2003 Annual Report - Enerflex

2003 Annual Report - Enerflex

2003 Annual Report - Enerflex

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

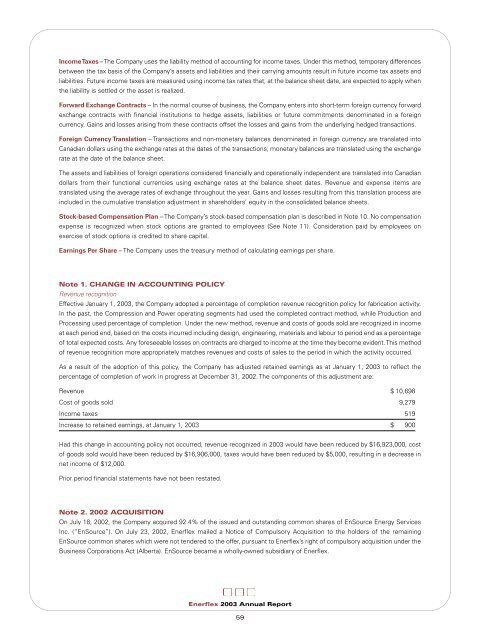

Income Taxes – The Company uses the liability method of accounting for income taxes. Under this method, temporary differencesbetween the tax basis of the Company’s assets and liabilities and their carrying amounts result in future income tax assets andliabilities. Future income taxes are measured using income tax rates that, at the balance sheet date, are expected to apply whenthe liability is settled or the asset is realized.Forward Exchange Contracts – In the normal course of business, the Company enters into short-term foreign currency forwardexchange contracts with financial institutions to hedge assets, liabilities or future commitments denominated in a foreigncurrency. Gains and losses arising from these contracts offset the losses and gains from the underlying hedged transactions.Foreign Currency Translation – Transactions and non-monetary balances denominated in foreign currency are translated intoCanadian dollars using the exchange rates at the dates of the transactions; monetary balances are translated using the exchangerate at the date of the balance sheet.The assets and liabilities of foreign operations considered financially and operationally independent are translated into Canadiandollars from their functional currencies using exchange rates at the balance sheet dates. Revenue and expense items aretranslated using the average rates of exchange throughout the year. Gains and losses resulting from this translation process areincluded in the cumulative translation adjustment in shareholders’ equity in the consolidated balance sheets.Stock-based Compensation Plan – The Company’s stock-based compensation plan is described in Note 10. No compensationexpense is recognized when stock options are granted to employees (See Note 11). Consideration paid by employees onexercise of stock options is credited to share capital.Earnings Per Share – The Company uses the treasury method of calculating earnings per share.Note 1. CHANGE IN ACCOUNTING POLICYRevenue recognitionEffective January 1, <strong>2003</strong>, the Company adopted a percentage of completion revenue recognition policy for fabrication activity.In the past, the Compression and Power operating segments had used the completed contract method, while Production andProcessing used percentage of completion. Under the new method, revenue and costs of goods sold are recognized in incomeat each period end, based on the costs incurred including design, engineering, materials and labour to period end as a percentageof total expected costs. Any foreseeable losses on contracts are charged to income at the time they become evident. This methodof revenue recognition more appropriately matches revenues and costs of sales to the period in which the activity occurred.As a result of the adoption of this policy, the Company has adjusted retained earnings as at January 1, <strong>2003</strong> to reflect thepercentage of completion of work in progress at December 31, 2002. The components of this adjustment are:Revenue $ 10,698Cost of goods sold 9,279Income taxes 519Increase to retained earnings, at January 1, <strong>2003</strong> $ 900Had this change in accounting policy not occurred, revenue recognized in <strong>2003</strong> would have been reduced by $16,923,000, costof goods sold would have been reduced by $16,906,000, taxes would have been reduced by $5,000, resulting in a decrease innet income of $12,000.Prior period financial statements have not been restated.Note 2. 2002 ACQUISITIONOn July 18, 2002, the Company acquired 92.4% of the issued and outstanding common shares of EnSource Energy ServicesInc. (“EnSource”). On July 23, 2002, <strong>Enerflex</strong> mailed a Notice of Compulsory Acquisition to the holders of the remainingEnSource common shares which were not tendered to the offer, pursuant to <strong>Enerflex</strong>’s right of compulsory acquisition under theBusiness Corporations Act (Alberta). EnSource became a wholly-owned subsidiary of <strong>Enerflex</strong>.<strong>Enerflex</strong> <strong>2003</strong> <strong>Annual</strong> <strong>Report</strong>59