Pg 147 - Berjaya Corporation Berhad

Pg 147 - Berjaya Corporation Berhad

Pg 147 - Berjaya Corporation Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

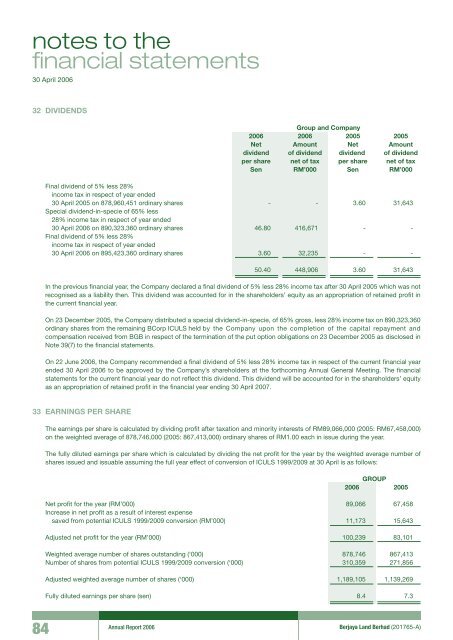

notes to thefinancial statements30 April 200632 DIVIDENDSGroup and Company2006 2006 2005 2005Net Amount Net Amountdividend of dividend dividend of dividendper share net of tax per share net of taxSen RM’000 Sen RM’000Final dividend of 5% less 28%income tax in respect of year ended30 April 2005 on 878,960,451 ordinary shares - - 3.60 31,643Special dividend-in-specie of 65% less28% income tax in respect of year ended30 April 2006 on 890,323,360 ordinary shares 46.80 416,671 - -Final dividend of 5% less 28%income tax in respect of year ended30 April 2006 on 895,423,360 ordinary shares 3.60 32,235 - -50.40 448,906 3.60 31,643In the previous financial year, the Company declared a final dividend of 5% less 28% income tax after 30 April 2005 which was notrecognised as a liability then. This dividend was accounted for in the shareholders’ equity as an appropriation of retained profit inthe current financial year.On 23 December 2005, the Company distributed a special dividend-in-specie, of 65% gross, less 28% income tax on 890,323,360ordinary shares from the remaining BCorp ICULS held by the Company upon the completion of the capital repayment andcompensation received from BGB in respect of the termination of the put option obligations on 23 December 2005 as disclosed inNote 39(7) to the financial statements.On 22 June 2006, the Company recommended a final dividend of 5% less 28% income tax in respect of the current financial yearended 30 April 2006 to be approved by the Company’s shareholders at the forthcoming Annual General Meeting. The financialstatements for the current financial year do not reflect this dividend. This dividend will be accounted for in the shareholders’ equityas an appropriation of retained profit in the financial year ending 30 April 2007.33 EARNINGS PER SHAREThe earnings per share is calculated by dividing profit after taxation and minority interests of RM89,066,000 (2005: RM67,458,000)on the weighted average of 878,746,000 (2005: 867,413,000) ordinary shares of RM1.00 each in issue during the year.The fully diluted earnings per share which is calculated by dividing the net profit for the year by the weighted average number ofshares issued and issuable assuming the full year effect of conversion of ICULS 1999/2009 at 30 April is as follows:Group2006 2005Net profit for the year (RM’000) 89,066 67,458Increase in net profit as a result of interest expensesaved from potential ICULS 1999/2009 conversion (RM’000) 11,173 15,643Adjusted net profit for the year (RM’000) 100,239 83,101Weighted average number of shares outstanding (‘000) 878,746 867,413Number of shares from potential ICULS 1999/2009 conversion (‘000) 310,359 271,856Adjusted weighted average number of shares (‘000) 1,189,105 1,139,269Fully diluted earnings per share (sen) 8.4 7.384Annual Report 2006<strong>Berjaya</strong> Land <strong>Berhad</strong> (201765-A)