Richemont is one of the world's leading luxury - Alle jaarverslagen

Richemont is one of the world's leading luxury - Alle jaarverslagen

Richemont is one of the world's leading luxury - Alle jaarverslagen

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

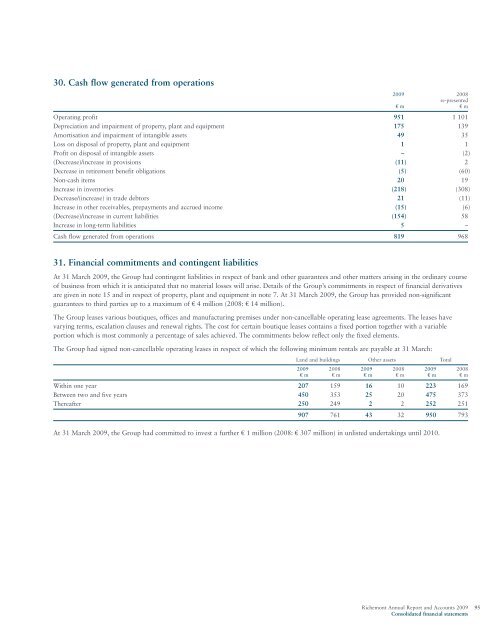

30. Cash flow generated from operations2009 2008re-presented€ m € mOperating pr<strong>of</strong>it 951 1 101Depreciation and impairment <strong>of</strong> property, plant and equipment 175 139Amort<strong>is</strong>ation and impairment <strong>of</strong> intangible assets 49 35Loss on d<strong>is</strong>posal <strong>of</strong> property, plant and equipment 1 1Pr<strong>of</strong>it on d<strong>is</strong>posal <strong>of</strong> intangible assets – (2)(Decrease)/increase in prov<strong>is</strong>ions (11) 2Decrease in retirement benefit obligations (5) (60)Non-cash items 20 19Increase in inventories (218) (308)Decrease/(increase) in trade debtors 21 (11)Increase in o<strong>the</strong>r receivables, prepayments and accrued income (15) (6)(Decrease)/increase in current liabilities (154) 58Increase in long-term liabilities 5 –Cash flow generated from operations 819 96831. Financial commitments and contingent liabilitiesAt 31 March 2009, <strong>the</strong> Group had contingent liabilities in respect <strong>of</strong> bank and o<strong>the</strong>r guarantees and o<strong>the</strong>r matters ar<strong>is</strong>ing in <strong>the</strong> ordinary course<strong>of</strong> business from which it <strong>is</strong> anticipated that no material losses will ar<strong>is</strong>e. Details <strong>of</strong> <strong>the</strong> Group’s commitments in respect <strong>of</strong> financial derivativesare given in note 15 and in respect <strong>of</strong> property, plant and equipment in note 7. At 31 March 2009, <strong>the</strong> Group has provided non-significantguarantees to third parties up to a maximum <strong>of</strong> € 4 million (2008: € 14 million).The Group leases various boutiques, <strong>of</strong>fices and manufacturing prem<strong>is</strong>es under non-cancellable operating lease agreements. The leases havevarying terms, escalation clauses and renewal rights. The cost for certain boutique leases contains a fixed portion toge<strong>the</strong>r with a variableportion which <strong>is</strong> most commonly a percentage <strong>of</strong> sales achieved. The commitments below reflect only <strong>the</strong> fixed elements.The Group had signed non-cancellable operating leases in respect <strong>of</strong> which <strong>the</strong> following minimum rentals are payable at 31 March:Land and buildings O<strong>the</strong>r assets Total2009 2008 2009 2008 2009 2008€ m € m € m € m € m € mWithin <strong>one</strong> year 207 159 16 10 223 169Between two and five years 450 353 25 20 475 373Thereafter 250 249 2 2 252 251907 761 43 32 950 793At 31 March 2009, <strong>the</strong> Group had committed to invest a fur<strong>the</strong>r € 1 million (2008: € 307 million) in unl<strong>is</strong>ted undertakings until 2010.<strong>Richemont</strong> Annual Report and Accounts 2009 95Consolidated financial statements