2003 Annual Report - Enerflex

2003 Annual Report - Enerflex

2003 Annual Report - Enerflex

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

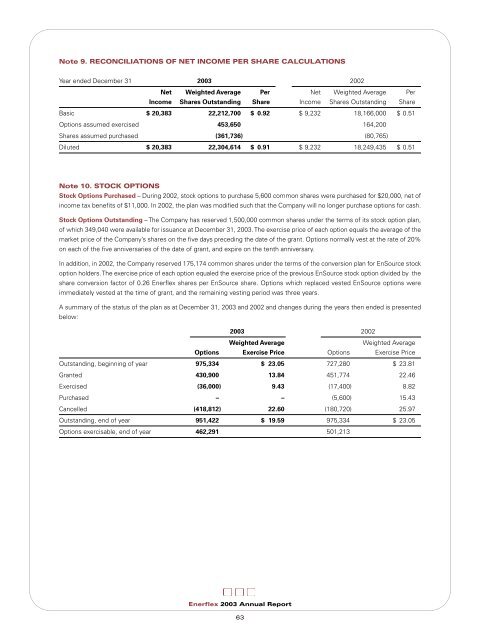

Note 9. RECONCILIATIONS OF NET INCOME PER SHARE CALCULATIONSYear ended December 31 <strong>2003</strong> 2002Net Weighted Average Per Net Weighted Average PerIncome Shares Outstanding Share Income Shares Outstanding ShareBasic $ 20,383 22,212,700 $ 0.92 $ 9,232 18,166,000 $ 0.51Options assumed exercised 453,650 164,200Shares assumed purchased (361,736) (80,765)Diluted $ 20,383 22,304,614 $ 0.91 $ 9,232 18,249,435 $ 0.51Note 10. STOCK OPTIONSStock Options Purchased – During 2002, stock options to purchase 5,600 common shares were purchased for $20,000, net ofincome tax benefits of $11,000. In 2002, the plan was modified such that the Company will no longer purchase options for cash.Stock Options Outstanding – The Company has reserved 1,500,000 common shares under the terms of its stock option plan,of which 349,040 were available for issuance at December 31, <strong>2003</strong>. The exercise price of each option equals the average of themarket price of the Company’s shares on the five days preceding the date of the grant. Options normally vest at the rate of 20%on each of the five anniversaries of the date of grant, and expire on the tenth anniversary.In addition, in 2002, the Company reserved 175,174 common shares under the terms of the conversion plan for EnSource stockoption holders. The exercise price of each option equaled the exercise price of the previous EnSource stock option divided by theshare conversion factor of 0.26 <strong>Enerflex</strong> shares per EnSource share. Options which replaced vested EnSource options wereimmediately vested at the time of grant, and the remaining vesting period was three years.A summary of the status of the plan as at December 31, <strong>2003</strong> and 2002 and changes during the years then ended is presentedbelow:<strong>2003</strong> 2002Weighted AverageWeighted AverageOptions Exercise Price Options Exercise PriceOutstanding, beginning of year 975,334 $ 23.05 727,280 $ 23.81Granted 430,900 13.84 451,774 22.46Exercised (36,000) 9.43 (17,400) 8.82Purchased – – (5,600) 15.43Cancelled (418,812) 22.60 (180,720) 25.97Outstanding, end of year 951,422 $ 19.59 975,334 $ 23.05Options exercisable, end of year 462,291 501,213<strong>Enerflex</strong> <strong>2003</strong> <strong>Annual</strong> <strong>Report</strong>63