Pg 147 - Berjaya Corporation Berhad

Pg 147 - Berjaya Corporation Berhad

Pg 147 - Berjaya Corporation Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

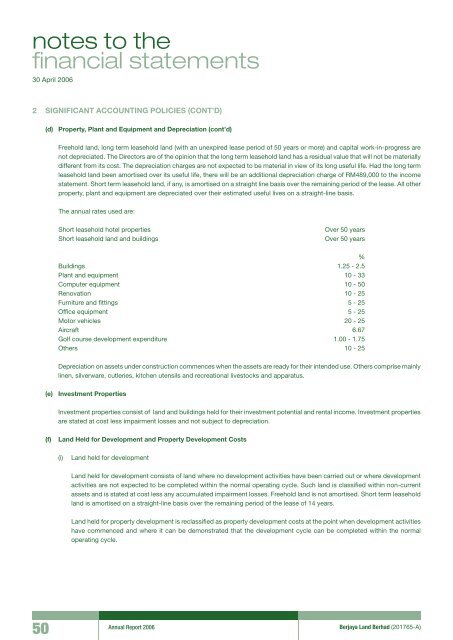

notes to thefinancial statements30 April 20062 SIGNIFICANT ACCOUNTING POLICIES (CONT’D)(d) Property, Plant and Equipment and Depreciation (cont’d)Freehold land, long term leasehold land (with an unexpired lease period of 50 years or more) and capital work-in-progress arenot depreciated. The Directors are of the opinion that the long term leasehold land has a residual value that will not be materiallydifferent from its cost. The depreciation charges are not expected to be material in view of its long useful life. Had the long termleasehold land been amortised over its useful life, there will be an additional depreciation charge of RM489,000 to the incomestatement. Short term leasehold land, if any, is amortised on a straight line basis over the remaining period of the lease. All otherproperty, plant and equipment are depreciated over their estimated useful lives on a straight-line basis.The annual rates used are:Short leasehold hotel propertiesShort leasehold land and buildingsOver 50 yearsOver 50 years%Buildings 1.25 - 2.5Plant and equipment 10 - 33Computer equipment 10 - 50Renovation 10 - 25Furniture and fittings 5 - 25Office equipment 5 - 25Motor vehicles 20 - 25Aircraft 6.67Golf course development expenditure 1.00 - 1.75Others 10 - 25Depreciation on assets under construction commences when the assets are ready for their intended use. Others comprise mainlylinen, silverware, cutleries, kitchen utensils and recreational livestocks and apparatus.(e) Investment PropertiesInvestment properties consist of land and buildings held for their investment potential and rental income. Investment propertiesare stated at cost less impairment losses and not subject to depreciation.(f)Land Held for Development and Property Development Costs(i)Land held for developmentLand held for development consists of land where no development activities have been carried out or where developmentactivities are not expected to be completed within the normal operating cycle. Such land is classified within non-currentassets and is stated at cost less any accumulated impairment losses. Freehold land is not amortised. Short term leaseholdland is amortised on a straight-line basis over the remaining period of the lease of 14 years.Land held for property development is reclassified as property development costs at the point when development activitieshave commenced and where it can be demonstrated that the development cycle can be completed within the normaloperating cycle.50Annual Report 2006<strong>Berjaya</strong> Land <strong>Berhad</strong> (201765-A)