Pg 147 - Berjaya Corporation Berhad

Pg 147 - Berjaya Corporation Berhad

Pg 147 - Berjaya Corporation Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

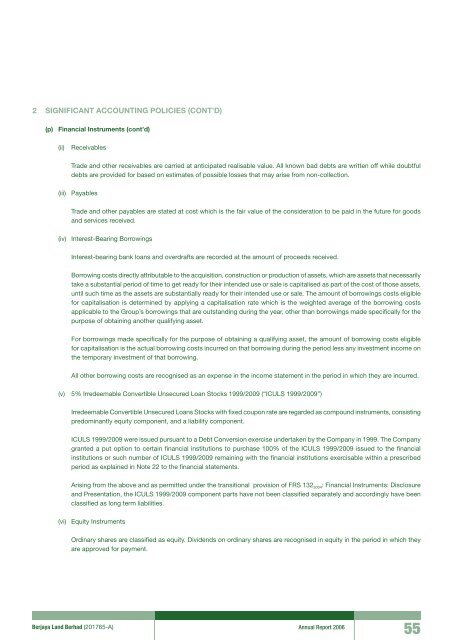

2 SIGNIFICANT ACCOUNTING POLICIES (CONT’D)(p) Financial Instruments (cont’d)(ii)ReceivablesTrade and other receivables are carried at anticipated realisable value. All known bad debts are written off while doubtfuldebts are provided for based on estimates of possible losses that may arise from non-collection.(iii) PayablesTrade and other payables are stated at cost which is the fair value of the consideration to be paid in the future for goodsand services received.(iv) Interest-Bearing BorrowingsInterest-bearing bank loans and overdrafts are recorded at the amount of proceeds received.Borrowing costs directly attributable to the acquisition, construction or production of assets, which are assets that necessarilytake a substantial period of time to get ready for their intended use or sale is capitalised as part of the cost of those assets,until such time as the assets are substantially ready for their intended use or sale. The amount of borrowings costs eligiblefor capitalisation is determined by applying a capitalisation rate which is the weighted average of the borrowing costsapplicable to the Group’s borrowings that are outstanding during the year, other than borrowings made specifically for thepurpose of obtaining another qualifying asset.For borrowings made specifically for the purpose of obtaining a qualifying asset, the amount of borrowing costs eligiblefor capitalisation is the actual borrowing costs incurred on that borrowing during the period less any investment income onthe temporary investment of that borrowing.All other borrowing costs are recognised as an expense in the income statement in the period in which they are incurred.(v) 5% Irredeemable Convertible Unsecured Loan Stocks 1999/2009 (“ICULS 1999/2009”)Irredeemable Convertible Unsecured Loans Stocks with fixed coupon rate are regarded as compound instruments, consistingpredominantly equity component, and a liability component.ICULS 1999/2009 were issued pursuant to a Debt Conversion exercise undertaken by the Company in 1999. The Companygranted a put option to certain financial institutions to purchase 100% of the ICULS 1999/2009 issued to the financialinstitutions or such number of ICULS 1999/2009 remaining with the financial institutions exercisable within a prescribedperiod as explained in Note 22 to the financial statements.Arising from the above and as permitted under the transitional provision of FRS 132 2004 : Financial Instruments: Disclosureand Presentation, the ICULS 1999/2009 component parts have not been classified separately and accordingly have beenclassified as long term liabilities.(vi) Equity InstrumentsOrdinary shares are classified as equity. Dividends on ordinary shares are recognised in equity in the period in which theyare approved for payment.<strong>Berjaya</strong> Land <strong>Berhad</strong> (201765-A) Annual Report 200655