Pg 147 - Berjaya Corporation Berhad

Pg 147 - Berjaya Corporation Berhad

Pg 147 - Berjaya Corporation Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

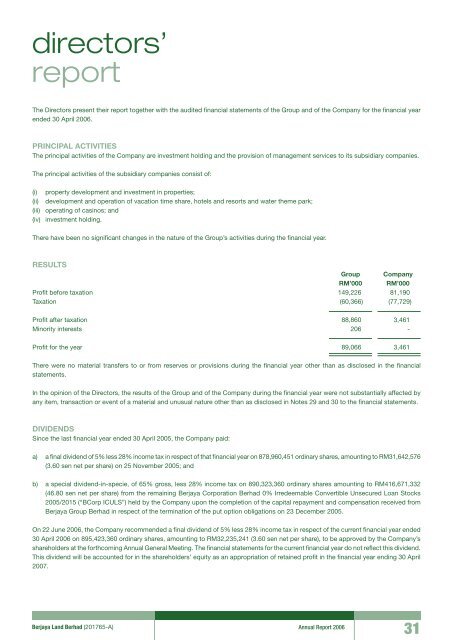

directors’reportThe Directors present their report together with the audited financial statements of the Group and of the Company for the financial yearended 30 April 2006.PRINCIPAL ACTIVITIESThe principal activities of the Company are investment holding and the provision of management services to its subsidiary companies.The principal activities of the subsidiary companies consist of:(i) property development and investment in properties;(ii) development and operation of vacation time share, hotels and resorts and water theme park;(iii) operating of casinos; and(iv) investment holding.There have been no significant changes in the nature of the Group’s activities during the financial year.RESULTSGroup CompanyRM’000 RM’000Profit before taxation 149,226 81,190Taxation (60,366) (77,729)Profit after taxation 88,860 3,461Minority interests 206 -Profit for the year 89,066 3,461There were no material transfers to or from reserves or provisions during the financial year other than as disclosed in the financialstatements.In the opinion of the Directors, the results of the Group and of the Company during the financial year were not substantially affected byany item, transaction or event of a material and unusual nature other than as disclosed in Notes 29 and 30 to the financial statements.DIVIDENDSSince the last financial year ended 30 April 2005, the Company paid:a) a final dividend of 5% less 28% income tax in respect of that financial year on 878,960,451 ordinary shares, amounting to RM31,642,576(3.60 sen net per share) on 25 November 2005; andb) a special dividend-in-specie, of 65% gross, less 28% income tax on 890,323,360 ordinary shares amounting to RM416,671,332(46.80 sen net per share) from the remaining <strong>Berjaya</strong> <strong>Corporation</strong> <strong>Berhad</strong> 0% Irredeemable Convertible Unsecured Loan Stocks2005/2015 (“BCorp ICULS”) held by the Company upon the completion of the capital repayment and compensation received from<strong>Berjaya</strong> Group <strong>Berhad</strong> in respect of the termination of the put option obligations on 23 December 2005.On 22 June 2006, the Company recommended a final dividend of 5% less 28% income tax in respect of the current financial year ended30 April 2006 on 895,423,360 ordinary shares, amounting to RM32,235,241 (3.60 sen net per share), to be approved by the Company’sshareholders at the forthcoming Annual General Meeting. The financial statements for the current financial year do not reflect this dividend.This dividend will be accounted for in the shareholders’ equity as an appropriation of retained profit in the financial year ending 30 April2007.<strong>Berjaya</strong> Land <strong>Berhad</strong> (201765-A) Annual Report 200631