Richemont is one of the world's leading luxury - Alle jaarverslagen

Richemont is one of the world's leading luxury - Alle jaarverslagen

Richemont is one of the world's leading luxury - Alle jaarverslagen

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

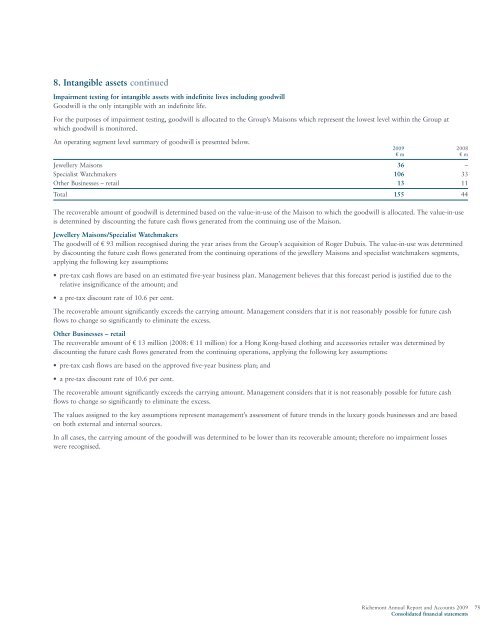

8. Intangible assets continuedImpairment testing for intangible assets with indefinite lives including goodwillGoodwill <strong>is</strong> <strong>the</strong> only intangible with an indefinite life.For <strong>the</strong> purposes <strong>of</strong> impairment testing, goodwill <strong>is</strong> allocated to <strong>the</strong> Group’s Ma<strong>is</strong>ons which represent <strong>the</strong> lowest level within <strong>the</strong> Group atwhich goodwill <strong>is</strong> monitored.An operating segment level summary <strong>of</strong> goodwill <strong>is</strong> presented below.2009 2008€ m € mJewellery Ma<strong>is</strong>ons 36 –Special<strong>is</strong>t Watchmakers 106 33O<strong>the</strong>r Businesses – retail 13 11Total 155 44The recoverable amount <strong>of</strong> goodwill <strong>is</strong> determined based on <strong>the</strong> value-in-use <strong>of</strong> <strong>the</strong> Ma<strong>is</strong>on to which <strong>the</strong> goodwill <strong>is</strong> allocated. The value-in-use<strong>is</strong> determined by d<strong>is</strong>counting <strong>the</strong> future cash flows generated from <strong>the</strong> continuing use <strong>of</strong> <strong>the</strong> Ma<strong>is</strong>on.Jewellery Ma<strong>is</strong>ons/Special<strong>is</strong>t WatchmakersThe goodwill <strong>of</strong> € 93 million recogn<strong>is</strong>ed during <strong>the</strong> year ar<strong>is</strong>es from <strong>the</strong> Group’s acqu<strong>is</strong>ition <strong>of</strong> Roger Dubu<strong>is</strong>. The value-in-use was determinedby d<strong>is</strong>counting <strong>the</strong> future cash flows generated from <strong>the</strong> continuing operations <strong>of</strong> <strong>the</strong> jewellery Ma<strong>is</strong>ons and special<strong>is</strong>t watchmakers segments,applying <strong>the</strong> following key assumptions:• pre-tax cash flows are based on an estimated five-year business plan. Management believes that th<strong>is</strong> forecast period <strong>is</strong> justified due to <strong>the</strong>relative insignificance <strong>of</strong> <strong>the</strong> amount; and• a pre-tax d<strong>is</strong>count rate <strong>of</strong> 10.6 per cent.The recoverable amount significantly exceeds <strong>the</strong> carrying amount. Management considers that it <strong>is</strong> not reasonably possible for future cashflows to change so significantly to eliminate <strong>the</strong> excess.O<strong>the</strong>r Businesses – retailThe recoverable amount <strong>of</strong> € 13 million (2008: € 11 million) for a Hong Kong-based clothing and accessories retailer was determined byd<strong>is</strong>counting <strong>the</strong> future cash flows generated from <strong>the</strong> continuing operations, applying <strong>the</strong> following key assumptions:• pre-tax cash flows are based on <strong>the</strong> approved five-year business plan; and• a pre-tax d<strong>is</strong>count rate <strong>of</strong> 10.6 per cent.The recoverable amount significantly exceeds <strong>the</strong> carrying amount. Management considers that it <strong>is</strong> not reasonably possible for future cashflows to change so significantly to eliminate <strong>the</strong> excess.The values assigned to <strong>the</strong> key assumptions represent management’s assessment <strong>of</strong> future trends in <strong>the</strong> <strong>luxury</strong> goods businesses and are basedon both external and internal sources.In all cases, <strong>the</strong> carrying amount <strong>of</strong> <strong>the</strong> goodwill was determined to be lower than its recoverable amount; <strong>the</strong>refore no impairment losseswere recogn<strong>is</strong>ed.<strong>Richemont</strong> Annual Report and Accounts 2009 75Consolidated financial statements