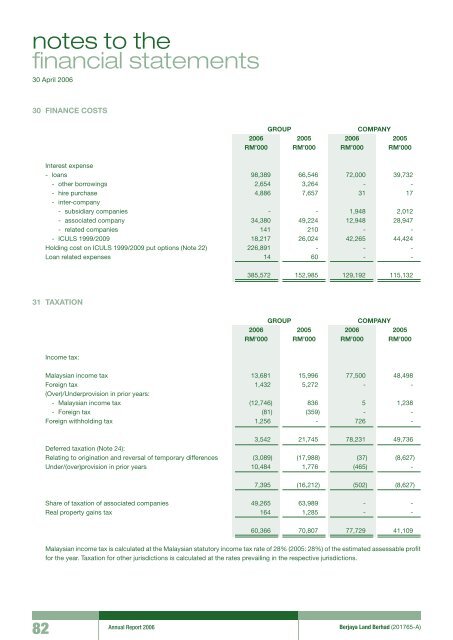

notes to thefinancial statements30 April 200630 FINANCE COSTSGroupCompany2006 2005 2006 2005RM’000 RM’000 RM’000 RM’000Interest expense- loans 98,389 66,546 72,000 39,732- other borrowings 2,654 3,264 - -- hire purchase 4,886 7,657 31 17- inter-company- subsidiary companies - - 1,948 2,012- associated company 34,380 49,224 12,948 28,947- related companies 141 210 - -- ICULS 1999/2009 18,217 26,024 42,265 44,424Holding cost on ICULS 1999/2009 put options (Note 22) 226,891 - - -Loan related expenses 14 60 - -385,572 152,985 129,192 115,13231 TAXATIONGroupCompany2006 2005 2006 2005RM’000 RM’000 RM’000 RM’000Income tax:Malaysian income tax 13,681 15,996 77,500 48,498Foreign tax 1,432 5,272 - -(Over)/Underprovision in prior years:- Malaysian income tax (12,746) 836 5 1,238- Foreign tax (81) (359) - -Foreign withholding tax 1,256 - 726 -3,542 21,745 78,231 49,736Deferred taxation (Note 24):Relating to origination and reversal of temporary differences (3,089) (17,988) (37) (8,627)Under/(over)provision in prior years 10,484 1,776 (465) -7,395 (16,212) (502) (8,627)Share of taxation of associated companies 49,265 63,989 - -Real property gains tax 164 1,285 - -60,366 70,807 77,729 41,109Malaysian income tax is calculated at the Malaysian statutory income tax rate of 28% (2005: 28%) of the estimated assessable profitfor the year. Taxation for other jurisdictions is calculated at the rates prevailing in the respective jurisdictions.82Annual Report 2006<strong>Berjaya</strong> Land <strong>Berhad</strong> (201765-A)

31 TAXATION (cont’d)A reconciliation of income tax expense applicable to profit before taxation at the statutory income tax rate to income tax expenseat the effective income tax of the Group and of the Company is as follows:Group 2006 2005RM’000 RM’000Profit before taxation 149,226 140,577Taxation at Malaysian statutory tax rate of 28% (2005: 28%) 41,783 39,362Effect of different tax rates in other countries (2,861) 487Effect of lower tax rates for small and medium scale companies (122) (288)Effect of income subject to real property gains tax and foreign withholding tax (1,579) (6,572)Effect of income not subject to tax (17,457) (25,573)Effect of expenses not deductible for tax purposes 61,932 75,053Effect of utilisation of previously unrecognised tax losses,unabsorbed capital allowances and unabsorbed investment tax allowances (5,439) (4,848)Effect of deferred tax no longer required due to reduction in foreign income tax rate - (17,066)Deferred tax assets not recognised in respect of current year’s tax losses,unabsorbed capital allowances and unabsorbed investment tax allowances 14,905 8,256Deferred tax assets recognised on previouslyunrecognised tax losses and unabsorbed capital allowances (548) (257)Underprovision of deferred tax in prior years 10,484 1,776(Over)/Underprovision of tax expense in prior years- Group (12,827) 477- Associated company (27,905) -Tax expense for the year 60,366 70,807Company 2006 2005RM’000 RM’000Profit before taxation 81,190 109,560Taxation at Malaysian statutory tax rate of 28% (2005: 28%) 22,733 30,677Effect of expenses not deductible for tax purposes 56,172 9,088Effect of income subject to foreign withholding tax (628) -Effect of income not subject to tax (169) -Deferred tax assets not recognised in respect of unabsorbed capital allowances 81 106Underprovision of tax expense in prior years 5 1,238Overprovision of deferred tax in prior years (465) -Tax expense for the year 77,729 41,109Tax savings during the financial year arising from:GroupCompany2006 2005 2006 2005RM’000 RM’000 RM’000 RM’000Utilisation of current year tax losses 5,984 3,665 1,365 3,612Utilisation of previously unrecognised tax losses 655 1,600 - -<strong>Berjaya</strong> Land <strong>Berhad</strong> (201765-A) Annual Report 200683