Pg 147 - Berjaya Corporation Berhad

Pg 147 - Berjaya Corporation Berhad

Pg 147 - Berjaya Corporation Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

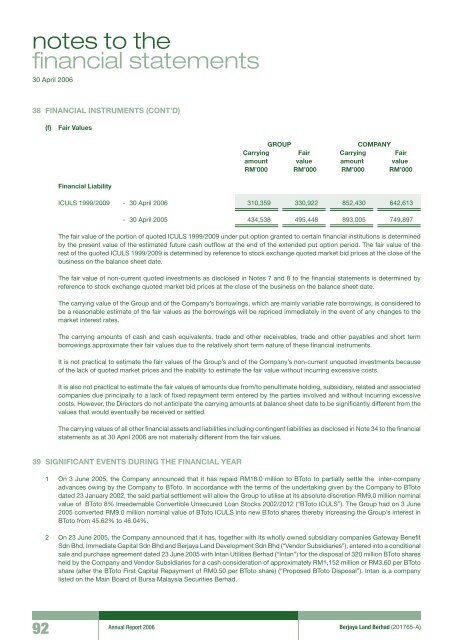

notes to thefinancial statements30 April 200638 FINANCIAL INSTRUMENTS (CONT’D)(f)Fair ValuesGroupCompanyCarrying Fair Carrying Fairamount value amount valueRM’000 RM’000 RM’000 RM’000Financial LiabilityICULS 1999/2009 - 30 April 2006 310,359 330,922 852,430 642,613- 30 April 2005 434,538 495,448 893,005 749,897The fair value of the portion of quoted ICULS 1999/2009 under put option granted to certain financial institutions is determinedby the present value of the estimated future cash outflow at the end of the extended put option period. The fair value of therest of the quoted ICULS 1999/2009 is determined by reference to stock exchange quoted market bid prices at the close of thebusiness on the balance sheet date.The fair value of non-current quoted investments as disclosed in Notes 7 and 8 to the financial statements is determined byreference to stock exchange quoted market bid prices at the close of the business on the balance sheet date.The carrying value of the Group and of the Company’s borrowings, which are mainly variable rate borrowings, is considered tobe a reasonable estimate of the fair values as the borrowings will be repriced immediately in the event of any changes to themarket interest rates.The carrying amounts of cash and cash equivalents, trade and other receivables, trade and other payables and short termborrowings approximate their fair values due to the relatively short term nature of these financial instruments.It is not practical to estimate the fair values of the Group’s and of the Company’s non-current unquoted investments becauseof the lack of quoted market prices and the inability to estimate the fair value without incurring excessive costs.It is also not practical to estimate the fair values of amounts due from/to penultimate holding, subsidiary, related and associatedcompanies due principally to a lack of fixed repayment term entered by the parties involved and without incurring excessivecosts. However, the Directors do not anticipate the carrying amounts at balance sheet date to be significantly different from thevalues that would eventually be received or settled.The carrying values of all other financial assets and liabilities including contingent liabilities as disclosed in Note 34 to the financialstatements as at 30 April 2006 are not materially different from the fair values.39 SIGNIFICANT EVENTS DURING THE FINANCIAL YEAR1 On 3 June 2005, the Company announced that it has repaid RM18.0 million to BToto to partially settle the inter-companyadvances owing by the Company to BToto. In accordance with the terms of the undertaking given by the Company to BTotodated 23 January 2002, the said partial settlement will allow the Group to utilise at its absolute discretion RM9.0 million nominalvalue of BToto 8% Irreedemable Convertible Unsecured Loan Stocks 2002/2012 (“BToto ICULS”). The Group had on 3 June2005 converted RM9.0 million nominal value of BToto ICULS into new BToto shares thereby increasing the Group’s interest inBToto from 45.62% to 46.04%.2 On 23 June 2005, the Company announced that it has, together with its wholly owned subsidiary companies Gateway BenefitSdn Bhd, Immediate Capital Sdn Bhd and <strong>Berjaya</strong> Land Development Sdn Bhd (“Vendor Subsidiaries”), entered into a conditionalsale and purchase agreement dated 23 June 2005 with Intan Utilities <strong>Berhad</strong> (“Intan”) for the disposal of 320 million BToto sharesheld by the Company and Vendor Subsidiaries for a cash consideration of approximately RM1,152 million or RM3.60 per BTotoshare (after the BToto First Capital Repayment of RM0.50 per BToto share) (“Proposed BToto Disposal”). Intan is a companylisted on the Main Board of Bursa Malaysia Securities <strong>Berhad</strong>.92Annual Report 2006<strong>Berjaya</strong> Land <strong>Berhad</strong> (201765-A)