Richemont is one of the world's leading luxury - Alle jaarverslagen

Richemont is one of the world's leading luxury - Alle jaarverslagen

Richemont is one of the world's leading luxury - Alle jaarverslagen

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

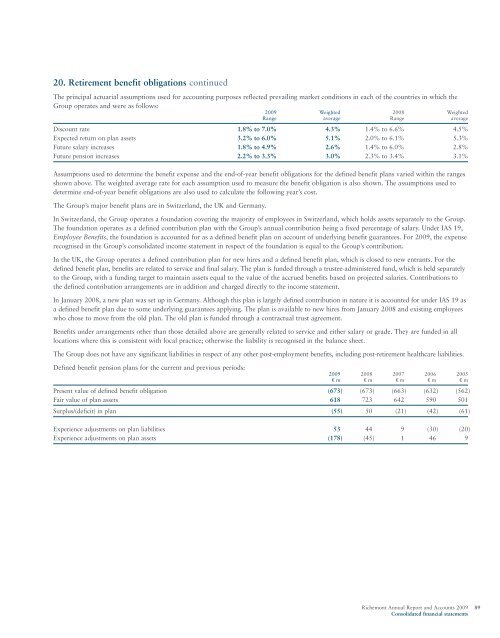

20. Retirement benefit obligations continuedThe principal actuarial assumptions used for accounting purposes reflected prevailing market conditions in each <strong>of</strong> <strong>the</strong> countries in which <strong>the</strong>Group operates and were as follows:2009 Weighted 2008 WeightedRange average Range averageD<strong>is</strong>count rate 1.8% to 7.0% 4.3% 1.4% to 6.6% 4.5%Expected return on plan assets 3.2% to 6.0% 5.1% 2.0% to 6.1% 5.3%Future salary increases 1.8% to 4.9% 2.6% 1.4% to 6.0% 2.8%Future pension increases 2.2% to 3.3% 3.0% 2.3% to 3.4% 3.1%Assumptions used to determine <strong>the</strong> benefit expense and <strong>the</strong> end-<strong>of</strong>-year benefit obligations for <strong>the</strong> defined benefit plans varied within <strong>the</strong> rangesshown above. The weighted average rate for each assumption used to measure <strong>the</strong> benefit obligation <strong>is</strong> also shown. The assumptions used todetermine end-<strong>of</strong>-year benefit obligations are also used to calculate <strong>the</strong> following year’s cost.The Group’s major benefit plans are in Switzerland, <strong>the</strong> UK and Germany.In Switzerland, <strong>the</strong> Group operates a foundation covering <strong>the</strong> majority <strong>of</strong> employees in Switzerland, which holds assets separately to <strong>the</strong> Group.The foundation operates as a defined contribution plan with <strong>the</strong> Group’s annual contribution being a fixed percentage <strong>of</strong> salary. Under IAS 19,Employee Benefits, <strong>the</strong> foundation <strong>is</strong> accounted for as a defined benefit plan on account <strong>of</strong> underlying benefit guarantees. For 2009, <strong>the</strong> expenserecogn<strong>is</strong>ed in <strong>the</strong> Group’s consolidated income statement in respect <strong>of</strong> <strong>the</strong> foundation <strong>is</strong> equal to <strong>the</strong> Group’s contribution.In <strong>the</strong> UK, <strong>the</strong> Group operates a defined contribution plan for new hires and a defined benefit plan, which <strong>is</strong> closed to new entrants. For <strong>the</strong>defined benefit plan, benefits are related to service and final salary. The plan <strong>is</strong> funded through a trustee-admin<strong>is</strong>tered fund, which <strong>is</strong> held separatelyto <strong>the</strong> Group, with a funding target to maintain assets equal to <strong>the</strong> value <strong>of</strong> <strong>the</strong> accrued benefits based on projected salaries. Contributions to<strong>the</strong> defined contribution arrangements are in addition and charged directly to <strong>the</strong> income statement.In January 2008, a new plan was set up in Germany. Although th<strong>is</strong> plan <strong>is</strong> largely defined contribution in nature it <strong>is</strong> accounted for under IAS 19 asa defined benefit plan due to some underlying guarantees applying. The plan <strong>is</strong> available to new hires from January 2008 and ex<strong>is</strong>ting employeeswho chose to move from <strong>the</strong> old plan. The old plan <strong>is</strong> funded through a contractual trust agreement.Benefits under arrangements o<strong>the</strong>r than those detailed above are generally related to service and ei<strong>the</strong>r salary or grade. They are funded in alllocations where th<strong>is</strong> <strong>is</strong> cons<strong>is</strong>tent with local practice; o<strong>the</strong>rw<strong>is</strong>e <strong>the</strong> liability <strong>is</strong> recogn<strong>is</strong>ed in <strong>the</strong> balance sheet.The Group does not have any significant liabilities in respect <strong>of</strong> any o<strong>the</strong>r post-employment benefits, including post-retirement healthcare liabilities.Defined benefit pension plans for <strong>the</strong> current and previous periods:2009 2008 2007 2006 2005€ m € m € m € m € mPresent value <strong>of</strong> defined benefit obligation (673) (673) (663) (632) (562)Fair value <strong>of</strong> plan assets 618 723 642 590 501Surplus/(deficit) in plan (55) 50 (21) (42) (61)Experience adjustments on plan liabilities 53 44 9 (30) (20)Experience adjustments on plan assets (178) (45) 1 46 9<strong>Richemont</strong> Annual Report and Accounts 2009 89Consolidated financial statements