Banken for en verden i endring The bank for a ... - BNP Paribas

Banken for en verden i endring The bank for a ... - BNP Paribas

Banken for en verden i endring The bank for a ... - BNP Paribas

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

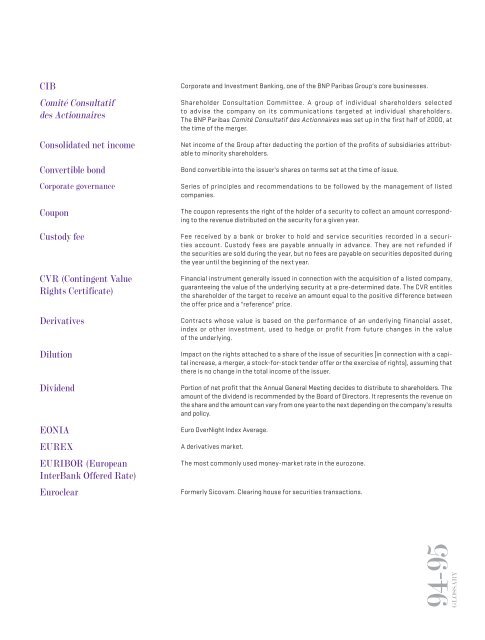

CIB<br />

Comité Consultatif<br />

des Actionnaires<br />

Consolidated net income<br />

Convertible bond<br />

Corporate and Investm<strong>en</strong>t Banking, one of the <strong>BNP</strong> <strong>Paribas</strong> Group's core businesses.<br />

Shareholder Consultation Committee. A group of individual shareholders selected<br />

to advise the company on its communications targeted at individual shareholders.<br />

<strong>The</strong> <strong>BNP</strong> <strong>Paribas</strong> Comité Consultatif des Actionnaires was set up in the fi rst half of 2000, at<br />

the time of the merger.<br />

Net income of the Group after deducting the portion of the profi ts of subsidiaries attributable<br />

to minority shareholders.<br />

Bond convertible into the issuer's shares on terms set at the time of issue.<br />

Corporate governance Series of principles and recomm<strong>en</strong>dations to be followed by the managem<strong>en</strong>t of listed<br />

companies.<br />

Coupon<br />

Custody fee<br />

CVR (Conting<strong>en</strong>t Value<br />

Rights Certificate)<br />

Derivatives<br />

Dilution<br />

Divid<strong>en</strong>d<br />

EONIA<br />

EUREX<br />

EURIBOR (European<br />

InterBank Offered Rate)<br />

Euroclear<br />

<strong>The</strong> coupon repres<strong>en</strong>ts the right of the holder of a security to collect an amount corresponding<br />

to the rev<strong>en</strong>ue distributed on the security <strong>for</strong> a giv<strong>en</strong> year.<br />

Fee received by a <strong>bank</strong> or broker to hold and service securities recorded in a securities<br />

account. Custody fees are payable annually in advance. <strong>The</strong>y are not refunded if<br />

the securities are sold during the year, but no fees are payable on securities deposited during<br />

the year until the beginning of the next year.<br />

Financial instrum<strong>en</strong>t g<strong>en</strong>erally issued in connection with the acquisition of a listed company,<br />

guaranteeing the value of the underlying security at a pre-determined date. <strong>The</strong> CVR <strong>en</strong>titles<br />

the shareholder of the target to receive an amount equal to the positive differ<strong>en</strong>ce betwe<strong>en</strong><br />

the offer price and a "refer<strong>en</strong>ce" price.<br />

Contracts whose value is based on the per<strong>for</strong>mance of an underlying financial asset,<br />

index or other investm<strong>en</strong>t, used to hedge or profit from future changes in the value<br />

of the underlying.<br />

Impact on the rights attached to a share of the issue of securities (in connection with a capital<br />

increase, a merger, a stock-<strong>for</strong>-stock t<strong>en</strong>der offer or the exercise of rights), assuming that<br />

there is no change in the total income of the issuer.<br />

Portion of net profi t that the Annual G<strong>en</strong>eral Meeting decides to distribute to shareholders. <strong>The</strong><br />

amount of the divid<strong>en</strong>d is recomm<strong>en</strong>ded by the Board of Directors. It repres<strong>en</strong>ts the rev<strong>en</strong>ue on<br />

the share and the amount can vary from one year to the next dep<strong>en</strong>ding on the company's results<br />

and policy.<br />

Euro OverNight Index Average.<br />

A derivatives market.<br />

<strong>The</strong> most commonly used money-market rate in the eurozone.<br />

Formerly Sicovam. Clearing house <strong>for</strong> securities transactions.<br />

94-95<br />

GLOSSARY