Banken for en verden i endring The bank for a ... - BNP Paribas

Banken for en verden i endring The bank for a ... - BNP Paribas

Banken for en verden i endring The bank for a ... - BNP Paribas

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

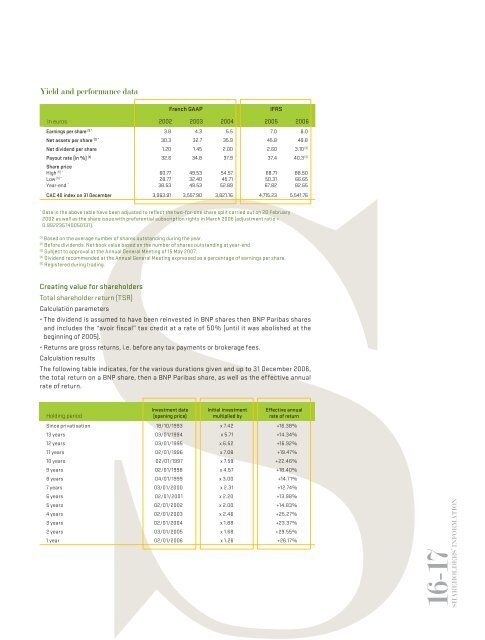

Yield and per<strong>for</strong>mance data<br />

Fr<strong>en</strong>ch GAAP IFRS<br />

In euros 2002 2003 2004 2005 2006<br />

Earnings per share (1) * 3.8 4.3 5.5 7.0 8.0<br />

Net assets per share (2) * 30.3 32.7 35.9 45.8 49.8<br />

Net divid<strong>en</strong>d per share 1.20 1.45 2.00 2.60 3.10 (3)<br />

Payout rate (in %) (4) 32.6 34.8 37.9 37.4 40.3 (3)<br />

Share price<br />

(5) * High<br />

(5) * Low<br />

Year-<strong>en</strong>d *<br />

60.77<br />

28.77<br />

38.53<br />

49.53<br />

32.40<br />

49.53<br />

54.57<br />

45.71<br />

52.89<br />

sSHAREHOLDERS’ 16-17<br />

INFORMATION<br />

68.71<br />

50.31<br />

67.82<br />

88.50<br />

66.65<br />

82.65<br />

CAC 40 index on 31 December 3,063.91 3,557.90 3,821.16 4,715.23 5,541.76<br />

* Data in the above table have be<strong>en</strong> adjusted to refl ect the two-<strong>for</strong>-one share split carried out on 20 February<br />

2002 as well as the share issue with prefer<strong>en</strong>tial subscription rights in March 2006 (adjustm<strong>en</strong>t ratio =<br />

0.992235740050131).<br />

(1) Based on the average number of shares outstanding during the year.<br />

(2) Be<strong>for</strong>e divid<strong>en</strong>ds. Net book value based on the number of shares outstanding at year-<strong>en</strong>d.<br />

(3) Subject to approval at the Annual G<strong>en</strong>eral Meeting of 15 May 2007.<br />

(4) Divid<strong>en</strong>d recomm<strong>en</strong>ded at the Annual G<strong>en</strong>eral Meeting expressed as a perc<strong>en</strong>tage of earnings per share.<br />

(5) Registered during trading.<br />

Creating value <strong>for</strong> shareholders<br />

Total shareholder return (TSR)<br />

Calculation parameters<br />

• <strong>The</strong> divid<strong>en</strong>d is assumed to have be<strong>en</strong> reinvested in <strong>BNP</strong> shares th<strong>en</strong> <strong>BNP</strong> <strong>Paribas</strong> shares<br />

and includes the “avoir fi scal” tax credit at a rate of 50% (until it was abolished at the<br />

beginning of 2005).<br />

• Returns are gross returns, i.e. be<strong>for</strong>e any tax paym<strong>en</strong>ts or brokerage fees.<br />

Calculation results<br />

<strong>The</strong> following table indicates, <strong>for</strong> the various durations giv<strong>en</strong> and up to 31 December 2006,<br />

the total return on a <strong>BNP</strong> share, th<strong>en</strong> a <strong>BNP</strong> <strong>Paribas</strong> share, as well as the effective annual<br />

rate of return.<br />

Investm<strong>en</strong>t date Initial investm<strong>en</strong>t Effective annual<br />

Holding period<br />

(op<strong>en</strong>ing price)<br />

multiplied by<br />

rate of return<br />

Since privatisation 18/10/1993 x 7.42 +16.38%<br />

13 years 03/01/1994 x 5.71 +14.34%<br />

12 years 03/01/1995 x 6.52 +16.92%<br />

11 years 02/01/1996 x 7.08 +19.47%<br />

10 years 02/01/1997 x 7.59 +22.46%<br />

9 years 02/01/1998 x 4.57 +18.40%<br />

8 years 04/01/1999 x 3.00 +14.71%<br />

7 years 03/01/2000 x 2.31 +12.74%<br />

6 years 02/01/2001 x 2.20 +13.98%<br />

5 years 02/01/2002 x 2.00 +14.83%<br />

4 years 02/01/2003 x 2.46 +25.27%<br />

3 years 02/01/2004 x 1.88 +23.37%<br />

2 years 03/01/2005 x 1.68 +29.55%<br />

1 year 02/01/2006 x 1.26 +26.17%