Pg 147 - Berjaya Corporation Berhad

Pg 147 - Berjaya Corporation Berhad

Pg 147 - Berjaya Corporation Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

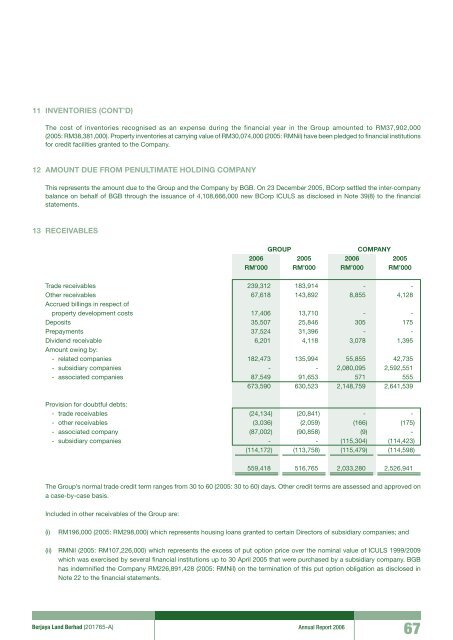

11 INVENTORIES (CONT’D)The cost of inventories recognised as an expense during the financial year in the Group amounted to RM37,902,000(2005: RM38,381,000). Property inventories at carrying value of RM30,074,000 (2005: RMNil) have been pledged to financial institutionsfor credit facilities granted to the Company.12 AMOUNT DUE FROM PENULTIMATE HOLDING COMPANYThis represents the amount due to the Group and the Company by BGB. On 23 December 2005, BCorp settled the inter-companybalance on behalf of BGB through the issuance of 4,108,666,000 new BCorp ICULS as disclosed in Note 39(8) to the financialstatements.13 RECEIVABLESGroupCompany2006 2005 2006 2005RM’000 RM’000 RM’000 RM’000Trade receivables 239,312 183,914 - -Other receivables 67,618 143,892 8,855 4,128Accrued billings in respect ofproperty development costs 17,406 13,710 - -Deposits 35,507 25,846 305 175Prepayments 37,524 31,396 - -Dividend receivable 6,201 4,118 3,078 1,395Amount owing by:- related companies 182,473 135,994 55,855 42,735- subsidiary companies - - 2,080,095 2,592,551- associated companies 87,549 91,653 571 555673,590 630,523 2,148,759 2,641,539Provision for doubtful debts:- trade receivables (24,134) (20,841) - -- other receivables (3,036) (2,059) (166) (175)- associated company (87,002) (90,858) (9) -- subsidiary companies - - (115,304) (114,423)(114,172) (113,758) (115,479) (114,598)559,418 516,765 2,033,280 2,526,941The Group’s normal trade credit term ranges from 30 to 60 (2005: 30 to 60) days. Other credit terms are assessed and approved ona case-by-case basis.Included in other receivables of the Group are:(i)RM196,000 (2005: RM298,000) which represents housing loans granted to certain Directors of subsidiary companies; and(ii) RMNil (2005: RM107,226,000) which represents the excess of put option price over the nominal value of ICULS 1999/2009which was exercised by several financial institutions up to 30 April 2005 that were purchased by a subsidiary company. BGBhas indemnified the Company RM226,891,428 (2005: RMNil) on the termination of this put option obligation as disclosed inNote 22 to the financial statements.<strong>Berjaya</strong> Land <strong>Berhad</strong> (201765-A) Annual Report 200667