2003 Annual Report - Enerflex

2003 Annual Report - Enerflex

2003 Annual Report - Enerflex

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

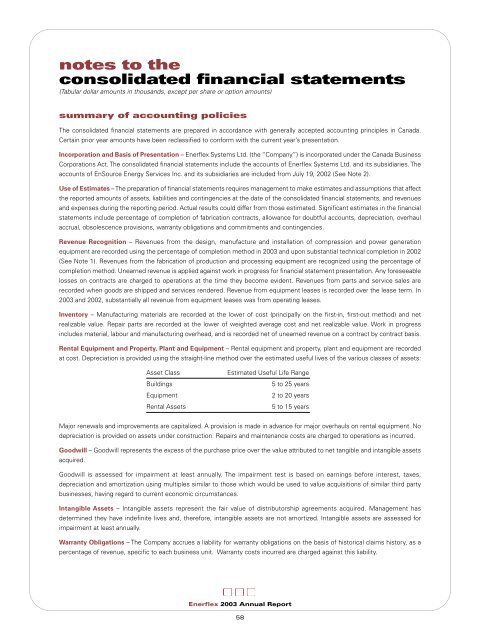

notes to theconsolidated financial statements(Tabular dollar amounts in thousands, except per share or option amounts)summary of accounting policiesThe consolidated financial statements are prepared in accordance with generally accepted accounting principles in Canada.Certain prior year amounts have been reclassified to conform with the current year’s presentation.Incorporation and Basis of Presentation – <strong>Enerflex</strong> Systems Ltd. (the “Company”) is incorporated under the Canada BusinessCorporations Act. The consolidated financial statements include the accounts of <strong>Enerflex</strong> Systems Ltd. and its subsidiaries. Theaccounts of EnSource Energy Services Inc. and its subsidiaries are included from July 19, 2002 (See Note 2).Use of Estimates – The preparation of financial statements requires management to make estimates and assumptions that affectthe reported amounts of assets, liabilities and contingencies at the date of the consolidated financial statements, and revenuesand expenses during the reporting period. Actual results could differ from those estimated. Significant estimates in the financialstatements include percentage of completion of fabrication contracts, allowance for doubtful accounts, depreciation, overhaulaccrual, obsolescence provisions, warranty obligations and commitments and contingencies.Revenue Recognition – Revenues from the design, manufacture and installation of compression and power generationequipment are recorded using the percentage of completion method in <strong>2003</strong> and upon substantial technical completion in 2002(See Note 1). Revenues from the fabrication of production and processing equipment are recognized using the percentage ofcompletion method. Unearned revenue is applied against work in progress for financial statement presentation. Any foreseeablelosses on contracts are charged to operations at the time they become evident. Revenues from parts and service sales arerecorded when goods are shipped and services rendered. Revenue from equipment leases is recorded over the lease term. In<strong>2003</strong> and 2002, substantially all revenue from equipment leases was from operating leases.Inventory – Manufacturing materials are recorded at the lower of cost (principally on the first-in, first-out method) and netrealizable value. Repair parts are recorded at the lower of weighted average cost and net realizable value. Work in progressincludes material, labour and manufacturing overhead, and is recorded net of unearned revenue on a contract by contract basis.Rental Equipment and Property, Plant and Equipment – Rental equipment and property, plant and equipment are recordedat cost. Depreciation is provided using the straight-line method over the estimated useful lives of the various classes of assets:Asset ClassBuildingsEquipmentRental AssetsEstimated Useful Life Range5 to 25 years2 to 20 years5 to 15 yearsMajor renewals and improvements are capitalized. A provision is made in advance for major overhauls on rental equipment. Nodepreciation is provided on assets under construction. Repairs and maintenance costs are charged to operations as incurred.Goodwill – Goodwill represents the excess of the purchase price over the value attributed to net tangible and intangible assetsacquired.Goodwill is assessed for impairment at least annually. The impairment test is based on earnings before interest, taxes,depreciation and amortization using multiples similar to those which would be used to value acquisitions of similar third partybusinesses, having regard to current economic circumstances.Intangible Assets – Intangible assets represent the fair value of distributorship agreements acquired. Management hasdetermined they have indefinite lives and, therefore, intangible assets are not amortized. Intangible assets are assessed forimpairment at least annually.Warranty Obligations – The Company accrues a liability for warranty obligations on the basis of historical claims history, as apercentage of revenue, specific to each business unit. Warranty costs incurred are charged against this liability.<strong>Enerflex</strong> <strong>2003</strong> <strong>Annual</strong> <strong>Report</strong>58