Richemont is one of the world's leading luxury - Alle jaarverslagen

Richemont is one of the world's leading luxury - Alle jaarverslagen

Richemont is one of the world's leading luxury - Alle jaarverslagen

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

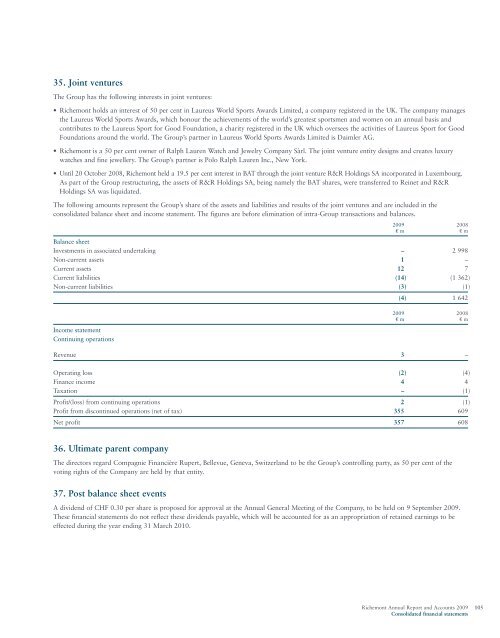

35. Joint venturesThe Group has <strong>the</strong> following interests in joint ventures:• <strong>Richemont</strong> holds an interest <strong>of</strong> 50 per cent in Laureus World Sports Awards Limited, a company reg<strong>is</strong>tered in <strong>the</strong> UK. The company manages<strong>the</strong> Laureus World Sports Awards, which honour <strong>the</strong> achievements <strong>of</strong> <strong>the</strong> world’s greatest sportsmen and women on an annual bas<strong>is</strong> andcontributes to <strong>the</strong> Laureus Sport for Good Foundation, a charity reg<strong>is</strong>tered in <strong>the</strong> UK which oversees <strong>the</strong> activities <strong>of</strong> Laureus Sport for GoodFoundations around <strong>the</strong> world. The Group’s partner in Laureus World Sports Awards Limited <strong>is</strong> Daimler AG.• <strong>Richemont</strong> <strong>is</strong> a 50 per cent owner <strong>of</strong> Ralph Lauren Watch and Jewelry Company Sàrl. The joint venture entity designs and creates <strong>luxury</strong>watches and fine jewellery. The Group’s partner <strong>is</strong> Polo Ralph Lauren Inc., New York.• Until 20 October 2008, <strong>Richemont</strong> held a 19.5 per cent interest in BAT through <strong>the</strong> joint venture R&R Holdings SA incorporated in Luxembourg.As part <strong>of</strong> <strong>the</strong> Group restructuring, <strong>the</strong> assets <strong>of</strong> R&R Holdings SA, being namely <strong>the</strong> BAT shares, were transferred to Reinet and R&RHoldings SA was liquidated.The following amounts represent <strong>the</strong> Group’s share <strong>of</strong> <strong>the</strong> assets and liabilities and results <strong>of</strong> <strong>the</strong> joint ventures and are included in <strong>the</strong>consolidated balance sheet and income statement. The figures are before elimination <strong>of</strong> intra-Group transactions and balances.2009 2008€ m € mBalance sheetInvestments in associated undertaking – 2 998Non-current assets 1 –Current assets 12 7Current liabilities (14) (1 362)Non-current liabilities (3) (1)(4) 1 642Income statementContinuing operations2009 2008€ m € mRevenue 3 –Operating loss (2) (4)Finance income 4 4Taxation – (1)Pr<strong>of</strong>it/(loss) from continuing operations 2 (1)Pr<strong>of</strong>it from d<strong>is</strong>continued operations (net <strong>of</strong> tax) 355 609Net pr<strong>of</strong>it 357 60836. Ultimate parent companyThe directors regard Compagnie Financière Rupert, Bellevue, Geneva, Switzerland to be <strong>the</strong> Group’s controlling party, as 50 per cent <strong>of</strong> <strong>the</strong>voting rights <strong>of</strong> <strong>the</strong> Company are held by that entity.37. Post balance sheet eventsA dividend <strong>of</strong> CHF 0.30 per share <strong>is</strong> proposed for approval at <strong>the</strong> Annual General Meeting <strong>of</strong> <strong>the</strong> Company, to be held on 9 September 2009.These financial statements do not reflect <strong>the</strong>se dividends payable, which will be accounted for as an appropriation <strong>of</strong> retained earnings to beeffected during <strong>the</strong> year ending 31 March 2010.<strong>Richemont</strong> Annual Report and Accounts 2009 105Consolidated financial statements