Banken for en verden i endring The bank for a ... - BNP Paribas

Banken for en verden i endring The bank for a ... - BNP Paribas

Banken for en verden i endring The bank for a ... - BNP Paribas

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

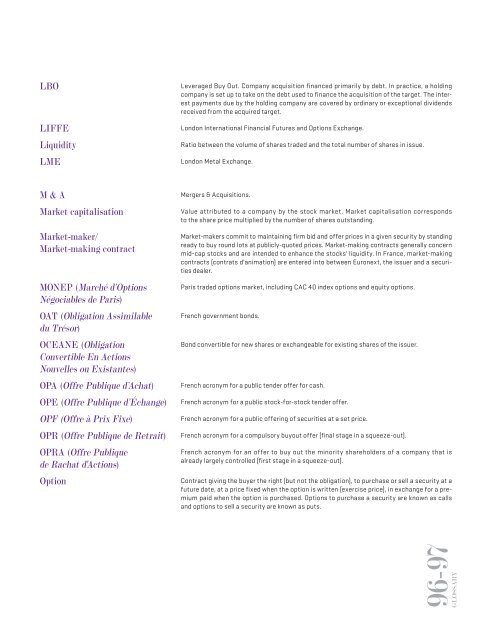

LBO<br />

LIFFE<br />

Liquidity<br />

LME<br />

M & A<br />

Market capitalisation<br />

Market-maker/<br />

Market-making contract<br />

MONEP (Marché d’Options<br />

Négociables de Paris)<br />

OAT (Obligation Assimilable<br />

du Trésor)<br />

OCEANE (Obligation<br />

Convertible En Actions<br />

Nouvelles ou Existantes)<br />

OPA (Offre Publique d’Achat)<br />

OPE (Offre Publique d’Échange)<br />

OPF (Offre à Prix Fixe)<br />

OPR (Offre Publique de Retrait)<br />

OPRA (Offre Publique<br />

de Rachat d'Actions)<br />

Option<br />

Leveraged Buy Out. Company acquisition fi nanced primarily by debt. In practice, a holding<br />

company is set up to take on the debt used to fi nance the acquisition of the target. <strong>The</strong> interest<br />

paym<strong>en</strong>ts due by the holding company are covered by ordinary or exceptional divid<strong>en</strong>ds<br />

received from the acquired target.<br />

London International Financial Futures and Options Exchange.<br />

Ratio betwe<strong>en</strong> the volume of shares traded and the total number of shares in issue.<br />

London Metal Exchange.<br />

Mergers & Acquisitions.<br />

Value attributed to a company by the stock market. Market capitalisation corresponds<br />

to the share price multiplied by the number of shares outstanding.<br />

Market-makers commit to maintaining fi rm bid and offer prices in a giv<strong>en</strong> security by standing<br />

ready to buy round lots at publicly-quoted prices. Market-making contracts g<strong>en</strong>erally concern<br />

mid-cap stocks and are int<strong>en</strong>ded to <strong>en</strong>hance the stocks' liquidity. In France, market-making<br />

contracts (contrats d'animation) are <strong>en</strong>tered into betwe<strong>en</strong> Euronext, the issuer and a securities<br />

dealer.<br />

Paris traded options market, including CAC 40 index options and equity options.<br />

Fr<strong>en</strong>ch governm<strong>en</strong>t bonds.<br />

Bond convertible <strong>for</strong> new shares or exchangeable <strong>for</strong> existing shares of the issuer.<br />

Fr<strong>en</strong>ch acronym <strong>for</strong> a public t<strong>en</strong>der offer <strong>for</strong> cash.<br />

Fr<strong>en</strong>ch acronym <strong>for</strong> a public stock-<strong>for</strong>-stock t<strong>en</strong>der offer.<br />

Fr<strong>en</strong>ch acronym <strong>for</strong> a public offering of securities at a set price.<br />

Fr<strong>en</strong>ch acronym <strong>for</strong> a compulsory buyout offer (fi nal stage in a squeeze-out).<br />

Fr<strong>en</strong>ch acronym <strong>for</strong> an offer to buy out the minority shareholders of a company that is<br />

already largely controlled (fi rst stage in a squeeze-out).<br />

Contract giving the buyer the right (but not the obligation), to purchase or sell a security at a<br />

future date, at a price fi xed wh<strong>en</strong> the option is writt<strong>en</strong> (exercise price), in exchange <strong>for</strong> a premium<br />

paid wh<strong>en</strong> the option is purchased. Options to purchase a security are known as calls<br />

and options to sell a security are known as puts.<br />

96-97<br />

GLOSSARY