Pg 147 - Berjaya Corporation Berhad

Pg 147 - Berjaya Corporation Berhad

Pg 147 - Berjaya Corporation Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

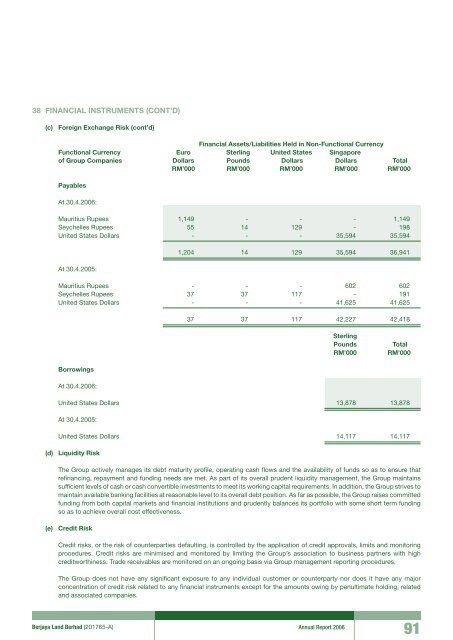

38 FINANCIAL INSTRUMENTS (CONT’D)(c) Foreign Exchange Risk (cont’d)Financial Assets/Liabilities Held in Non-Functional CurrencyFunctional Currency Euro Sterling United States Singaporeof Group Companies Dollars Pounds Dollars Dollars TotalRM’000 RM’000 RM’000 RM’000 RM’000PayablesAt 30.4.2006:Mauritius Rupees 1,149 - - - 1,149Seychelles Rupees 55 14 129 - 198United States Dollars - - - 35,594 35,594At 30.4.2005:1,204 14 129 35,594 36,941Mauritius Rupees - - - 602 602Seychelles Rupees 37 37 117 - 191United States Dollars - - - 41,625 41,62537 37 117 42,227 42,418SterlingPoundsRM’000TotalRM’000BorrowingsAt 30.4.2006:United States Dollars 13,878 13,878At 30.4.2005:United States Dollars 14,117 14,117(d) Liquidity RiskThe Group actively manages its debt maturity profile, operating cash flows and the availability of funds so as to ensure thatrefinancing, repayment and funding needs are met. As part of its overall prudent liquidity management, the Group maintainssufficient levels of cash or cash convertible investments to meet its working capital requirements. In addition, the Group strives tomaintain available banking facilities at reasonable level to its overall debt position. As far as possible, the Group raises committedfunding from both capital markets and financial institutions and prudently balances its portfolio with some short term fundingso as to achieve overall cost effectiveness.(e) Credit RiskCredit risks, or the risk of counterparties defaulting, is controlled by the application of credit approvals, limits and monitoringprocedures. Credit risks are minimised and monitored by limiting the Group’s association to business partners with highcreditworthiness. Trade receivables are monitored on an ongoing basis via Group management reporting procedures.The Group does not have any significant exposure to any individual customer or counterparty nor does it have any majorconcentration of credit risk related to any financial instruments except for the amounts owing by penultimate holding, relatedand associated companies.<strong>Berjaya</strong> Land <strong>Berhad</strong> (201765-A) Annual Report 200691