2003 Annual Report - Enerflex

2003 Annual Report - Enerflex

2003 Annual Report - Enerflex

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

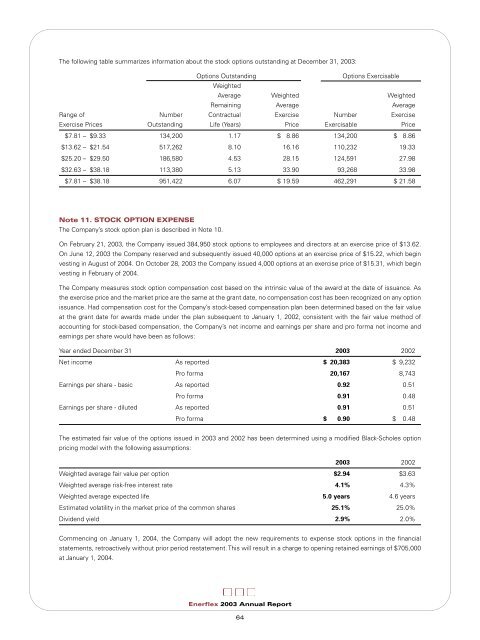

The following table summarizes information about the stock options outstanding at December 31, <strong>2003</strong>:Options OutstandingOptions ExercisableWeightedAverage Weighted WeightedRemaining Average AverageRange of Number Contractual Exercise Number ExerciseExercise Prices Outstanding Life (Years) Price Exercisable Price$7.81 – $9.33 134,200 1.17 $ 8.86 134,200 $ 8.86$13.62 – $21.54 517,262 8.10 16.16 110,232 19.33$25.20 – $29.50 186,580 4.53 28.15 124,591 27.98$32.63 – $38.18 113,380 5.13 33.90 93,268 33.98$7.81 – $38.18 951,422 6.07 $ 19.59 462,291 $ 21.58Note 11. STOCK OPTION EXPENSEThe Company’s stock option plan is described in Note 10.On February 21, <strong>2003</strong>, the Company issued 384,950 stock options to employees and directors at an exercise price of $13.62.On June 12, <strong>2003</strong> the Company reserved and subsequently issued 40,000 options at an exercise price of $15.22, which beginvesting in August of 2004. On October 28, <strong>2003</strong> the Company issued 4,000 options at an exercise price of $15.31, which beginvesting in February of 2004.The Company measures stock option compensation cost based on the intrinsic value of the award at the date of issuance. Asthe exercise price and the market price are the same at the grant date, no compensation cost has been recognized on any optionissuance. Had compensation cost for the Company’s stock-based compensation plan been determined based on the fair valueat the grant date for awards made under the plan subsequent to January 1, 2002, consistent with the fair value method ofaccounting for stock-based compensation, the Company’s net income and earnings per share and pro forma net income andearnings per share would have been as follows:Year ended December 31 <strong>2003</strong> 2002Net income As reported $ 20,383 $ 9,232Pro forma 20,167 8,743Earnings per share - basic As reported 0.92 0.51Pro forma 0.91 0.48Earnings per share - diluted As reported 0.91 0.51Pro forma $ 0.90 $ 0.48The estimated fair value of the options issued in <strong>2003</strong> and 2002 has been determined using a modified Black-Scholes optionpricing model with the following assumptions:<strong>2003</strong> 2002Weighted average fair value per option $2.94 $3.63Weighted average risk-free interest rate 4.1% 4.3%Weighted average expected life 5.0 years 4.6 yearsEstimated volatility in the market price of the common shares 25.1% 25.0%Dividend yield 2.9% 2.0%Commencing on January 1, 2004, the Company will adopt the new requirements to expense stock options in the financialstatements, retroactively without prior period restatement. This will result in a charge to opening retained earnings of $705,000at January 1, 2004.<strong>Enerflex</strong> <strong>2003</strong> <strong>Annual</strong> <strong>Report</strong>64