Pg 147 - Berjaya Corporation Berhad

Pg 147 - Berjaya Corporation Berhad

Pg 147 - Berjaya Corporation Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

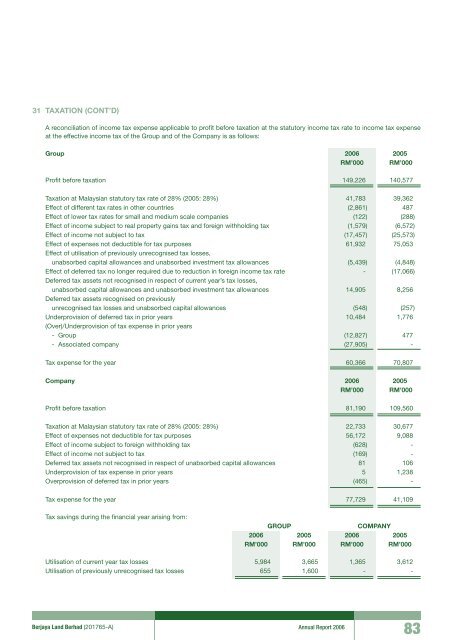

31 TAXATION (cont’d)A reconciliation of income tax expense applicable to profit before taxation at the statutory income tax rate to income tax expenseat the effective income tax of the Group and of the Company is as follows:Group 2006 2005RM’000 RM’000Profit before taxation 149,226 140,577Taxation at Malaysian statutory tax rate of 28% (2005: 28%) 41,783 39,362Effect of different tax rates in other countries (2,861) 487Effect of lower tax rates for small and medium scale companies (122) (288)Effect of income subject to real property gains tax and foreign withholding tax (1,579) (6,572)Effect of income not subject to tax (17,457) (25,573)Effect of expenses not deductible for tax purposes 61,932 75,053Effect of utilisation of previously unrecognised tax losses,unabsorbed capital allowances and unabsorbed investment tax allowances (5,439) (4,848)Effect of deferred tax no longer required due to reduction in foreign income tax rate - (17,066)Deferred tax assets not recognised in respect of current year’s tax losses,unabsorbed capital allowances and unabsorbed investment tax allowances 14,905 8,256Deferred tax assets recognised on previouslyunrecognised tax losses and unabsorbed capital allowances (548) (257)Underprovision of deferred tax in prior years 10,484 1,776(Over)/Underprovision of tax expense in prior years- Group (12,827) 477- Associated company (27,905) -Tax expense for the year 60,366 70,807Company 2006 2005RM’000 RM’000Profit before taxation 81,190 109,560Taxation at Malaysian statutory tax rate of 28% (2005: 28%) 22,733 30,677Effect of expenses not deductible for tax purposes 56,172 9,088Effect of income subject to foreign withholding tax (628) -Effect of income not subject to tax (169) -Deferred tax assets not recognised in respect of unabsorbed capital allowances 81 106Underprovision of tax expense in prior years 5 1,238Overprovision of deferred tax in prior years (465) -Tax expense for the year 77,729 41,109Tax savings during the financial year arising from:GroupCompany2006 2005 2006 2005RM’000 RM’000 RM’000 RM’000Utilisation of current year tax losses 5,984 3,665 1,365 3,612Utilisation of previously unrecognised tax losses 655 1,600 - -<strong>Berjaya</strong> Land <strong>Berhad</strong> (201765-A) Annual Report 200683