Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Utah State Bulletin, January 15, 2012, Vol. 2012, No. 2

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

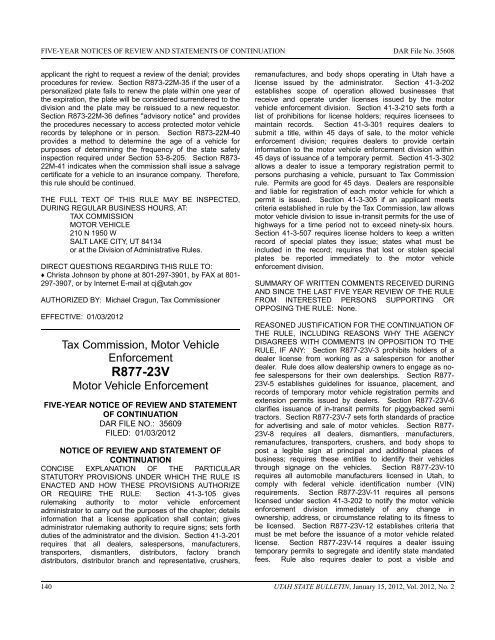

FIVE-YEAR NOTICES OF REVIEW AND STATEMENTS OF CONTINUATION DAR File <strong>No</strong>. 35608applicant the right to request a review of the denial; providesprocedures for review. Section R873-22M-35 if the user of apersonalized plate fails to renew the plate within one year ofthe expiration, the plate will be considered surrendered to thedivision and the plate may be reissued to a new requestor.Section R873-22M-36 defines "advisory notice" and providesthe procedures necessary to access protected motor vehiclerecords by telephone or in person. Section R873-22M-40provides a method to determine the age of a vehicle forpurposes of determining the frequency of the state safetyinspection required under Section 53-8-205. Section R873-22M-41 indicates when the commission shall issue a salvagecertificate for a vehicle to an insurance company. Therefore,this rule should be continued.THE FULL TEXT OF THIS RULE MAY BE INSPECTED,DURING REGULAR BUSINESS HOURS, AT:TAX COMMISSIONMOTOR VEHICLE210 N 1950 WSALT LAKE CITY, UT 84134or at the Division of Administrative Rules.DIRECT QUESTIONS REGARDING THIS RULE TO:♦ Christa Johnson by phone at 801-297-3901, by FAX at 801-297-3907, or by Internet E-mail at cj@utah.govAUTHORIZED BY: Michael Cragun, Tax CommissionerEFFECTIVE: 01/03/<strong>2012</strong>Tax Commission, Motor VehicleEnforcementR877-23VMotor Vehicle EnforcementFIVE-YEAR NOTICE OF REVIEW AND STATEMENTOF CONTINUATIONDAR FILE NO.: 35609FILED: 01/03/<strong>2012</strong>NOTICE OF REVIEW AND STATEMENT OFCONTINUATIONCONCISE EXPLANATION OF THE PARTICULARSTATUTORY PROVISIONS UNDER WHICH THE RULE ISENACTED AND HOW THESE PROVISIONS AUTHORIZEOR REQUIRE THE RULE: Section 41-3-105 givesrulemaking authority to motor vehicle enforcementadministrator to carry out the purposes of the chapter; detailsinformation that a license application shall contain; givesadministrator rulemaking authority to require signs; sets forthduties of the administrator and the division. Section 41-3-201requires that all dealers, salespersons, manufacturers,transporters, dismantlers, distributors, factory branchdistributors, distributor branch and representative, crushers,remanufactures, and body shops operating in <strong>Utah</strong> have alicense issued by the administrator. Section 41-3-202establishes scope of operation allowed businesses thatreceive and operate under licenses issued by the motorvehicle enforcement division. Section 41-3-210 sets forth alist of prohibitions for license holders; requires licensees tomaintain records. Section 41-3-301 requires dealers tosubmit a title, within 45 days of sale, to the motor vehicleenforcement division; requires dealers to provide certaininformation to the motor vehicle enforcement division within45 days of issuance of a temporary permit. Section 41-3-302allows a dealer to issue a temporary registration permit topersons purchasing a vehicle, pursuant to Tax Commissionrule. Permits are good for 45 days. Dealers are responsibleand liable for registration of each motor vehicle for which apermit is issued. Section 41-3-305 if an applicant meetscriteria established in rule by the Tax Commission, law allowsmotor vehicle division to issue in-transit permits for the use ofhighways for a time period not to exceed ninety-six hours.Section 41-3-507 requires license holders to keep a writtenrecord of special plates they issue; states what must beincluded in the record; requires that lost or stolen specialplates be reported immediately to the motor vehicleenforcement division.SUMMARY OF WRITTEN COMMENTS RECEIVED DURINGAND SINCE THE LAST FIVE YEAR REVIEW OF THE RULEFROM INTERESTED PERSONS SUPPORTING OROPPOSING THE RULE: <strong>No</strong>ne.REASONED JUSTIFICATION FOR THE CONTINUATION OFTHE RULE, INCLUDING REASONS WHY THE AGENCYDISAGREES WITH COMMENTS IN OPPOSITION TO THERULE, IF ANY: Section R877-23V-3 prohibits holders of adealer license from working as a salesperson for anotherdealer. Rule does allow dealership owners to engage as nofeesalespersons for their own dealerships. Section R877-23V-5 establishes guidelines for issuance, placement, andrecords of temporary motor vehicle registration permits andextension permits issued by dealers. Section R877-23V-6clarifies issuance of in-transit permits for piggybacked semitractors. Section R877-23V-7 sets forth standards of practicefor advertising and sale of motor vehicles. Section R877-23V-8 requires all dealers, dismantlers, manufacturers,remanufactures, transporters, crushers, and body shops topost a legible sign at principal and additional places ofbusiness; requires these entities to identify their vehiclesthrough signage on the vehicles. Section R877-23V-10requires all automobile manufacturers licensed in <strong>Utah</strong>, tocomply with federal vehicle identification number (VIN)requirements. Section R877-23V-11 requires all personslicensed under section 41-3-202 to notify the motor vehicleenforcement division immediately of any change inownership, address, or circumstance relating to its fitness tobe licensed. Section R877-23V-12 establishes criteria thatmust be met before the issuance of a motor vehicle relatedlicense. Section R877-23V-14 requires a dealer issuingtemporary permits to segregate and identify state mandatedfees. Rule also requires dealer to post a visible and140 UTAH STATE BULLETIN, <strong>January</strong> <strong>15</strong>, <strong>2012</strong>, <strong>Vol</strong>. <strong>2012</strong>, <strong>No</strong>. 2

![Lynx avoidance [PDF] - Wisconsin Department of Natural Resources](https://img.yumpu.com/41279089/1/159x260/lynx-avoidance-pdf-wisconsin-department-of-natural-resources.jpg?quality=85)