2003 Annual Report - Enerflex

2003 Annual Report - Enerflex

2003 Annual Report - Enerflex

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

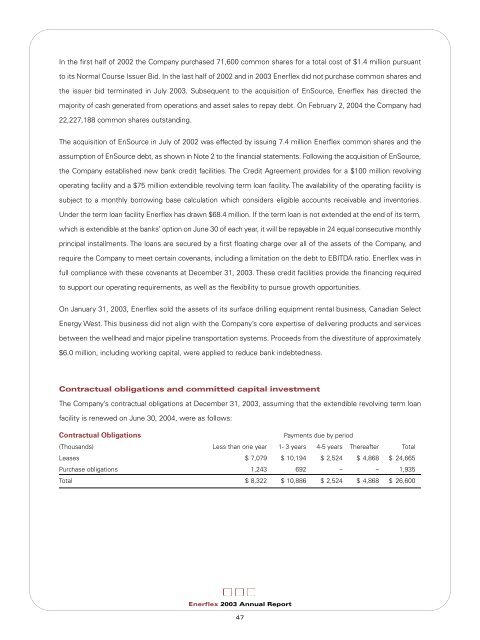

In the first half of 2002 the Company purchased 71,600 common shares for a total cost of $1.4 million pursuantto its Normal Course Issuer Bid. In the last half of 2002 and in <strong>2003</strong> <strong>Enerflex</strong> did not purchase common shares andthe issuer bid terminated in July <strong>2003</strong>. Subsequent to the acquisition of EnSource, <strong>Enerflex</strong> has directed themajority of cash generated from operations and asset sales to repay debt. On February 2, 2004 the Company had22,227,188 common shares outstanding.The acquisition of EnSource in July of 2002 was effected by issuing 7.4 million <strong>Enerflex</strong> common shares and theassumption of EnSource debt, as shown in Note 2 to the financial statements. Following the acquisition of EnSource,the Company established new bank credit facilities. The Credit Agreement provides for a $100 million revolvingoperating facility and a $75 million extendible revolving term loan facility. The availability of the operating facility issubject to a monthly borrowing base calculation which considers eligible accounts receivable and inventories.Under the term loan facility <strong>Enerflex</strong> has drawn $68.4 million. If the term loan is not extended at the end of its term,which is extendible at the banks’ option on June 30 of each year, it will be repayable in 24 equal consecutive monthlyprincipal installments. The loans are secured by a first floating charge over all of the assets of the Company, andrequire the Company to meet certain covenants, including a limitation on the debt to EBITDA ratio. <strong>Enerflex</strong> was infull compliance with these covenants at December 31, <strong>2003</strong>. These credit facilities provide the financing requiredto support our operating requirements, as well as the flexibility to pursue growth opportunities.On January 31, <strong>2003</strong>, <strong>Enerflex</strong> sold the assets of its surface drilling equipment rental business, Canadian SelectEnergy West. This business did not align with the Company’s core expertise of delivering products and servicesbetween the wellhead and major pipeline transportation systems. Proceeds from the divestiture of approximately$6.0 million, including working capital, were applied to reduce bank indebtedness.Contractual obligations and committed capital investmentThe Company’s contractual obligations at December 31, <strong>2003</strong>, assuming that the extendible revolving term loanfacility is renewed on June 30, 2004, were as follows:Contractual ObligationsPayments due by period(Thousands) Less than one year 1- 3 years 4-5 years Thereafter TotalLeases $ 7,079 $ 10,194 $ 2,524 $ 4,868 $ 24,665Purchase obligations 1,243 692 – – 1,935Total $ 8,322 $ 10,886 $ 2,524 $ 4,868 $ 26,600<strong>Enerflex</strong> <strong>2003</strong> <strong>Annual</strong> <strong>Report</strong>47