Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

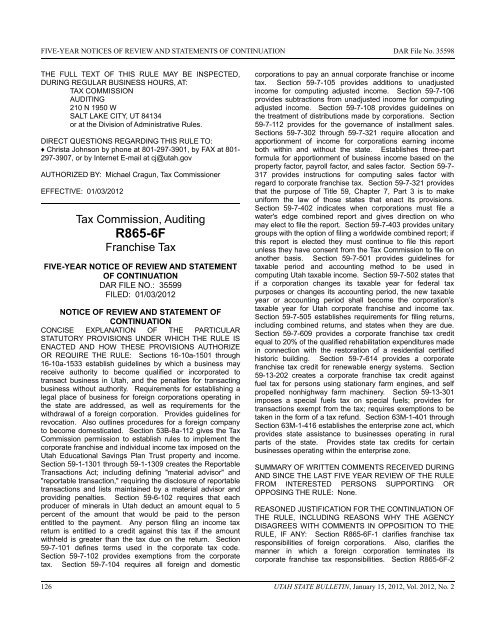

FIVE-YEAR NOTICES OF REVIEW AND STATEMENTS OF CONTINUATION DAR File <strong>No</strong>. 35598THE FULL TEXT OF THIS RULE MAY BE INSPECTED,DURING REGULAR BUSINESS HOURS, AT:TAX COMMISSIONAUDITING210 N 1950 WSALT LAKE CITY, UT 84134or at the Division of Administrative Rules.DIRECT QUESTIONS REGARDING THIS RULE TO:♦ Christa Johnson by phone at 801-297-3901, by FAX at 801-297-3907, or by Internet E-mail at cj@utah.govAUTHORIZED BY: Michael Cragun, Tax CommissionerEFFECTIVE: 01/03/<strong>2012</strong>Tax Commission, AuditingR865-6FFranchise TaxFIVE-YEAR NOTICE OF REVIEW AND STATEMENTOF CONTINUATIONDAR FILE NO.: 35599FILED: 01/03/<strong>2012</strong>NOTICE OF REVIEW AND STATEMENT OFCONTINUATIONCONCISE EXPLANATION OF THE PARTICULARSTATUTORY PROVISIONS UNDER WHICH THE RULE ISENACTED AND HOW THESE PROVISIONS AUTHORIZEOR REQUIRE THE RULE: Sections 16-10a-<strong>15</strong>01 through16-10a-<strong>15</strong>33 establish guidelines by which a business mayreceive authority to become qualified or incorporated totransact business in <strong>Utah</strong>, and the penalties for transactingbusiness without authority. Requirements for establishing alegal place of business for foreign corporations operating inthe state are addressed, as well as requirements for thewithdrawal of a foreign corporation. Provides guidelines forrevocation. Also outlines procedures for a foreign companyto become domesticated. Section 53B-8a-112 gives the TaxCommission permission to establish rules to implement thecorporate franchise and individual income tax imposed on the<strong>Utah</strong> Educational Savings Plan Trust property and income.Section 59-1-1301 through 59-1-1309 creates the ReportableTransactions Act; including defining "material advisor" and"reportable transaction," requiring the disclosure of reportabletransactions and lists maintained by a material advisor andproviding penalties. Section 59-6-102 requires that eachproducer of minerals in <strong>Utah</strong> deduct an amount equal to 5percent of the amount that would be paid to the personentitled to the payment. Any person filing an income taxreturn is entitled to a credit against this tax if the amountwithheld is greater than the tax due on the return. Section59-7-101 defines terms used in the corporate tax code.Section 59-7-102 provides exemptions from the corporatetax. Section 59-7-104 requires all foreign and domesticcorporations to pay an annual corporate franchise or incometax. Section 59-7-105 provides additions to unadjustedincome for computing adjusted income. Section 59-7-106provides subtractions from unadjusted income for computingadjusted income. Section 59-7-108 provides guidelines onthe treatment of distributions made by corporations. Section59-7-112 provides for the governance of installment sales.Sections 59-7-302 through 59-7-321 require allocation andapportionment of income for corporations earning incomeboth within and without the state. Establishes three-partformula for apportionment of business income based on theproperty factor, payroll factor, and sales factor. Section 59-7-317 provides instructions for computing sales factor withregard to corporate franchise tax. Section 59-7-321 providesthat the purpose of Title 59, Chapter 7, Part 3 is to makeuniform the law of those states that enact its provisions.Section 59-7-402 indicates when corporations must file awater's edge combined report and gives direction on whomay elect to file the report. Section 59-7-403 provides unitarygroups with the option of filing a worldwide combined report; ifthis report is elected they must continue to file this reportunless they have consent from the Tax Commission to file onanother basis. Section 59-7-501 provides guidelines fortaxable period and accounting method to be used incomputing <strong>Utah</strong> taxable income. Section 59-7-502 states thatif a corporation changes its taxable year for federal taxpurposes or changes its accounting period, the new taxableyear or accounting period shall become the corporation’staxable year for <strong>Utah</strong> corporate franchise and income tax.Section 59-7-505 establishes requirements for filing returns,including combined returns, and states when they are due.Section 59-7-609 provides a corporate franchise tax creditequal to 20% of the qualified rehabilitation expenditures madein connection with the restoration of a residential certifiedhistoric building. Section 59-7-614 provides a corporatefranchise tax credit for renewable energy systems. Section59-13-202 creates a corporate franchise tax credit againstfuel tax for persons using stationary farm engines, and selfpropelled nonhighway farm machinery. Section 59-13-301imposes a special fuels tax on special fuels; provides fortransactions exempt from the tax; requires exemptions to betaken in the form of a tax refund. Section 63M-1-401 throughSection 63M-1-416 establishes the enterprise zone act, whichprovides state assistance to businesses operating in ruralparts of the state. Provides state tax credits for certainbusinesses operating within the enterprise zone.SUMMARY OF WRITTEN COMMENTS RECEIVED DURINGAND SINCE THE LAST FIVE YEAR REVIEW OF THE RULEFROM INTERESTED PERSONS SUPPORTING OROPPOSING THE RULE: <strong>No</strong>ne.REASONED JUSTIFICATION FOR THE CONTINUATION OFTHE RULE, INCLUDING REASONS WHY THE AGENCYDISAGREES WITH COMMENTS IN OPPOSITION TO THERULE, IF ANY: Section R865-6F-1 clarifies franchise taxresponsibilities of foreign corporations. Also, clarifies themanner in which a foreign corporation terminates itscorporate franchise tax responsibilities. Section R865-6F-2126 UTAH STATE BULLETIN, <strong>January</strong> <strong>15</strong>, <strong>2012</strong>, <strong>Vol</strong>. <strong>2012</strong>, <strong>No</strong>. 2

![Lynx avoidance [PDF] - Wisconsin Department of Natural Resources](https://img.yumpu.com/41279089/1/159x260/lynx-avoidance-pdf-wisconsin-department-of-natural-resources.jpg?quality=85)