:♦ Jilene Whitby by phone at 801-538-3803, by FAX at 801-538-3829, or by Internet E-mail at jwhitby@utah.govAUTHORIZED BY: Jilene Whitby, Information SpecialistEFFECTIVE: 12/29/2011Insurance, AdministrationR590-103Security DepositsFIVE-YEAR NOTICE OF REVIEW AND STATEMENTOF CONTINUATIONDAR FILE NO.: 35554FILED: 12/19/2011NOTICE OF REVIEW AND STATEMENT OFCONTINUATIONCONCISE EXPLANATION OF THE PARTICULARSTATUTORY PROVISIONS UNDER WHICH THE RULE ISENACTED AND HOW THESE PROVISIONS AUTHORIZEOR REQUIRE THE RULE: Subsection 31A-2-201(3)authorizes the commissioner to write rules to implement Title31A of the <strong>Utah</strong> Code. Subsection 31A-2-206(17) authorizesthe commissioner to write rules to implement the provisions ofthis section dealing with the receipt and handling of depositsand type of securities that may be qualified in the deposits.SUMMARY OF WRITTEN COMMENTS RECEIVED DURINGAND SINCE THE LAST FIVE YEAR REVIEW OF THE RULEFROM INTERESTED PERSONS SUPPORTING OROPPOSING THE RULE: <strong>No</strong> written comments have beenreceived by the department in the past five years regardingthis rule.REASONED JUSTIFICATION FOR THE CONTINUATION OFTHE RULE, INCLUDING REASONS WHY THE AGENCYDISAGREES WITH COMMENTS IN OPPOSITION TO THERULE, IF ANY: This rule requires insurance companies todeposit a certain amount of money into an account to takecare of claims in case they go out of business. The depositshelp pay for claims, which are also covered, in part, by aguaranty association, which most companies are associatedwith. However, the most important use of these deposits is tohelp cover administrative costs of a liquidation. The ruleprovides guidelines that help secure that the deposits arefederally secured and the financial institution is holding therequired amount. Without these safeguards, it would be verydifficult to be sure that the funds are actually deposited, asrequired by the law. Therefore, this rule should be continued.THE FULL TEXT OF THIS RULE MAY BE INSPECTED,DURING REGULAR BUSINESS HOURS, AT:INSURANCEADMINISTRATIONROOM 3110 STATE OFFICE BLDG450 N MAIN STSALT LAKE CITY, UT 84114-1201or at the Division of Administrative Rules.DIRECT QUESTIONS REGARDING THIS RULE TO:♦ Jilene Whitby by phone at 801-538-3803, by FAX at 801-538-3829, or by Internet E-mail at jwhitby@utah.govAUTHORIZED BY: Jilene Whitby, Information SpecialistEFFECTIVE: 12/19/2011Insurance, AdministrationR590-121Rate Modification Plan RuleFIVE-YEAR NOTICE OF REVIEW AND STATEMENTOF CONTINUATIONDAR FILE NO.: 35570FILED: 12/22/2011NOTICE OF REVIEW AND STATEMENT OFCONTINUATIONCONCISE EXPLANATION OF THE PARTICULARSTATUTORY PROVISIONS UNDER WHICH THE RULE ISENACTED AND HOW THESE PROVISIONS AUTHORIZEOR REQUIRE THE RULE: Subsections 31A-2-201(3) and(4), General Duties and Powers, give the commissionerauthority to write rules to implement the provisions of Title31A of the <strong>Utah</strong> Code; Section 31A-2-203, Examinations,authorizes the commissioner to make rules pertaining to thefinancial condition and market regulation surveillancesystems; Section 31A-2-204, Conduct of Examinations, dealswith the conduct of an examination of an insurer by thedepartment, what is contained in the order, accessinglicensees records, compliance to the examiner's requests,resolving the issue of inadequate records and the preparationand the issuance and distribution of the report; Section 31A-2-205, Examination Expenses, sets standards for setting thecost of the examination of an insurer and how and when it isto be paid; Sections 31A-19a-201, 31A-19a-202, and 31A-19a-203, Rate Standards, require a rule to set procedures forsubmitting rate filings electronically; and Section 31A-23a-402, Unfair Marketing Practices, allows the commissioner todefine by rule insurance practices that are unfair methods ofcompetition or deceptive acts or practices as determined afterUTAH STATE BULLETIN, <strong>January</strong> <strong>15</strong>, <strong>2012</strong>, <strong>Vol</strong>. <strong>2012</strong>, <strong>No</strong>. 2 113

![Lynx avoidance [PDF] - Wisconsin Department of Natural Resources](https://img.yumpu.com/41279089/1/159x260/lynx-avoidance-pdf-wisconsin-department-of-natural-resources.jpg?quality=85)